Stifel Financial Corp grew its stake in HSBC Holdings plc (NYSE:HSBC - Free Report) by 40.0% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 138,127 shares of the financial services provider's stock after acquiring an additional 39,465 shares during the period. Stifel Financial Corp's holdings in HSBC were worth $6,242,000 at the end of the most recent quarter.

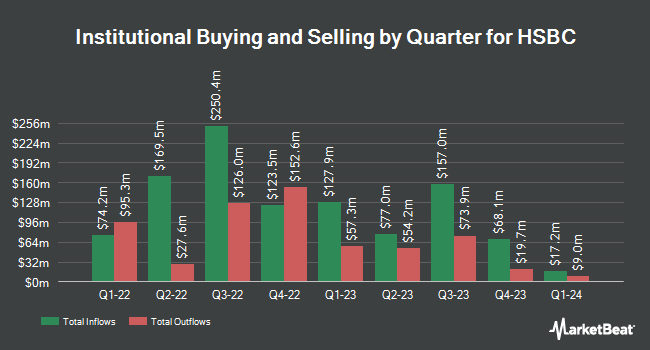

Several other institutional investors and hedge funds have also bought and sold shares of HSBC. Mediolanum International Funds Ltd bought a new position in shares of HSBC in the 3rd quarter valued at about $139,895,000. FMR LLC raised its stake in HSBC by 44.3% in the 3rd quarter. FMR LLC now owns 2,442,205 shares of the financial services provider's stock valued at $110,363,000 after acquiring an additional 749,759 shares during the period. American Century Companies Inc. boosted its position in HSBC by 4.6% during the second quarter. American Century Companies Inc. now owns 850,842 shares of the financial services provider's stock worth $37,012,000 after purchasing an additional 37,781 shares during the period. Crossmark Global Holdings Inc. boosted its holdings in shares of HSBC by 15.7% during the 3rd quarter. Crossmark Global Holdings Inc. now owns 500,547 shares of the financial services provider's stock worth $22,620,000 after buying an additional 67,941 shares during the period. Finally, Natixis Advisors LLC grew its stake in HSBC by 22.1% in the 2nd quarter. Natixis Advisors LLC now owns 413,789 shares of the financial services provider's stock valued at $18,000,000 after buying an additional 74,980 shares during the last quarter. Institutional investors own 1.48% of the company's stock.

HSBC Stock Performance

HSBC stock traded up $0.22 during mid-day trading on Friday, hitting $48.60. 1,359,513 shares of the company were exchanged, compared to its average volume of 1,635,665. HSBC Holdings plc has a 1-year low of $36.93 and a 1-year high of $48.76. The stock has a market capitalization of $175.10 billion, a PE ratio of 8.03 and a beta of 0.56. The business has a 50 day simple moving average of $45.96 and a 200-day simple moving average of $44.42. The company has a current ratio of 0.96, a quick ratio of 0.96 and a debt-to-equity ratio of 0.52.

HSBC Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, December 19th. Shareholders of record on Friday, November 8th will be issued a $0.50 dividend. This represents a $2.00 dividend on an annualized basis and a yield of 4.12%. The ex-dividend date of this dividend is Friday, November 8th. HSBC's dividend payout ratio is 32.73%.

HSBC Profile

(

Free Report)

HSBC Holdings plc provides banking and financial services worldwide. The company operates through Wealth and Personal Banking, Commercial Banking, and Global Banking and Markets segments. The Wealth and Personal Banking segment offers retail banking and wealth products, including current and savings accounts, mortgages and personal loans, credit and debit cards, and local and international payment services; and wealth management services comprising insurance and investment products, global asset management services, investment management, and private wealth solutions.

Further Reading

Before you consider HSBC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HSBC wasn't on the list.

While HSBC currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.