Horizon Technology Finance (NASDAQ:HRZN - Get Free Report) was upgraded by investment analysts at Compass Point from a "sell" rating to a "neutral" rating in a research note issued to investors on Tuesday, Marketbeat reports. The firm currently has a $8.25 target price on the investment management company's stock. Compass Point's price target indicates a potential downside of 6.14% from the stock's previous close.

Horizon Technology Finance Stock Up 2.6 %

Shares of NASDAQ HRZN traded up $0.22 during trading on Tuesday, reaching $8.79. 1,020,129 shares of the stock were exchanged, compared to its average volume of 317,163. Horizon Technology Finance has a twelve month low of $8.46 and a twelve month high of $13.73. The company has a market capitalization of $334.56 million, a price-to-earnings ratio of -73.25 and a beta of 1.22. The business's 50-day moving average price is $9.61 and its 200 day moving average price is $10.83.

Horizon Technology Finance (NASDAQ:HRZN - Get Free Report) last released its earnings results on Tuesday, October 29th. The investment management company reported $0.32 earnings per share for the quarter, missing the consensus estimate of $0.35 by ($0.03). The company had revenue of $24.56 million during the quarter, compared to the consensus estimate of $25.38 million. Horizon Technology Finance had a positive return on equity of 15.78% and a negative net margin of 3.69%. During the same period in the previous year, the firm posted $0.53 EPS. As a group, sell-side analysts expect that Horizon Technology Finance will post 1.38 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, President Gerald A. Michaud purchased 8,000 shares of the company's stock in a transaction on Monday, November 25th. The shares were bought at an average price of $9.31 per share, with a total value of $74,480.00. Following the completion of the acquisition, the president now owns 169,309 shares of the company's stock, valued at approximately $1,576,266.79. This represents a 4.96 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, Director Michael Balkin bought 20,000 shares of the firm's stock in a transaction that occurred on Monday, December 16th. The stock was bought at an average price of $8.53 per share, for a total transaction of $170,600.00. Following the completion of the acquisition, the director now directly owns 20,000 shares in the company, valued at approximately $170,600. The trade was a ∞ increase in their ownership of the stock. The disclosure for this purchase can be found here. Corporate insiders own 1.40% of the company's stock.

Hedge Funds Weigh In On Horizon Technology Finance

A number of institutional investors have recently bought and sold shares of HRZN. International Assets Investment Management LLC boosted its holdings in shares of Horizon Technology Finance by 810.1% in the third quarter. International Assets Investment Management LLC now owns 50,055 shares of the investment management company's stock worth $5,330,000 after buying an additional 44,555 shares during the period. Paloma Partners Management Co acquired a new position in Horizon Technology Finance in the 3rd quarter worth approximately $348,000. Dynamic Technology Lab Private Ltd purchased a new position in Horizon Technology Finance during the 3rd quarter worth approximately $217,000. Adell Harriman & Carpenter Inc. purchased a new position in Horizon Technology Finance during the 3rd quarter worth approximately $128,000. Finally, Quantbot Technologies LP acquired a new stake in shares of Horizon Technology Finance in the third quarter worth $99,000. Hedge funds and other institutional investors own 4.94% of the company's stock.

Horizon Technology Finance Company Profile

(

Get Free Report)

Horizon Technology Finance Corporation is a business development company specializing in lending and and investing in development-stage investments. It focuses on making secured debt and venture lending investments to venture capital backed companies in the technology, life science, healthcare information and services, cleantech and sustainability industries.

Featured Articles

Before you consider Horizon Technology Finance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Horizon Technology Finance wasn't on the list.

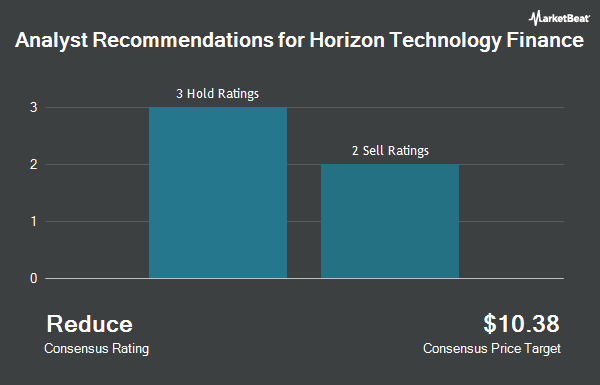

While Horizon Technology Finance currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.