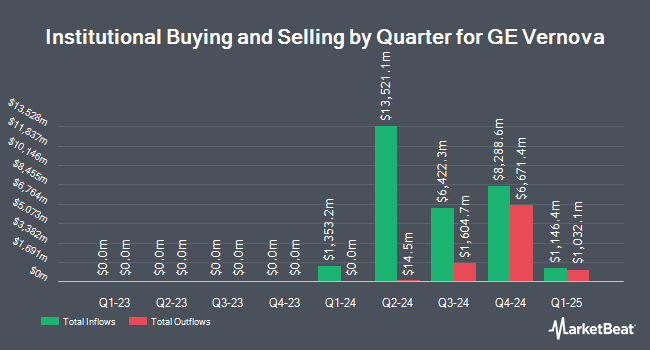

Howard Financial Services LTD. purchased a new stake in GE Vernova Inc. (NYSE:GEV - Free Report) in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm purchased 821 shares of the company's stock, valued at approximately $270,000.

Several other institutional investors have also added to or reduced their stakes in GEV. Armstrong Advisory Group Inc. boosted its stake in GE Vernova by 3.5% in the 4th quarter. Armstrong Advisory Group Inc. now owns 798 shares of the company's stock worth $262,000 after purchasing an additional 27 shares in the last quarter. AdvisorNet Financial Inc grew its holdings in shares of GE Vernova by 1.6% during the fourth quarter. AdvisorNet Financial Inc now owns 1,859 shares of the company's stock valued at $611,000 after buying an additional 30 shares during the last quarter. Pittenger & Anderson Inc. raised its stake in GE Vernova by 28.0% in the 3rd quarter. Pittenger & Anderson Inc. now owns 160 shares of the company's stock worth $41,000 after acquiring an additional 35 shares during the last quarter. Regent Peak Wealth Advisors LLC lifted its position in GE Vernova by 3.8% during the 4th quarter. Regent Peak Wealth Advisors LLC now owns 966 shares of the company's stock worth $318,000 after acquiring an additional 35 shares during the period. Finally, SteelPeak Wealth LLC grew its stake in GE Vernova by 2.5% during the 3rd quarter. SteelPeak Wealth LLC now owns 1,569 shares of the company's stock valued at $400,000 after purchasing an additional 38 shares during the last quarter.

GE Vernova Stock Performance

GE Vernova stock traded up $10.84 during trading on Friday, reaching $401.84. 2,360,990 shares of the company were exchanged, compared to its average volume of 2,430,212. The stock's 50 day simple moving average is $344.59 and its two-hundred day simple moving average is $263.70. GE Vernova Inc. has a 52-week low of $115.00 and a 52-week high of $404.13.

GE Vernova announced that its board has initiated a stock repurchase program on Tuesday, December 10th that allows the company to buyback $6.00 billion in shares. This buyback authorization allows the company to buy up to 6.7% of its shares through open market purchases. Shares buyback programs are usually an indication that the company's leadership believes its shares are undervalued.

GE Vernova Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, January 28th. Stockholders of record on Friday, December 20th will be issued a dividend of $0.25 per share. The ex-dividend date is Friday, December 20th. This represents a $1.00 annualized dividend and a dividend yield of 0.25%.

Wall Street Analyst Weigh In

Several brokerages have recently issued reports on GEV. Guggenheim reduced their price objective on GE Vernova from $400.00 to $380.00 and set a "buy" rating for the company in a research note on Wednesday, December 11th. Citigroup raised their price target on shares of GE Vernova from $292.00 to $361.00 and gave the stock a "neutral" rating in a research report on Monday, December 9th. JPMorgan Chase & Co. upped their price objective on shares of GE Vernova from $367.00 to $374.00 and gave the company an "overweight" rating in a report on Tuesday. Royal Bank of Canada reissued an "outperform" rating and set a $376.00 target price on shares of GE Vernova in a report on Wednesday, December 11th. Finally, Bank of America upped their price target on shares of GE Vernova from $380.00 to $415.00 and gave the company a "buy" rating in a report on Tuesday. Seven equities research analysts have rated the stock with a hold rating, twenty have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, GE Vernova currently has a consensus rating of "Moderate Buy" and a consensus price target of $321.35.

Check Out Our Latest Stock Report on GE Vernova

GE Vernova Company Profile

(

Free Report)

GE Vernova LLC, an energy business company, generates electricity. It operates under three segments: Power, Wind, and Electrification. The Power segments generates and sells electricity through hydro, gas, nuclear, and steam power. Wind segment engages in the manufacturing and sale of wind turbine blades; and Electrification segment provides grid solutions, power conversion, solar, and storage solutions.

Recommended Stories

Before you consider GE Vernova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GE Vernova wasn't on the list.

While GE Vernova currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.