Deutsche Bank Aktiengesellschaft lowered shares of Hubbell (NYSE:HUBB - Free Report) from a buy rating to a hold rating in a research note released on Tuesday, MarketBeat.com reports. They currently have $473.00 price target on the industrial products company's stock, down from their prior price target of $493.00.

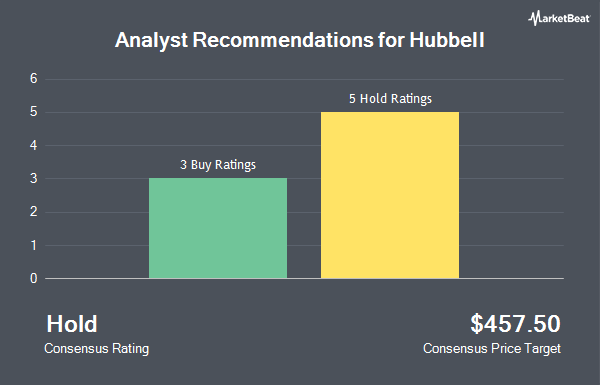

A number of other research firms also recently issued reports on HUBB. Stephens restated an "overweight" rating and set a $450.00 price target on shares of Hubbell in a research note on Friday, August 2nd. Barclays lifted their target price on shares of Hubbell from $400.00 to $402.00 and gave the company an "equal weight" rating in a report on Wednesday, October 30th. Wells Fargo & Company raised their price objective on shares of Hubbell from $445.00 to $455.00 and gave the stock an "equal weight" rating in a research report on Wednesday, October 30th. Morgan Stanley upped their target price on shares of Hubbell from $407.00 to $445.00 and gave the company an "equal weight" rating in a report on Wednesday, October 30th. Finally, Mizuho raised their price target on Hubbell from $450.00 to $490.00 and gave the stock an "outperform" rating in a report on Thursday, October 17th. Five analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $449.11.

Check Out Our Latest Analysis on HUBB

Hubbell Stock Down 0.2 %

HUBB stock traded down $1.07 during trading on Tuesday, hitting $462.79. 245,036 shares of the company's stock were exchanged, compared to its average volume of 443,692. The business has a 50-day moving average price of $442.31 and a two-hundred day moving average price of $402.71. The company has a current ratio of 1.66, a quick ratio of 1.05 and a debt-to-equity ratio of 0.51. The stock has a market capitalization of $24.84 billion, a price-to-earnings ratio of 33.41, a PEG ratio of 1.71 and a beta of 0.90. Hubbell has a 52-week low of $293.91 and a 52-week high of $481.35.

Hubbell (NYSE:HUBB - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The industrial products company reported $4.49 earnings per share for the quarter, topping the consensus estimate of $4.47 by $0.02. Hubbell had a net margin of 13.33% and a return on equity of 28.81%. The business had revenue of $1.44 billion during the quarter, compared to the consensus estimate of $1.48 billion. During the same quarter in the previous year, the firm earned $3.95 EPS. The company's revenue was up 4.9% compared to the same quarter last year. As a group, equities research analysts expect that Hubbell will post 16.47 EPS for the current year.

Hubbell Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 29th will be paid a $1.32 dividend. The ex-dividend date of this dividend is Friday, November 29th. This is an increase from Hubbell's previous quarterly dividend of $1.22. This represents a $5.28 dividend on an annualized basis and a dividend yield of 1.14%. Hubbell's payout ratio is 35.16%.

Insiders Place Their Bets

In other news, insider Mark Eugene Mikes sold 1,144 shares of Hubbell stock in a transaction that occurred on Thursday, November 7th. The shares were sold at an average price of $466.20, for a total transaction of $533,332.80. Following the completion of the sale, the insider now directly owns 2,957 shares in the company, valued at approximately $1,378,553.40. This trade represents a 27.90 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 0.78% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Hubbell

Several hedge funds and other institutional investors have recently bought and sold shares of HUBB. Mizuho Securities USA LLC grew its position in shares of Hubbell by 192,421.1% in the third quarter. Mizuho Securities USA LLC now owns 7,980,000 shares of the industrial products company's stock valued at $3,418,233,000 after purchasing an additional 7,975,855 shares during the last quarter. International Assets Investment Management LLC boosted its stake in shares of Hubbell by 42,735.0% during the third quarter. International Assets Investment Management LLC now owns 1,919,865 shares of the industrial products company's stock valued at $8,223,740,000 after acquiring an additional 1,915,383 shares during the last quarter. Impax Asset Management Group plc increased its position in Hubbell by 53.8% during the 2nd quarter. Impax Asset Management Group plc now owns 922,801 shares of the industrial products company's stock worth $336,984,000 after purchasing an additional 322,728 shares in the last quarter. Bank of New York Mellon Corp raised its stake in Hubbell by 16.7% in the 2nd quarter. Bank of New York Mellon Corp now owns 2,035,596 shares of the industrial products company's stock valued at $743,970,000 after purchasing an additional 291,850 shares during the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank lifted its stake in shares of Hubbell by 268.3% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 231,130 shares of the industrial products company's stock valued at $99,005,000 after buying an additional 168,380 shares during the period. 88.16% of the stock is owned by institutional investors and hedge funds.

About Hubbell

(

Get Free Report)

Hubbell Incorporated, together with its subsidiaries, designs, manufactures, and sells electrical and utility solutions in the United States and internationally. It operates through two segments, Electrical Solutions and Utility Solutions. The Electrical Solution segment offers standard and special application wiring device products, rough-in electrical products, connector and grounding products, lighting fixtures, and other electrical equipment for use in industrial, commercial, and institutional facilities by electrical contractors, maintenance personnel, electricians, utilities, and telecommunications companies, as well as components and assemblies.

Featured Stories

Before you consider Hubbell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hubbell wasn't on the list.

While Hubbell currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.