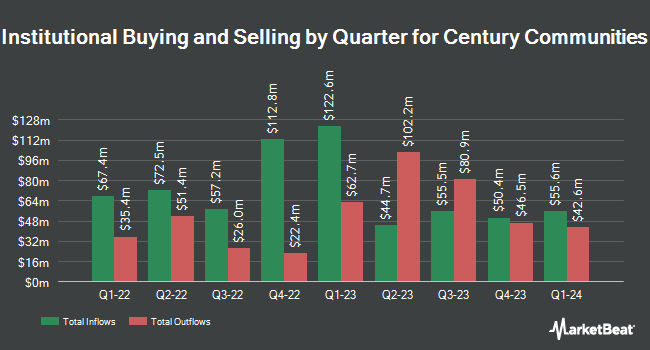

Hotchkis & Wiley Capital Management LLC decreased its holdings in Century Communities, Inc. (NYSE:CCS - Free Report) by 39.8% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 64,460 shares of the construction company's stock after selling 42,630 shares during the period. Hotchkis & Wiley Capital Management LLC owned about 0.21% of Century Communities worth $6,638,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors have also modified their holdings of the company. Point72 Hong Kong Ltd purchased a new position in shares of Century Communities in the 3rd quarter valued at approximately $51,000. Signaturefd LLC raised its holdings in shares of Century Communities by 11.2% in the second quarter. Signaturefd LLC now owns 1,138 shares of the construction company's stock worth $93,000 after buying an additional 115 shares during the last quarter. GAMMA Investing LLC lifted its stake in shares of Century Communities by 37.6% during the third quarter. GAMMA Investing LLC now owns 1,050 shares of the construction company's stock worth $108,000 after buying an additional 287 shares during the period. Daiwa Securities Group Inc. purchased a new stake in shares of Century Communities during the third quarter valued at $144,000. Finally, Innealta Capital LLC acquired a new position in shares of Century Communities in the second quarter valued at about $162,000. 99.54% of the stock is currently owned by institutional investors.

Century Communities Stock Down 0.3 %

Shares of NYSE:CCS traded down $0.26 on Friday, hitting $86.55. 185,269 shares of the company's stock were exchanged, compared to its average volume of 303,177. The firm's 50-day moving average is $93.00 and its 200 day moving average is $91.80. The company has a market capitalization of $2.71 billion, a PE ratio of 8.66 and a beta of 1.87. Century Communities, Inc. has a 1-year low of $74.76 and a 1-year high of $108.42. The company has a debt-to-equity ratio of 0.44, a quick ratio of 0.63 and a current ratio of 0.63.

Century Communities (NYSE:CCS - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The construction company reported $2.72 earnings per share for the quarter, beating the consensus estimate of $2.56 by $0.16. Century Communities had a return on equity of 13.79% and a net margin of 7.44%. The business had revenue of $1.10 billion during the quarter, compared to the consensus estimate of $1.10 billion. During the same period in the prior year, the company earned $2.58 earnings per share. The company's revenue was up 23.7% compared to the same quarter last year. Sell-side analysts predict that Century Communities, Inc. will post 10.95 EPS for the current year.

Century Communities Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, December 11th. Stockholders of record on Wednesday, November 27th will be paid a dividend of $0.26 per share. The ex-dividend date is Wednesday, November 27th. This represents a $1.04 dividend on an annualized basis and a dividend yield of 1.20%. Century Communities's dividend payout ratio (DPR) is 10.37%.

Wall Street Analysts Forecast Growth

Several equities research analysts recently commented on the stock. Wedbush increased their target price on Century Communities from $90.00 to $96.00 and gave the company a "neutral" rating in a report on Thursday, October 24th. B. Riley reiterated a "buy" rating and issued a $119.00 price objective (up previously from $113.00) on shares of Century Communities in a report on Thursday, October 24th. Finally, StockNews.com cut Century Communities from a "hold" rating to a "sell" rating in a report on Thursday.

Read Our Latest Stock Analysis on Century Communities

About Century Communities

(

Free Report)

Century Communities, Inc, together with its subsidiaries, engages in the design, development, construction, marketing, and sale of single-family attached and detached homes. It is also involved in the entitlement and development of the underlying land; and provision of mortgage, title, and insurance services to its homebuyers.

Featured Articles

Before you consider Century Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Century Communities wasn't on the list.

While Century Communities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.