Hotchkis & Wiley Capital Management LLC reduced its holdings in shares of M/I Homes, Inc. (NYSE:MHO - Free Report) by 24.0% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 56,643 shares of the construction company's stock after selling 17,855 shares during the quarter. Hotchkis & Wiley Capital Management LLC owned 0.20% of M/I Homes worth $9,706,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

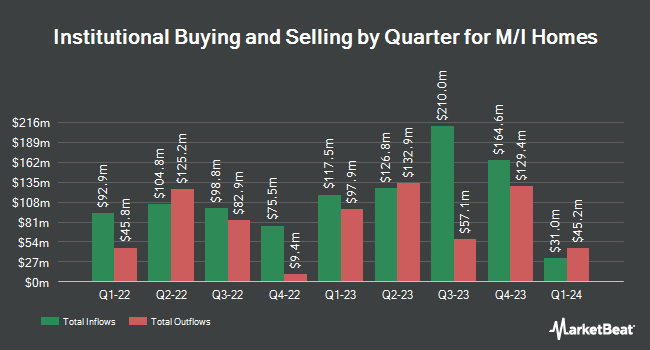

Several other institutional investors also recently modified their holdings of the business. Westfield Capital Management Co. LP lifted its stake in M/I Homes by 3.7% during the 3rd quarter. Westfield Capital Management Co. LP now owns 1,107,024 shares of the construction company's stock valued at $189,700,000 after acquiring an additional 39,492 shares during the period. American Century Companies Inc. lifted its position in M/I Homes by 7.7% during the second quarter. American Century Companies Inc. now owns 703,983 shares of the construction company's stock valued at $85,984,000 after purchasing an additional 50,330 shares during the period. Charles Schwab Investment Management Inc. grew its position in M/I Homes by 4.5% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 462,081 shares of the construction company's stock worth $79,182,000 after purchasing an additional 19,754 shares during the period. Basswood Capital Management L.L.C. raised its stake in M/I Homes by 1.8% during the 3rd quarter. Basswood Capital Management L.L.C. now owns 314,634 shares of the construction company's stock valued at $53,916,000 after buying an additional 5,571 shares during the last quarter. Finally, Bank of New York Mellon Corp lifted its holdings in shares of M/I Homes by 5.5% during the 2nd quarter. Bank of New York Mellon Corp now owns 262,373 shares of the construction company's stock valued at $32,046,000 after buying an additional 13,782 shares during the period. 95.14% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at M/I Homes

In related news, CFO Phillip G. Creek sold 20,000 shares of the company's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $160.00, for a total value of $3,200,000.00. Following the completion of the transaction, the chief financial officer now owns 18,545 shares of the company's stock, valued at approximately $2,967,200. This represents a 51.89 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. Corporate insiders own 3.70% of the company's stock.

Analyst Ratings Changes

A number of analysts recently commented on the company. Wedbush upgraded M/I Homes from a "neutral" rating to an "outperform" rating and upped their price objective for the company from $155.00 to $185.00 in a research report on Monday, November 4th. StockNews.com cut shares of M/I Homes from a "strong-buy" rating to a "buy" rating in a research note on Thursday, October 31st.

View Our Latest Research Report on MHO

M/I Homes Stock Performance

Shares of NYSE:MHO traded down $2.39 during midday trading on Thursday, hitting $159.81. The company had a trading volume of 247,860 shares, compared to its average volume of 274,039. The company has a market cap of $4.43 billion, a price-to-earnings ratio of 8.56 and a beta of 2.23. The company has a debt-to-equity ratio of 0.33, a current ratio of 6.81 and a quick ratio of 1.60. The company has a fifty day moving average of $162.27 and a two-hundred day moving average of $149.05. M/I Homes, Inc. has a 12-month low of $109.92 and a 12-month high of $176.18.

M/I Homes Profile

(

Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

Featured Stories

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.