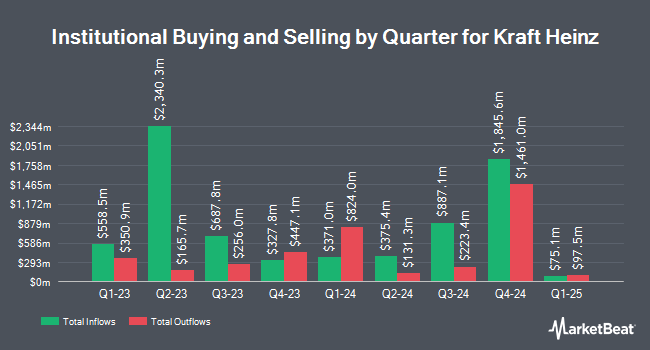

Hotchkis & Wiley Capital Management LLC bought a new stake in The Kraft Heinz Company (NASDAQ:KHC - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund bought 11,714,730 shares of the company's stock, valued at approximately $411,304,000. Kraft Heinz makes up approximately 1.4% of Hotchkis & Wiley Capital Management LLC's holdings, making the stock its 26th biggest holding. Hotchkis & Wiley Capital Management LLC owned 0.97% of Kraft Heinz as of its most recent SEC filing.

Other institutional investors have also added to or reduced their stakes in the company. Dimensional Fund Advisors LP increased its holdings in Kraft Heinz by 47.3% during the second quarter. Dimensional Fund Advisors LP now owns 5,536,214 shares of the company's stock worth $178,379,000 after buying an additional 1,778,263 shares during the last quarter. Thompson Siegel & Walmsley LLC lifted its position in Kraft Heinz by 387.7% during the third quarter. Thompson Siegel & Walmsley LLC now owns 1,455,033 shares of the company's stock valued at $51,086,000 after purchasing an additional 1,156,712 shares during the last quarter. Marshall Wace LLP lifted its position in Kraft Heinz by 260.8% during the second quarter. Marshall Wace LLP now owns 1,169,657 shares of the company's stock valued at $37,686,000 after purchasing an additional 845,490 shares during the last quarter. Poplar Forest Capital LLC purchased a new position in shares of Kraft Heinz during the second quarter worth approximately $26,353,000. Finally, Legal & General Group Plc raised its holdings in Kraft Heinz by 9.7% during the 2nd quarter. Legal & General Group Plc now owns 9,064,592 shares of the company's stock valued at $292,061,000 after buying an additional 799,581 shares during the last quarter. 78.17% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

KHC has been the topic of a number of recent research reports. Piper Sandler reaffirmed a "neutral" rating and issued a $35.00 target price (down from $40.00) on shares of Kraft Heinz in a research report on Tuesday, November 19th. Mizuho reduced their price objective on shares of Kraft Heinz from $43.00 to $41.00 and set an "outperform" rating on the stock in a research report on Thursday, October 31st. Citigroup decreased their target price on Kraft Heinz from $39.00 to $38.00 and set a "buy" rating for the company in a research report on Thursday, October 31st. Stifel Nicolaus downgraded shares of Kraft Heinz from a "buy" rating to a "hold" rating and reduced their target price for the stock from $40.00 to $38.00 in a report on Friday, October 25th. Finally, Barclays dropped their target price on Kraft Heinz from $36.00 to $35.00 and set an "equal weight" rating on the stock in a research report on Friday, November 1st. One investment analyst has rated the stock with a sell rating, six have issued a hold rating and four have assigned a buy rating to the company. According to MarketBeat.com, Kraft Heinz presently has a consensus rating of "Hold" and an average target price of $36.55.

Read Our Latest Stock Analysis on Kraft Heinz

Kraft Heinz Trading Down 0.5 %

KHC stock traded down $0.16 during mid-day trading on Tuesday, reaching $31.45. 13,272,539 shares of the stock traded hands, compared to its average volume of 8,046,959. The company has a current ratio of 1.06, a quick ratio of 0.56 and a debt-to-equity ratio of 0.40. The Kraft Heinz Company has a 52-week low of $30.40 and a 52-week high of $38.96. The company has a market cap of $38.03 billion, a P/E ratio of 28.33, a P/E/G ratio of 3.61 and a beta of 0.48. The stock's fifty day moving average is $33.77 and its 200-day moving average is $34.10.

Kraft Heinz (NASDAQ:KHC - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The company reported $0.75 EPS for the quarter, beating the consensus estimate of $0.74 by $0.01. The company had revenue of $6.38 billion for the quarter, compared to the consensus estimate of $6.42 billion. Kraft Heinz had a return on equity of 7.46% and a net margin of 5.24%. The company's revenue for the quarter was down 2.8% compared to the same quarter last year. During the same quarter last year, the company posted $0.72 earnings per share. As a group, sell-side analysts expect that The Kraft Heinz Company will post 3.01 earnings per share for the current year.

Kraft Heinz Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Friday, November 29th will be issued a dividend of $0.40 per share. This represents a $1.60 annualized dividend and a dividend yield of 5.09%. The ex-dividend date is Friday, November 29th. Kraft Heinz's dividend payout ratio (DPR) is presently 144.14%.

Insider Activity

In other Kraft Heinz news, EVP Pedro F. P. Navio sold 45,000 shares of the company's stock in a transaction on Tuesday, November 5th. The stock was sold at an average price of $33.45, for a total value of $1,505,250.00. Following the transaction, the executive vice president now directly owns 168,195 shares of the company's stock, valued at $5,626,122.75. This represents a 21.11 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this hyperlink. 0.37% of the stock is currently owned by company insiders.

About Kraft Heinz

(

Free Report)

The Kraft Heinz Company, together with its subsidiaries, manufactures and markets food and beverage products in North America and internationally. Its products include condiments and sauces, cheese and dairy products, meals, meats, refreshment beverages, coffee, and other grocery products under the Kraft, Oscar Mayer, Heinz, Philadelphia, Lunchables, Velveeta, Ore-Ida, Maxwell House, Kool-Aid, Jell-O, Heinz, ABC, Master, Quero, Kraft, Golden Circle, Wattie's, Pudliszki, and Plasmon brands.

Featured Stories

Before you consider Kraft Heinz, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kraft Heinz wasn't on the list.

While Kraft Heinz currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report