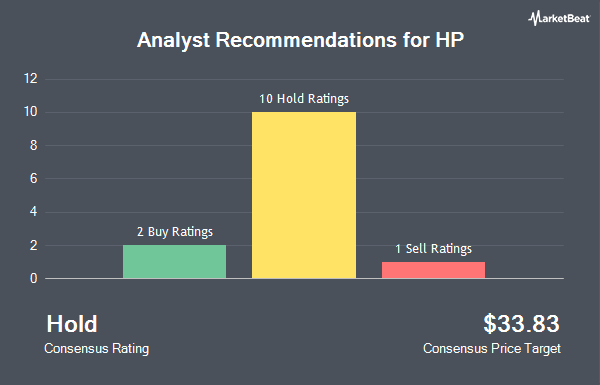

HP Inc. (NYSE:HPQ - Get Free Report) has been assigned an average recommendation of "Hold" from the twelve ratings firms that are covering the stock, MarketBeat.com reports. One equities research analyst has rated the stock with a sell rating, nine have issued a hold rating and two have assigned a buy rating to the company. The average 12-month price target among analysts that have issued a report on the stock in the last year is $36.77.

Several brokerages have recently weighed in on HPQ. Citigroup decreased their target price on shares of HP from $37.00 to $36.50 and set a "neutral" rating for the company in a research note on Wednesday, November 27th. Hsbc Global Res downgraded shares of HP from a "strong-buy" rating to a "hold" rating in a research note on Friday, November 29th. Barclays increased their price objective on shares of HP from $32.00 to $35.00 and gave the company an "equal weight" rating in a research note on Wednesday, November 27th. Loop Capital reduced their price objective on shares of HP from $37.00 to $35.00 and set a "hold" rating on the stock in a research note on Thursday, September 5th. Finally, JPMorgan Chase & Co. reduced their price target on shares of HP from $42.00 to $41.00 and set an "overweight" rating on the stock in a research report on Wednesday, November 20th.

Read Our Latest Analysis on HPQ

HP Stock Performance

HPQ stock traded down $0.56 during trading on Wednesday, reaching $36.23. 3,025,864 shares of the company were exchanged, compared to its average volume of 7,841,087. HP has a 52-week low of $27.42 and a 52-week high of $39.79. The company has a market cap of $34.92 billion, a P/E ratio of 13.09, a PEG ratio of 3.11 and a beta of 1.04. The stock's 50 day moving average price is $36.62 and its 200 day moving average price is $35.70.

HP (NYSE:HPQ - Get Free Report) last announced its quarterly earnings results on Tuesday, November 26th. The computer maker reported $0.93 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.93. The company had revenue of $14.06 billion for the quarter, compared to the consensus estimate of $13.99 billion. HP had a net margin of 5.18% and a negative return on equity of 253.39%. The company's revenue for the quarter was up 1.7% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $0.90 earnings per share. As a group, equities research analysts forecast that HP will post 3.56 EPS for the current year.

HP announced that its board has authorized a share buyback program on Wednesday, August 28th that permits the company to repurchase $10.00 billion in outstanding shares. This repurchase authorization permits the computer maker to buy up to 28.9% of its shares through open market purchases. Shares repurchase programs are generally an indication that the company's leadership believes its shares are undervalued.

HP Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 2nd. Investors of record on Wednesday, December 11th will be issued a $0.2894 dividend. This represents a $1.16 dividend on an annualized basis and a dividend yield of 3.20%. The ex-dividend date is Wednesday, December 11th. This is a boost from HP's previous quarterly dividend of $0.28. HP's dividend payout ratio (DPR) is 39.15%.

Insider Buying and Selling

In other HP news, CEO Enrique Lores sold 211,501 shares of the firm's stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $33.16, for a total transaction of $7,013,373.16. Following the transaction, the chief executive officer now owns 3 shares of the company's stock, valued at approximately $99.48. This trade represents a 100.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Alex Cho sold 10,298 shares of the firm's stock in a transaction dated Friday, November 29th. The shares were sold at an average price of $34.32, for a total transaction of $353,427.36. Following the transaction, the insider now directly owns 64,676 shares in the company, valued at approximately $2,219,680.32. The trade was a 13.74 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 0.41% of the company's stock.

Hedge Funds Weigh In On HP

Several large investors have recently bought and sold shares of the stock. Ashton Thomas Securities LLC acquired a new position in shares of HP in the 3rd quarter worth approximately $25,000. Triad Wealth Partners LLC acquired a new position in shares of HP in the second quarter worth about $33,000. Thurston Springer Miller Herd & Titak Inc. acquired a new position in shares of HP in the second quarter worth about $34,000. Wolff Wiese Magana LLC boosted its holdings in shares of HP by 115.1% in the third quarter. Wolff Wiese Magana LLC now owns 968 shares of the computer maker's stock worth $35,000 after buying an additional 518 shares during the period. Finally, ORG Wealth Partners LLC acquired a new position in shares of HP in the third quarter worth about $37,000. Institutional investors and hedge funds own 77.53% of the company's stock.

HP Company Profile

(

Get Free ReportHP Inc provides products, technologies, software, solutions, and services to individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors worldwide. It operates through Personal Systems and Printing segments. The Personal Systems segment offers commercial personal computers (PCs), consumer PCs, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories, software, support, and services for the commercial and consumer markets.

Further Reading

Before you consider HP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HP wasn't on the list.

While HP currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.