Hsbc Global Res downgraded shares of Progressive (NYSE:PGR - Free Report) from a strong-buy rating to a hold rating in a research report released on Tuesday,Zacks.com reports.

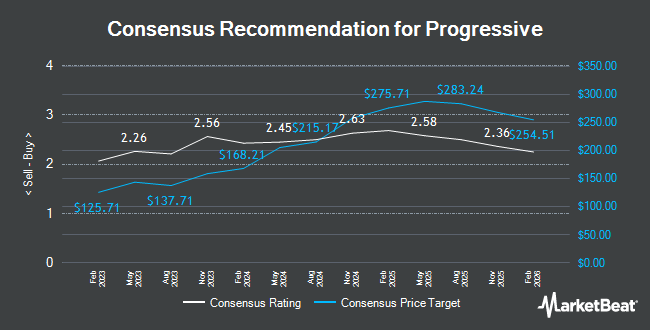

A number of other analysts have also commented on PGR. HSBC lowered shares of Progressive from a "buy" rating to a "hold" rating and set a $267.00 price objective on the stock. in a research report on Tuesday. Wells Fargo & Company increased their price objective on shares of Progressive from $281.00 to $282.00 and gave the stock an "overweight" rating in a research note on Tuesday, September 10th. TD Cowen raised their price objective on Progressive from $197.00 to $237.00 and gave the company a "hold" rating in a report on Friday, November 8th. StockNews.com upgraded Progressive from a "hold" rating to a "buy" rating in a report on Tuesday, November 19th. Finally, Barclays raised their price target on Progressive from $267.00 to $277.00 and gave the company an "equal weight" rating in a research note on Wednesday, October 23rd. Seven equities research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the stock. According to MarketBeat, Progressive has an average rating of "Moderate Buy" and an average price target of $270.69.

Get Our Latest Analysis on Progressive

Progressive Stock Down 1.4 %

NYSE PGR traded down $3.40 on Tuesday, reaching $243.87. The company had a trading volume of 2,156,024 shares, compared to its average volume of 2,468,905. The company's fifty day moving average is $254.38 and its 200-day moving average is $236.13. Progressive has a 1-year low of $149.14 and a 1-year high of $270.62. The firm has a market capitalization of $142.86 billion, a price-to-earnings ratio of 17.84, a price-to-earnings-growth ratio of 0.70 and a beta of 0.38. The company has a debt-to-equity ratio of 0.25, a quick ratio of 0.30 and a current ratio of 0.30.

Progressive (NYSE:PGR - Get Free Report) last posted its quarterly earnings data on Tuesday, October 15th. The insurance provider reported $3.58 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.40 by $0.18. The business had revenue of $19.43 billion during the quarter, compared to the consensus estimate of $18.95 billion. Progressive had a return on equity of 33.10% and a net margin of 11.27%. On average, research analysts forecast that Progressive will post 13.2 earnings per share for the current fiscal year.

Progressive Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 16th. Stockholders of record on Thursday, January 9th will be issued a dividend of $0.10 per share. This represents a $0.40 dividend on an annualized basis and a dividend yield of 0.16%. The ex-dividend date is Thursday, January 9th. Progressive's dividend payout ratio is presently 2.91%.

Insider Transactions at Progressive

In other Progressive news, CFO John P. Sauerland sold 10,000 shares of the stock in a transaction that occurred on Friday, November 29th. The shares were sold at an average price of $268.09, for a total transaction of $2,680,900.00. Following the transaction, the chief financial officer now owns 292,958 shares in the company, valued at $78,539,110.22. This represents a 3.30 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, insider Steven Broz sold 2,981 shares of Progressive stock in a transaction that occurred on Monday, October 21st. The shares were sold at an average price of $251.15, for a total transaction of $748,678.15. Following the completion of the sale, the insider now owns 26,353 shares of the company's stock, valued at approximately $6,618,555.95. The trade was a 10.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 25,839 shares of company stock worth $6,718,965. Company insiders own 0.34% of the company's stock.

Hedge Funds Weigh In On Progressive

Hedge funds and other institutional investors have recently added to or reduced their stakes in the stock. Geode Capital Management LLC lifted its position in Progressive by 13.2% during the third quarter. Geode Capital Management LLC now owns 14,425,792 shares of the insurance provider's stock worth $3,652,235,000 after purchasing an additional 1,682,213 shares during the period. Jennison Associates LLC raised its position in shares of Progressive by 21.6% in the 3rd quarter. Jennison Associates LLC now owns 4,749,628 shares of the insurance provider's stock valued at $1,205,266,000 after buying an additional 842,109 shares in the last quarter. Caisse DE Depot ET Placement DU Quebec lifted its holdings in shares of Progressive by 75.3% during the 3rd quarter. Caisse DE Depot ET Placement DU Quebec now owns 1,494,084 shares of the insurance provider's stock worth $379,139,000 after acquiring an additional 641,943 shares during the period. International Assets Investment Management LLC boosted its position in shares of Progressive by 29,701.6% during the 3rd quarter. International Assets Investment Management LLC now owns 596,331 shares of the insurance provider's stock worth $151,325,000 after acquiring an additional 594,330 shares in the last quarter. Finally, SG Americas Securities LLC raised its position in Progressive by 206.8% during the third quarter. SG Americas Securities LLC now owns 875,660 shares of the insurance provider's stock valued at $222,207,000 after purchasing an additional 590,235 shares in the last quarter. 85.34% of the stock is owned by institutional investors and hedge funds.

About Progressive

(

Get Free Report)

The Progressive Corporation, an insurance holding company, provides personal and commercial auto, personal residential and commercial property, business related general liability, and other specialty property-casualty insurance products and related services in the United States. It operates in three segments: Personal Lines, Commercial Lines, and Property.

Recommended Stories

Before you consider Progressive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progressive wasn't on the list.

While Progressive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.