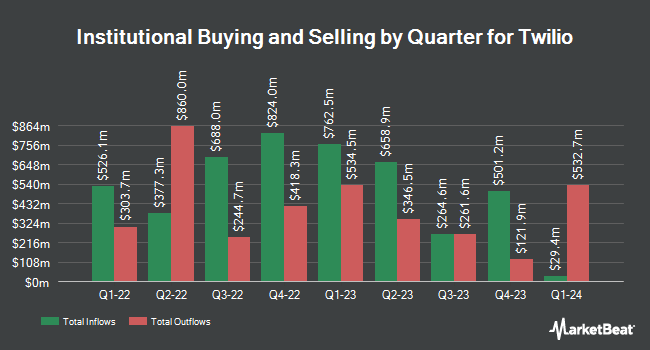

Hood River Capital Management LLC bought a new stake in Twilio Inc. (NYSE:TWLO - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 69,564 shares of the technology company's stock, valued at approximately $7,518,000.

Other institutional investors also recently made changes to their positions in the company. JFS Wealth Advisors LLC grew its holdings in Twilio by 244.0% in the fourth quarter. JFS Wealth Advisors LLC now owns 375 shares of the technology company's stock valued at $41,000 after purchasing an additional 266 shares during the last quarter. Parkside Financial Bank & Trust grew its stake in Twilio by 79.4% in the 4th quarter. Parkside Financial Bank & Trust now owns 375 shares of the technology company's stock valued at $41,000 after acquiring an additional 166 shares during the last quarter. Centricity Wealth Management LLC purchased a new position in Twilio during the 4th quarter valued at about $44,000. Private Trust Co. NA raised its position in Twilio by 395.6% during the fourth quarter. Private Trust Co. NA now owns 451 shares of the technology company's stock worth $49,000 after acquiring an additional 360 shares during the last quarter. Finally, Murphy & Mullick Capital Management Corp acquired a new position in Twilio during the fourth quarter worth about $75,000. 84.27% of the stock is currently owned by hedge funds and other institutional investors.

Twilio Trading Up 1.7 %

TWLO traded up $1.62 on Friday, reaching $95.15. 2,286,162 shares of the company's stock were exchanged, compared to its average volume of 2,645,171. The company has a debt-to-equity ratio of 0.12, a quick ratio of 5.06 and a current ratio of 5.06. Twilio Inc. has a twelve month low of $52.51 and a twelve month high of $151.95. The company's 50 day moving average is $99.35 and its 200-day moving average is $104.18. The company has a market cap of $14.52 billion, a price-to-earnings ratio of -148.67, a PEG ratio of 4.30 and a beta of 1.50.

Twilio (NYSE:TWLO - Get Free Report) last posted its earnings results on Thursday, February 13th. The technology company reported $0.22 earnings per share for the quarter, missing the consensus estimate of $0.99 by ($0.77). Twilio had a negative net margin of 2.45% and a positive return on equity of 1.38%. The business had revenue of $1.19 billion for the quarter, compared to analyst estimates of $1.19 billion. Equities analysts predict that Twilio Inc. will post 1.44 earnings per share for the current year.

Insider Activity

In other Twilio news, CEO Khozema Shipchandler sold 12,056 shares of the stock in a transaction that occurred on Monday, March 31st. The stock was sold at an average price of $95.88, for a total transaction of $1,155,929.28. Following the transaction, the chief executive officer now owns 295,134 shares of the company's stock, valued at $28,297,447.92. This trade represents a 3.92 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, CFO Aidan Viggiano sold 1,391 shares of the business's stock in a transaction that occurred on Tuesday, February 18th. The shares were sold at an average price of $124.51, for a total value of $173,193.41. Following the completion of the sale, the chief financial officer now owns 152,519 shares of the company's stock, valued at $18,990,140.69. This trade represents a 0.90 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 23,471 shares of company stock worth $2,344,149. 4.50% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

TWLO has been the subject of a number of recent research reports. Morgan Stanley dropped their price objective on shares of Twilio from $160.00 to $111.00 and set an "overweight" rating for the company in a research note on Wednesday, April 16th. Jefferies Financial Group raised their price target on Twilio from $105.00 to $145.00 and gave the stock a "hold" rating in a research report on Friday, February 14th. Needham & Company LLC upped their price objective on Twilio from $91.00 to $165.00 and gave the company a "buy" rating in a research report on Tuesday, January 28th. Robert W. Baird upgraded Twilio from a "neutral" rating to an "outperform" rating and lifted their price objective for the stock from $115.00 to $160.00 in a research report on Friday, January 24th. Finally, The Goldman Sachs Group raised shares of Twilio from a "neutral" rating to a "buy" rating and boosted their target price for the company from $77.00 to $185.00 in a research note on Monday, January 27th. One equities research analyst has rated the stock with a sell rating, eight have given a hold rating, sixteen have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, Twilio currently has an average rating of "Moderate Buy" and a consensus price target of $129.30.

Read Our Latest Report on Twilio

Twilio Profile

(

Free Report)

Twilio Inc, together with its subsidiaries, provides customer engagement platform solutions in the United States and internationally. It operates through two segments, Twilio Communications and Twilio Segment. The company provides various application programming interfaces and software solutions for communications between customers and end users, including messaging, voice, email, flex, marketing campaigns, and user identity and authentication.

Featured Stories

Before you consider Twilio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twilio wasn't on the list.

While Twilio currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.