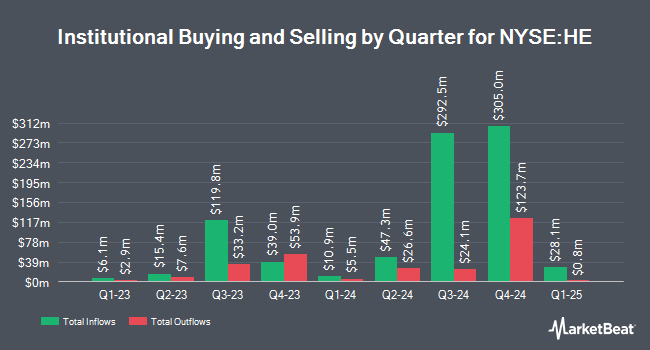

Horizon Kinetics Asset Management LLC purchased a new stake in shares of Hawaiian Electric Industries, Inc. (NYSE:HE - Free Report) in the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm purchased 2,379,498 shares of the utilities provider's stock, valued at approximately $23,153,000. Horizon Kinetics Asset Management LLC owned 1.38% of Hawaiian Electric Industries at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also bought and sold shares of HE. Zimmer Partners LP bought a new stake in shares of Hawaiian Electric Industries in the 3rd quarter worth approximately $145,200,000. FMR LLC grew its stake in shares of Hawaiian Electric Industries by 7,986.3% in the third quarter. FMR LLC now owns 5,340,679 shares of the utilities provider's stock worth $51,698,000 after acquiring an additional 5,274,633 shares during the last quarter. Geode Capital Management LLC increased its holdings in shares of Hawaiian Electric Industries by 49.3% during the third quarter. Geode Capital Management LLC now owns 3,793,142 shares of the utilities provider's stock valued at $36,725,000 after acquiring an additional 1,253,143 shares in the last quarter. Charles Schwab Investment Management Inc. increased its holdings in shares of Hawaiian Electric Industries by 14.9% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 3,471,522 shares of the utilities provider's stock valued at $33,778,000 after acquiring an additional 449,873 shares in the last quarter. Finally, State Street Corp raised its position in shares of Hawaiian Electric Industries by 19.8% in the 3rd quarter. State Street Corp now owns 3,368,096 shares of the utilities provider's stock worth $32,603,000 after purchasing an additional 556,747 shares during the last quarter. Hedge funds and other institutional investors own 59.91% of the company's stock.

Hawaiian Electric Industries Stock Performance

NYSE:HE traded down $0.11 during trading hours on Friday, reaching $10.98. The company had a trading volume of 3,593,815 shares, compared to its average volume of 3,461,341. The firm's 50 day moving average price is $10.06 and its 200-day moving average price is $10.19. The firm has a market cap of $1.89 billion, a price-to-earnings ratio of -0.93 and a beta of 0.46. The company has a current ratio of 0.18, a quick ratio of 0.18 and a debt-to-equity ratio of 1.80. Hawaiian Electric Industries, Inc. has a 52 week low of $7.61 and a 52 week high of $18.19.

Hawaiian Electric Industries (NYSE:HE - Get Free Report) last posted its quarterly earnings data on Friday, February 21st. The utilities provider reported $0.20 EPS for the quarter, missing analysts' consensus estimates of $0.39 by ($0.19). The firm had revenue of $799.18 million for the quarter. Hawaiian Electric Industries had a negative net margin of 35.38% and a positive return on equity of 11.12%. On average, analysts forecast that Hawaiian Electric Industries, Inc. will post 1.71 EPS for the current year.

Analyst Ratings Changes

HE has been the subject of a number of analyst reports. Evercore ISI upgraded shares of Hawaiian Electric Industries from an "in-line" rating to an "outperform" rating and raised their price objective for the company from $12.00 to $14.00 in a research note on Friday, March 7th. Barclays boosted their price objective on shares of Hawaiian Electric Industries from $10.00 to $11.00 and gave the stock an "equal weight" rating in a report on Tuesday, March 4th. Jefferies Financial Group reduced their target price on Hawaiian Electric Industries from $11.50 to $10.50 and set a "hold" rating for the company in a report on Friday, January 3rd. StockNews.com cut Hawaiian Electric Industries from a "hold" rating to a "sell" rating in a research note on Tuesday, February 11th. Finally, Wells Fargo & Company increased their price objective on Hawaiian Electric Industries from $11.00 to $12.50 and gave the company an "equal weight" rating in a research report on Thursday, February 27th. One analyst has rated the stock with a sell rating, three have issued a hold rating and one has issued a buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Hold" and an average price target of $12.00.

View Our Latest Analysis on Hawaiian Electric Industries

Hawaiian Electric Industries Profile

(

Free Report)

Hawaiian Electric Industries, Inc, together with its subsidiaries, engages in the electric utility businesses in the United States. It operates in three segments: Electric Utility, Bank, and Other. The Electric Utility segment engages in the production, purchase, transmission, distribution, and sale of electricity in the islands of Oahu, Hawaii, Maui, Lanai, and Molokai.

Featured Stories

Before you consider Hawaiian Electric Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hawaiian Electric Industries wasn't on the list.

While Hawaiian Electric Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.