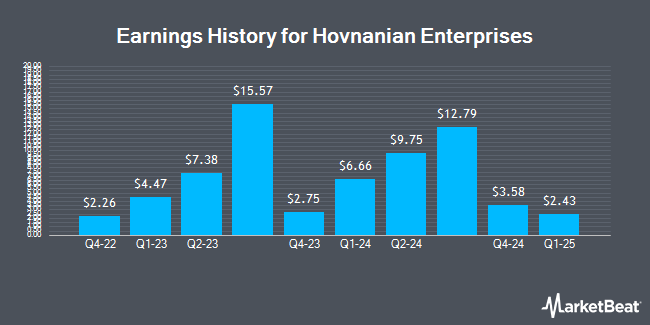

Hovnanian Enterprises (NYSE:HOV - Get Free Report) is expected to be posting its quarterly earnings results before the market opens on Thursday, February 27th. Analysts expect Hovnanian Enterprises to post earnings of $2.71 per share and revenue of $705.80 million for the quarter. Individual interested in registering for the company's earnings conference call can do so using this link.

Hovnanian Enterprises (NYSE:HOV - Get Free Report) last released its quarterly earnings data on Thursday, December 5th. The construction company reported $12.79 earnings per share for the quarter. Hovnanian Enterprises had a return on equity of 43.47% and a net margin of 8.05%.

Hovnanian Enterprises Trading Down 3.6 %

NYSE HOV traded down $4.59 on Friday, hitting $122.38. The company's stock had a trading volume of 26,758 shares, compared to its average volume of 66,804. Hovnanian Enterprises has a 52-week low of $115.90 and a 52-week high of $240.34. The company has a current ratio of 1.52, a quick ratio of 0.34 and a debt-to-equity ratio of 0.14. The company's 50-day simple moving average is $133.66 and its 200 day simple moving average is $171.89. The firm has a market cap of $741.59 million, a P/E ratio of 3.81 and a beta of 2.71.

Analyst Upgrades and Downgrades

HOV has been the subject of a number of research analyst reports. Zelman & Associates restated an "underperform" rating on shares of Hovnanian Enterprises in a research note on Wednesday, February 12th. Wedbush restated a "neutral" rating and issued a $155.00 target price on shares of Hovnanian Enterprises in a research note on Monday, December 16th.

Get Our Latest Report on HOV

About Hovnanian Enterprises

(

Get Free Report)

Hovnanian Enterprises, Inc, through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States. It offers single-family detached homes, attached townhomes and condominiums, urban infill, and active lifestyle homes with amenities, such as clubhouses, swimming pools, tennis courts, tot lots, and open areas.

See Also

Before you consider Hovnanian Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hovnanian Enterprises wasn't on the list.

While Hovnanian Enterprises currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.