HUB Investment Partners LLC lifted its position in shares of Corpay, Inc. (NYSE:CPAY - Free Report) by 83.6% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 1,652 shares of the company's stock after purchasing an additional 752 shares during the period. HUB Investment Partners LLC's holdings in Corpay were worth $559,000 at the end of the most recent quarter.

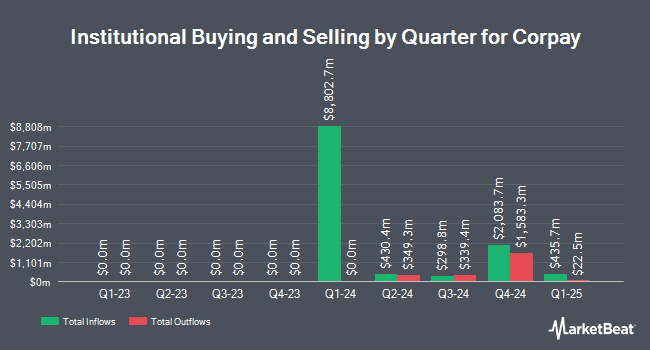

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Avion Wealth raised its holdings in shares of Corpay by 1,011.1% in the 4th quarter. Avion Wealth now owns 100 shares of the company's stock worth $33,000 after purchasing an additional 91 shares during the period. Versant Capital Management Inc raised its stake in shares of Corpay by 130.4% in the fourth quarter. Versant Capital Management Inc now owns 106 shares of the company's stock valued at $36,000 after buying an additional 60 shares during the period. Quarry LP purchased a new position in shares of Corpay during the 3rd quarter valued at $42,000. Spire Wealth Management bought a new position in shares of Corpay during the 4th quarter worth $42,000. Finally, Assetmark Inc. increased its holdings in Corpay by 93.8% in the 4th quarter. Assetmark Inc. now owns 124 shares of the company's stock worth $42,000 after acquiring an additional 60 shares during the last quarter. 98.84% of the stock is currently owned by hedge funds and other institutional investors.

Corpay Trading Down 0.3 %

CPAY stock traded down $1.15 during trading on Wednesday, hitting $357.51. 244,888 shares of the company traded hands, compared to its average volume of 459,174. The company has a 50-day moving average of $364.62 and a 200-day moving average of $351.21. The company has a debt-to-equity ratio of 1.66, a quick ratio of 1.05 and a current ratio of 1.00. Corpay, Inc. has a 1 year low of $247.10 and a 1 year high of $400.81. The firm has a market capitalization of $25.12 billion, a PE ratio of 25.57, a P/E/G ratio of 1.32 and a beta of 1.25.

Corpay (NYSE:CPAY - Get Free Report) last announced its quarterly earnings data on Wednesday, February 5th. The company reported $4.96 earnings per share for the quarter, missing the consensus estimate of $5.37 by ($0.41). Corpay had a net margin of 25.25% and a return on equity of 41.46%. Analysts predict that Corpay, Inc. will post 19.76 earnings per share for the current fiscal year.

Insider Activity

In other news, Director Richard Macchia sold 2,427 shares of Corpay stock in a transaction dated Monday, February 10th. The shares were sold at an average price of $375.23, for a total transaction of $910,683.21. Following the sale, the director now owns 12,215 shares of the company's stock, valued at approximately $4,583,434.45. The trade was a 16.58 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Insiders own 6.10% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities research analysts have commented on CPAY shares. Raymond James dropped their price objective on shares of Corpay from $434.00 to $417.00 and set an "outperform" rating on the stock in a report on Thursday, February 6th. Royal Bank of Canada raised their price objective on shares of Corpay from $354.00 to $400.00 and gave the stock a "sector perform" rating in a report on Thursday, February 6th. Keefe, Bruyette & Woods boosted their target price on shares of Corpay from $415.00 to $445.00 and gave the company an "outperform" rating in a report on Thursday, February 6th. BMO Capital Markets increased their price target on shares of Corpay from $400.00 to $440.00 and gave the stock an "outperform" rating in a report on Friday, December 13th. Finally, Wells Fargo & Company boosted their target price on Corpay from $340.00 to $375.00 and gave the stock an "equal weight" rating in a research report on Thursday, January 16th. Three equities research analysts have rated the stock with a hold rating, eleven have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $399.71.

View Our Latest Stock Report on Corpay

Corpay Company Profile

(

Free Report)

Corpay, Inc operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally. The company offers vehicle payment solutions, which include fuel, tolls, parking, fleet maintenance, and long-haul transportation services, as well as prepaid food and transportation vouchers and cards.

See Also

Before you consider Corpay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Corpay wasn't on the list.

While Corpay currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.