Howe & Rusling Inc. increased its holdings in Edwards Lifesciences Co. (NYSE:EW - Free Report) by 25.6% during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The fund owned 91,618 shares of the medical research company's stock after purchasing an additional 18,648 shares during the period. Howe & Rusling Inc.'s holdings in Edwards Lifesciences were worth $6,046,000 at the end of the most recent quarter.

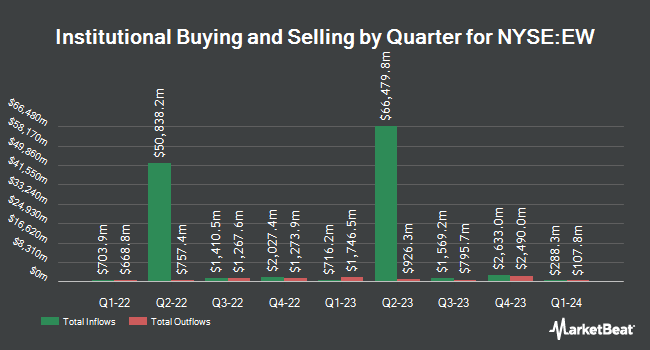

A number of other hedge funds also recently bought and sold shares of the business. Crewe Advisors LLC purchased a new position in Edwards Lifesciences during the 1st quarter valued at $28,000. First Community Trust NA bought a new position in shares of Edwards Lifesciences in the second quarter worth about $29,000. Webster Bank N. A. purchased a new position in Edwards Lifesciences in the 2nd quarter worth about $39,000. Versant Capital Management Inc lifted its holdings in Edwards Lifesciences by 206.3% during the 2nd quarter. Versant Capital Management Inc now owns 484 shares of the medical research company's stock valued at $45,000 after buying an additional 326 shares in the last quarter. Finally, Prospera Private Wealth LLC bought a new position in Edwards Lifesciences in the 3rd quarter worth about $32,000. Hedge funds and other institutional investors own 79.46% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts recently issued reports on EW shares. TD Cowen cut Edwards Lifesciences from a "buy" rating to a "hold" rating and dropped their price objective for the stock from $100.00 to $70.00 in a research note on Thursday, July 25th. Daiwa America downgraded Edwards Lifesciences from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, October 30th. Canaccord Genuity Group lowered their price objective on shares of Edwards Lifesciences from $66.00 to $63.00 and set a "hold" rating for the company in a research note on Friday, October 25th. Royal Bank of Canada cut their target price on shares of Edwards Lifesciences from $85.00 to $75.00 and set an "outperform" rating on the stock in a research report on Tuesday, October 8th. Finally, Robert W. Baird lowered their price target on shares of Edwards Lifesciences from $73.00 to $68.00 and set a "neutral" rating for the company in a research report on Friday, October 25th. Seventeen analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $75.67.

Get Our Latest Research Report on EW

Insider Buying and Selling

In other Edwards Lifesciences news, insider Larry L. Wood sold 25,000 shares of the company's stock in a transaction that occurred on Tuesday, November 5th. The stock was sold at an average price of $65.91, for a total value of $1,647,750.00. Following the sale, the insider now owns 198,526 shares in the company, valued at approximately $13,084,848.66. This represents a 11.18 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Also, VP Donald E. Bobo, Jr. sold 5,000 shares of the firm's stock in a transaction on Wednesday, November 13th. The shares were sold at an average price of $65.57, for a total transaction of $327,850.00. Following the sale, the vice president now owns 46,936 shares in the company, valued at approximately $3,077,593.52. This represents a 9.63 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 40,000 shares of company stock valued at $2,657,000 over the last quarter. 1.27% of the stock is currently owned by company insiders.

Edwards Lifesciences Trading Up 0.4 %

NYSE EW opened at $70.20 on Wednesday. Edwards Lifesciences Co. has a 12-month low of $58.93 and a 12-month high of $96.12. The company has a fifty day simple moving average of $67.59 and a two-hundred day simple moving average of $75.91. The company has a current ratio of 3.46, a quick ratio of 2.89 and a debt-to-equity ratio of 0.06. The stock has a market cap of $41.40 billion, a P/E ratio of 10.13, a P/E/G ratio of 3.81 and a beta of 1.12.

Edwards Lifesciences (NYSE:EW - Get Free Report) last issued its earnings results on Thursday, October 24th. The medical research company reported $0.67 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.67. The company had revenue of $1.35 billion during the quarter, compared to analyst estimates of $1.57 billion. Edwards Lifesciences had a return on equity of 20.76% and a net margin of 70.82%. The firm's quarterly revenue was up 8.9% on a year-over-year basis. During the same quarter last year, the business posted $0.59 EPS. On average, analysts forecast that Edwards Lifesciences Co. will post 2.57 earnings per share for the current year.

Edwards Lifesciences Company Profile

(

Free Report)

Edwards Lifesciences Corporation provides products and technologies for structural heart disease and critical care monitoring in the United States, Europe, Japan, and internationally. It offers transcatheter heart valve replacement products for the minimally invasive replacement of aortic heart valves under the Edwards SAPIEN family of valves system; and transcatheter heart valve repair and replacement products to treat mitral and tricuspid valve diseases under the PASCAL PRECISION and Cardioband names.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Edwards Lifesciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Edwards Lifesciences wasn't on the list.

While Edwards Lifesciences currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.