Hotchkis & Wiley Capital Management LLC increased its position in American International Group, Inc. (NYSE:AIG - Free Report) by 0.8% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 7,416,240 shares of the insurance provider's stock after purchasing an additional 59,180 shares during the period. American International Group accounts for about 1.8% of Hotchkis & Wiley Capital Management LLC's holdings, making the stock its 13th biggest holding. Hotchkis & Wiley Capital Management LLC owned 1.19% of American International Group worth $543,091,000 at the end of the most recent reporting period.

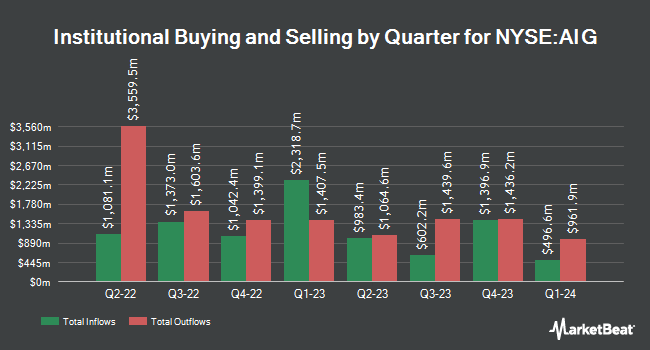

Other institutional investors and hedge funds have also made changes to their positions in the company. Diamond Hill Capital Management Inc. increased its position in American International Group by 5.6% in the 3rd quarter. Diamond Hill Capital Management Inc. now owns 13,685,138 shares of the insurance provider's stock valued at $1,002,163,000 after acquiring an additional 722,237 shares during the period. Bank of Montreal Can increased its position in American International Group by 83.6% during the 2nd quarter. Bank of Montreal Can now owns 1,312,741 shares of the insurance provider's stock worth $97,825,000 after purchasing an additional 597,765 shares during the period. Holocene Advisors LP increased its position in American International Group by 23.5% during the 3rd quarter. Holocene Advisors LP now owns 2,554,519 shares of the insurance provider's stock worth $187,067,000 after purchasing an additional 486,736 shares during the period. BNP PARIBAS ASSET MANAGEMENT Holding S.A. increased its position in American International Group by 66.0% during the 3rd quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 1,104,172 shares of the insurance provider's stock worth $80,858,000 after purchasing an additional 438,918 shares during the period. Finally, Marshall Wace LLP increased its position in American International Group by 2,493.5% during the 2nd quarter. Marshall Wace LLP now owns 349,341 shares of the insurance provider's stock worth $25,935,000 after purchasing an additional 335,871 shares during the period. 90.60% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In related news, major shareholder International Group American sold 5,000,000 shares of the firm's stock in a transaction on Monday, September 16th. The shares were sold at an average price of $28.86, for a total transaction of $144,300,000.00. Following the sale, the insider now directly owns 279,238,898 shares in the company, valued at $8,058,834,596.28. This trade represents a 1.76 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Company insiders own 0.61% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have issued reports on AIG shares. Jefferies Financial Group boosted their target price on American International Group from $82.00 to $88.00 and gave the stock a "buy" rating in a research report on Wednesday, October 9th. BMO Capital Markets cut American International Group from an "outperform" rating to a "market perform" rating and lowered their price target for the stock from $90.00 to $84.00 in a report on Tuesday, October 15th. UBS Group upped their price target on American International Group from $84.00 to $88.00 and gave the stock a "buy" rating in a report on Tuesday, October 15th. StockNews.com upgraded American International Group from a "sell" rating to a "hold" rating in a report on Friday, November 8th. Finally, TD Cowen lowered their price target on American International Group from $83.00 to $80.00 and set a "hold" rating on the stock in a report on Tuesday, August 13th. Eight equities research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company. According to MarketBeat.com, American International Group currently has a consensus rating of "Moderate Buy" and a consensus target price of $84.80.

Read Our Latest Stock Analysis on AIG

American International Group Trading Down 1.2 %

Shares of NYSE AIG traded down $0.90 during mid-day trading on Tuesday, hitting $75.11. 3,456,563 shares of the stock were exchanged, compared to its average volume of 4,100,216. The stock's fifty day simple moving average is $75.82 and its two-hundred day simple moving average is $75.46. The company has a debt-to-equity ratio of 0.22, a quick ratio of 0.65 and a current ratio of 0.65. American International Group, Inc. has a twelve month low of $64.81 and a twelve month high of $80.83.

American International Group (NYSE:AIG - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The insurance provider reported $1.23 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.10 by $0.13. American International Group had a negative net margin of 6.19% and a positive return on equity of 8.63%. The firm had revenue of $6.75 billion for the quarter, compared to analysts' expectations of $6.62 billion. During the same period last year, the firm earned $1.61 earnings per share. As a group, equities research analysts forecast that American International Group, Inc. will post 5.12 EPS for the current year.

American International Group Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, December 30th. Shareholders of record on Monday, December 16th will be issued a $0.40 dividend. The ex-dividend date of this dividend is Monday, December 16th. This represents a $1.60 annualized dividend and a yield of 2.13%. American International Group's dividend payout ratio (DPR) is presently -47.20%.

American International Group Company Profile

(

Free Report)

American International Group, Inc offers insurance products for commercial, institutional, and individual customers in North America and internationally. It operates through three segments: General Insurance, Life and Retirement, and Other Operations. The General Insurance segment provides commercial and industrial property insurance, including business interruption and package insurance that cover exposure to made and natural disasters; general liability, environmental, commercial automobile liability, workers' compensation, excess casualty, and crisis management insurance products; and professional liability insurance.

Recommended Stories

Before you consider American International Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American International Group wasn't on the list.

While American International Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.