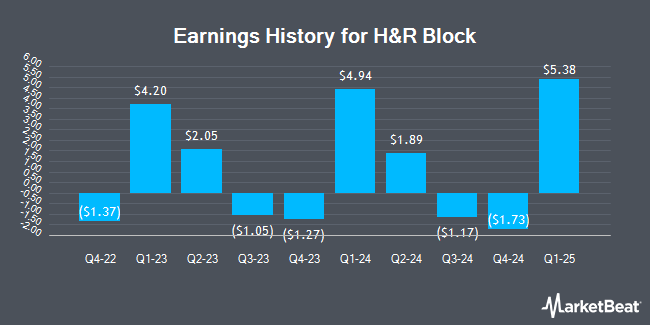

H&R Block (NYSE:HRB - Get Free Report) released its earnings results on Tuesday. The company reported ($1.73) earnings per share for the quarter, missing analysts' consensus estimates of ($1.59) by ($0.14), Zacks reports. H&R Block had a net margin of 14.71% and a negative return on equity of 179.15%. H&R Block updated its FY 2025 guidance to 5.150-5.350 EPS.

H&R Block Price Performance

HRB traded down $0.99 during trading on Friday, reaching $53.21. 1,290,103 shares of the company were exchanged, compared to its average volume of 1,171,457. H&R Block has a 12-month low of $44.81 and a 12-month high of $68.45. The company's 50-day moving average is $54.74 and its two-hundred day moving average is $58.69. The company has a quick ratio of 0.77, a current ratio of 0.73 and a debt-to-equity ratio of 16.46. The company has a market cap of $7.29 billion, a price-to-earnings ratio of 14.66, a P/E/G ratio of 0.82 and a beta of 0.69.

H&R Block Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, April 3rd. Stockholders of record on Tuesday, March 4th will be given a $0.375 dividend. This represents a $1.50 annualized dividend and a dividend yield of 2.82%. The ex-dividend date of this dividend is Tuesday, March 4th. H&R Block's dividend payout ratio (DPR) is presently 41.32%.

Wall Street Analysts Forecast Growth

HRB has been the topic of a number of recent research reports. StockNews.com raised H&R Block from a "hold" rating to a "buy" rating in a research report on Wednesday. Barrington Research reaffirmed an "outperform" rating and set a $70.00 price objective on shares of H&R Block in a report on Wednesday.

View Our Latest Stock Report on HRB

About H&R Block

(

Get Free Report)

H&R Block, Inc engages in the provision of tax return preparation solutions, financial products and small business solutions. The company was founded by Henry W. Bloch and Richard A. Bloch on January 25, 1955, and is headquartered in Kansas City, MO.

Featured Stories

Before you consider H&R Block, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H&R Block wasn't on the list.

While H&R Block currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.