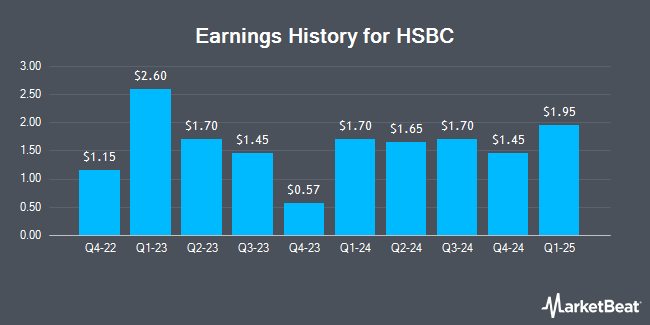

HSBC (NYSE:HSBC - Get Free Report) announced its quarterly earnings results on Wednesday. The financial services provider reported $1.45 EPS for the quarter, topping analysts' consensus estimates of $1.41 by $0.04, Zacks reports. The business had revenue of $11.56 billion for the quarter, compared to analysts' expectations of $13.79 billion. HSBC had a return on equity of 12.14% and a net margin of 16.17%.

HSBC Stock Up 0.2 %

Shares of NYSE HSBC traded up $0.10 during mid-day trading on Friday, hitting $56.07. 2,526,624 shares of the stock traded hands, compared to its average volume of 1,523,666. HSBC has a 52 week low of $36.93 and a 52 week high of $57.08. The company has a market cap of $200.81 billion, a price-to-earnings ratio of 9.04, a PEG ratio of 1.50 and a beta of 0.54. The company has a debt-to-equity ratio of 0.52, a quick ratio of 0.96 and a current ratio of 0.96. The stock has a fifty day moving average price of $51.11 and a 200-day moving average price of $46.98.

HSBC Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, April 25th. Shareholders of record on Friday, March 7th will be given a dividend of $1.80 per share. The ex-dividend date of this dividend is Friday, March 7th. This represents a $7.20 annualized dividend and a yield of 12.84%. HSBC's payout ratio is 31.94%.

Analysts Set New Price Targets

Separately, Deutsche Bank Aktiengesellschaft cut HSBC from a "buy" rating to a "hold" rating in a research note on Monday, February 3rd.

View Our Latest Analysis on HSBC

HSBC Company Profile

(

Get Free Report)

HSBC Holdings plc provides banking and financial services worldwide. The company operates through Wealth and Personal Banking, Commercial Banking, and Global Banking and Markets segments. The Wealth and Personal Banking segment offers retail banking and wealth products, including current and savings accounts, mortgages and personal loans, credit and debit cards, and local and international payment services; and wealth management services comprising insurance and investment products, global asset management services, investment management, and private wealth solutions.

Read More

Before you consider HSBC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HSBC wasn't on the list.

While HSBC currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.