Host Hotels & Resorts (NASDAQ:HST - Free Report) had its price target boosted by Wells Fargo & Company from $19.00 to $21.00 in a research report report published on Tuesday,Benzinga reports. They currently have an overweight rating on the stock.

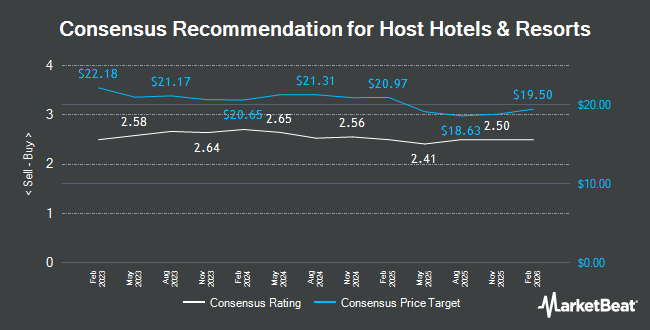

Several other analysts also recently issued reports on HST. UBS Group reduced their price objective on Host Hotels & Resorts from $20.00 to $19.00 and set a "neutral" rating on the stock in a research report on Friday, November 15th. Stifel Nicolaus dropped their target price on Host Hotels & Resorts from $21.00 to $20.50 and set a "buy" rating for the company in a research note on Friday. Truist Financial dropped their target price on Host Hotels & Resorts from $23.00 to $20.00 and set a "hold" rating for the company in a research note on Wednesday, September 4th. Robert W. Baird dropped their target price on Host Hotels & Resorts from $21.00 to $19.00 and set a "neutral" rating for the company in a research note on Monday, August 5th. Finally, Compass Point upgraded Host Hotels & Resorts from a "neutral" rating to a "buy" rating and upped their target price for the company from $18.00 to $22.00 in a research note on Thursday, October 17th. Two equities research analysts have rated the stock with a sell rating, three have issued a hold rating and ten have given a buy rating to the stock. According to MarketBeat.com, Host Hotels & Resorts currently has an average rating of "Moderate Buy" and a consensus target price of $21.32.

View Our Latest Report on Host Hotels & Resorts

Host Hotels & Resorts Price Performance

HST remained flat at $18.42 during trading on Tuesday. The company's stock had a trading volume of 2,243,715 shares, compared to its average volume of 6,810,639. The stock's 50-day moving average price is $17.81 and its 200 day moving average price is $17.66. The company has a debt-to-equity ratio of 0.76, a current ratio of 2.90 and a quick ratio of 2.90. The firm has a market capitalization of $12.88 billion, a P/E ratio of 17.88, a price-to-earnings-growth ratio of 1.65 and a beta of 1.32. Host Hotels & Resorts has a one year low of $15.71 and a one year high of $21.31.

Host Hotels & Resorts (NASDAQ:HST - Get Free Report) last posted its earnings results on Wednesday, November 6th. The company reported $0.12 EPS for the quarter, missing analysts' consensus estimates of $0.36 by ($0.24). Host Hotels & Resorts had a return on equity of 10.72% and a net margin of 12.92%. The firm had revenue of $1.32 billion for the quarter, compared to analysts' expectations of $1.29 billion. During the same quarter in the previous year, the firm posted $0.41 earnings per share. The firm's revenue for the quarter was up 8.6% compared to the same quarter last year. On average, analysts anticipate that Host Hotels & Resorts will post 1.94 EPS for the current year.

Host Hotels & Resorts Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Shareholders of record on Monday, September 30th were paid a dividend of $0.20 per share. The ex-dividend date of this dividend was Monday, September 30th. This represents a $0.80 annualized dividend and a yield of 4.34%. Host Hotels & Resorts's dividend payout ratio is presently 77.67%.

Institutional Investors Weigh In On Host Hotels & Resorts

A number of large investors have recently modified their holdings of the stock. State Street Corp grew its stake in shares of Host Hotels & Resorts by 1.9% in the third quarter. State Street Corp now owns 51,243,563 shares of the company's stock valued at $912,056,000 after buying an additional 950,431 shares in the last quarter. Geode Capital Management LLC boosted its holdings in Host Hotels & Resorts by 1.0% in the third quarter. Geode Capital Management LLC now owns 18,902,882 shares of the company's stock valued at $331,698,000 after purchasing an additional 180,904 shares during the last quarter. Daiwa Securities Group Inc. boosted its holdings in Host Hotels & Resorts by 66.9% in the third quarter. Daiwa Securities Group Inc. now owns 13,637,328 shares of the company's stock valued at $240,017,000 after purchasing an additional 5,466,629 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in Host Hotels & Resorts by 1.8% in the third quarter. Charles Schwab Investment Management Inc. now owns 10,300,937 shares of the company's stock valued at $181,296,000 after purchasing an additional 181,103 shares during the last quarter. Finally, LSV Asset Management boosted its holdings in Host Hotels & Resorts by 11.7% in the second quarter. LSV Asset Management now owns 9,189,000 shares of the company's stock valued at $165,218,000 after purchasing an additional 965,100 shares during the last quarter. Institutional investors and hedge funds own 98.52% of the company's stock.

About Host Hotels & Resorts

(

Get Free Report)

Host Hotels & Resorts, Inc is an S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels. The Company currently owns 72 properties in the United States and five properties internationally totaling approximately 42,000 rooms.

Recommended Stories

Before you consider Host Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Host Hotels & Resorts wasn't on the list.

While Host Hotels & Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.