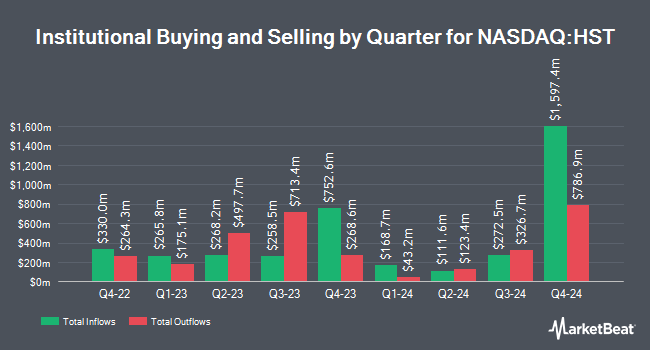

Achmea Investment Management B.V. reduced its holdings in Host Hotels & Resorts, Inc. (NASDAQ:HST - Free Report) by 3.8% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 607,726 shares of the company's stock after selling 23,757 shares during the period. Achmea Investment Management B.V. owned approximately 0.09% of Host Hotels & Resorts worth $10,647,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors and hedge funds have also made changes to their positions in HST. National Pension Service purchased a new position in shares of Host Hotels & Resorts in the 4th quarter worth $26,000. Jones Financial Companies Lllp lifted its holdings in shares of Host Hotels & Resorts by 202.6% in the 4th quarter. Jones Financial Companies Lllp now owns 1,625 shares of the company's stock worth $28,000 after acquiring an additional 1,088 shares during the last quarter. MassMutual Private Wealth & Trust FSB lifted its holdings in shares of Host Hotels & Resorts by 94.9% in the 4th quarter. MassMutual Private Wealth & Trust FSB now owns 2,035 shares of the company's stock worth $36,000 after acquiring an additional 991 shares during the last quarter. Kestra Investment Management LLC bought a new stake in shares of Host Hotels & Resorts in the 4th quarter worth about $40,000. Finally, Eastern Bank bought a new stake in shares of Host Hotels & Resorts in the 4th quarter worth about $45,000. 98.52% of the stock is owned by hedge funds and other institutional investors.

Host Hotels & Resorts Stock Down 1.5 %

NASDAQ HST traded down $0.23 during trading on Tuesday, reaching $15.07. 5,699,273 shares of the company's stock traded hands, compared to its average volume of 8,582,715. The company has a debt-to-equity ratio of 0.77, a current ratio of 1.91 and a quick ratio of 2.90. The firm has a market cap of $10.54 billion, a price-to-earnings ratio of 15.22 and a beta of 1.30. The company's 50 day simple moving average is $16.48 and its two-hundred day simple moving average is $17.38. Host Hotels & Resorts, Inc. has a 12-month low of $14.47 and a 12-month high of $21.27.

Host Hotels & Resorts (NASDAQ:HST - Get Free Report) last posted its earnings results on Wednesday, February 19th. The company reported $0.44 EPS for the quarter, beating analysts' consensus estimates of $0.15 by $0.29. The business had revenue of $1.43 billion for the quarter, compared to the consensus estimate of $1.37 billion. Host Hotels & Resorts had a net margin of 12.26% and a return on equity of 10.37%. As a group, sell-side analysts forecast that Host Hotels & Resorts, Inc. will post 1.88 EPS for the current fiscal year.

Host Hotels & Resorts Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Monday, March 31st will be given a $0.20 dividend. This represents a $0.80 dividend on an annualized basis and a dividend yield of 5.31%. The ex-dividend date is Monday, March 31st. Host Hotels & Resorts's payout ratio is currently 80.81%.

Analyst Upgrades and Downgrades

HST has been the subject of several analyst reports. Raymond James lowered their target price on shares of Host Hotels & Resorts from $23.00 to $20.00 and set an "outperform" rating for the company in a report on Tuesday, February 18th. UBS Group lowered their target price on shares of Host Hotels & Resorts from $19.00 to $18.00 and set a "neutral" rating for the company in a report on Tuesday, January 28th. Stifel Nicolaus lowered their target price on shares of Host Hotels & Resorts from $21.00 to $20.50 and set a "buy" rating for the company in a report on Friday, November 22nd. Citigroup lowered their target price on shares of Host Hotels & Resorts from $21.00 to $19.00 and set a "buy" rating for the company in a report on Monday. Finally, Compass Point lowered shares of Host Hotels & Resorts from a "buy" rating to a "neutral" rating and lowered their target price for the stock from $20.00 to $18.00 in a report on Monday, March 10th. Two analysts have rated the stock with a sell rating, four have given a hold rating and eight have given a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $20.12.

Get Our Latest Stock Report on Host Hotels & Resorts

Host Hotels & Resorts Profile

(

Free Report)

Host Hotels & Resorts, Inc is a real estate investment trust, which engages in the management of luxury and upper-upscale hotels. It operates through the following geographical segments: United States, Brazil, and Canada. The company was founded in 1927 and is headquartered in Bethesda, MD.

Recommended Stories

Before you consider Host Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Host Hotels & Resorts wasn't on the list.

While Host Hotels & Resorts currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.