StockNews.com downgraded shares of Host Hotels & Resorts (NASDAQ:HST - Free Report) from a hold rating to a sell rating in a research note issued to investors on Thursday.

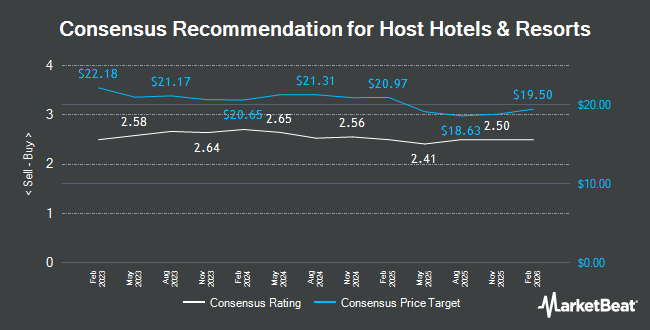

Several other equities research analysts have also issued reports on HST. Robert W. Baird lowered their price objective on Host Hotels & Resorts from $21.00 to $19.00 and set a "neutral" rating for the company in a research note on Monday, August 5th. Oppenheimer lowered their price objective on Host Hotels & Resorts from $24.00 to $22.00 and set an "outperform" rating for the company in a research note on Monday, August 12th. JPMorgan Chase & Co. lowered Host Hotels & Resorts from a "neutral" rating to an "underweight" rating and decreased their price target for the stock from $20.00 to $18.00 in a research note on Friday, July 19th. Stifel Nicolaus decreased their price target on Host Hotels & Resorts from $22.00 to $21.00 and set a "buy" rating for the company in a research note on Thursday, August 1st. Finally, Evercore ISI decreased their price target on Host Hotels & Resorts from $23.00 to $21.00 and set an "outperform" rating for the company in a research note on Tuesday, August 13th. Two research analysts have rated the stock with a sell rating, three have issued a hold rating and ten have assigned a buy rating to the stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $21.29.

Check Out Our Latest Report on HST

Host Hotels & Resorts Stock Performance

HST traded down $0.54 during midday trading on Thursday, reaching $17.46. The company had a trading volume of 9,861,421 shares, compared to its average volume of 6,807,916. The company has a quick ratio of 4.55, a current ratio of 2.90 and a debt-to-equity ratio of 0.76. The business has a 50-day moving average of $17.69 and a two-hundred day moving average of $17.73. The company has a market cap of $12.21 billion, a P/E ratio of 17.48, a P/E/G ratio of 1.61 and a beta of 1.32. Host Hotels & Resorts has a 1 year low of $15.71 and a 1 year high of $21.31.

Host Hotels & Resorts (NASDAQ:HST - Get Free Report) last released its earnings results on Wednesday, November 6th. The company reported $0.12 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.36 by ($0.24). Host Hotels & Resorts had a return on equity of 10.72% and a net margin of 12.92%. The business had revenue of $1.32 billion for the quarter, compared to analysts' expectations of $1.29 billion. During the same quarter in the prior year, the business posted $0.41 EPS. The business's revenue for the quarter was up 8.6% compared to the same quarter last year. As a group, equities research analysts predict that Host Hotels & Resorts will post 1.96 earnings per share for the current fiscal year.

Host Hotels & Resorts Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Monday, September 30th were issued a $0.20 dividend. The ex-dividend date was Monday, September 30th. This represents a $0.80 annualized dividend and a dividend yield of 4.58%. Host Hotels & Resorts's dividend payout ratio (DPR) is presently 77.67%.

Hedge Funds Weigh In On Host Hotels & Resorts

Several institutional investors and hedge funds have recently modified their holdings of HST. BROOKFIELD Corp ON purchased a new stake in Host Hotels & Resorts during the 1st quarter worth approximately $25,000. Blue Trust Inc. grew its position in shares of Host Hotels & Resorts by 212.7% in the second quarter. Blue Trust Inc. now owns 1,473 shares of the company's stock valued at $26,000 after purchasing an additional 1,002 shares in the last quarter. Global X Japan Co. Ltd. purchased a new stake in shares of Host Hotels & Resorts in the second quarter valued at approximately $30,000. Farther Finance Advisors LLC grew its position in shares of Host Hotels & Resorts by 44.5% in the third quarter. Farther Finance Advisors LLC now owns 2,816 shares of the company's stock valued at $50,000 after purchasing an additional 867 shares in the last quarter. Finally, 1620 Investment Advisors Inc. purchased a new stake in shares of Host Hotels & Resorts in the second quarter valued at approximately $51,000. Hedge funds and other institutional investors own 98.52% of the company's stock.

About Host Hotels & Resorts

(

Get Free Report)

Host Hotels & Resorts, Inc is an S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels. The Company currently owns 72 properties in the United States and five properties internationally totaling approximately 42,000 rooms.

Featured Stories

Before you consider Host Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Host Hotels & Resorts wasn't on the list.

While Host Hotels & Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.