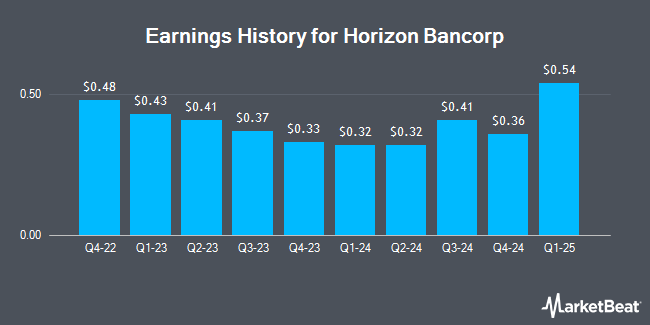

Horizon Bancorp (NASDAQ:HBNC - Get Free Report) is expected to be issuing its quarterly earnings data after the market closes on Wednesday, April 23rd. Analysts expect the company to post earnings of $0.40 per share and revenue of $64.52 million for the quarter. Parties interested in listening to the company's conference call can do so using this link.

Horizon Bancorp (NASDAQ:HBNC - Get Free Report) last released its earnings results on Wednesday, January 22nd. The financial services provider reported $0.36 earnings per share for the quarter, missing analysts' consensus estimates of $0.39 by ($0.03). Horizon Bancorp had a return on equity of 8.48% and a net margin of 9.86%. On average, analysts expect Horizon Bancorp to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Horizon Bancorp Price Performance

Shares of HBNC stock traded up $0.19 during mid-day trading on Friday, reaching $13.55. The company's stock had a trading volume of 185,992 shares, compared to its average volume of 166,511. The company has a debt-to-equity ratio of 1.83, a quick ratio of 0.88 and a current ratio of 0.88. The company has a market cap of $596.40 million, a P/E ratio of 16.94 and a beta of 0.87. Horizon Bancorp has a 1-year low of $11.30 and a 1-year high of $19.18. The firm's 50-day moving average is $15.42 and its two-hundred day moving average is $16.21.

Horizon Bancorp Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, April 18th. Shareholders of record on Friday, April 4th will be given a $0.16 dividend. The ex-dividend date is Friday, April 4th. This represents a $0.64 dividend on an annualized basis and a yield of 4.72%. Horizon Bancorp's dividend payout ratio (DPR) is presently 80.00%.

Wall Street Analysts Forecast Growth

Separately, Piper Sandler cut their target price on Horizon Bancorp from $20.00 to $19.00 and set a "neutral" rating on the stock in a research note on Monday, January 27th.

Check Out Our Latest Research Report on Horizon Bancorp

Horizon Bancorp Company Profile

(

Get Free Report)

Horizon Bancorp, Inc operates as the bank holding company for Horizon Bank that engages in the provision of commercial and retail banking services. The company offers checking, saving, money market, certificate of deposits, individual retirement accounts, and time deposits, as well as non-interest- and interest-bearing demand deposits.

See Also

Before you consider Horizon Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Horizon Bancorp wasn't on the list.

While Horizon Bancorp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.