Spyglass Capital Management LLC reduced its holdings in shares of HubSpot, Inc. (NYSE:HUBS - Free Report) by 1.5% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 93,328 shares of the software maker's stock after selling 1,436 shares during the period. HubSpot comprises 3.3% of Spyglass Capital Management LLC's portfolio, making the stock its 17th largest holding. Spyglass Capital Management LLC owned 0.18% of HubSpot worth $49,613,000 as of its most recent SEC filing.

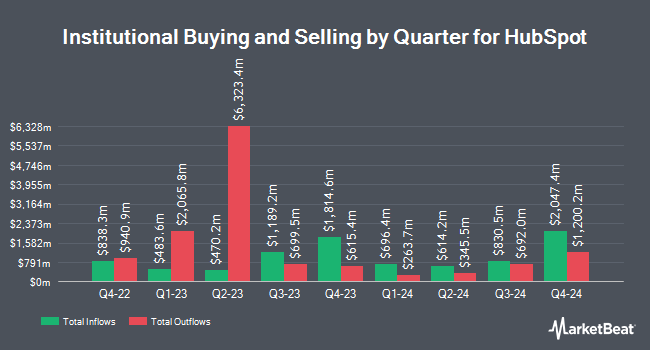

Several other institutional investors have also added to or reduced their stakes in HUBS. International Assets Investment Management LLC purchased a new position in shares of HubSpot during the 2nd quarter valued at about $35,000. HM Payson & Co. lifted its holdings in HubSpot by 36.0% during the third quarter. HM Payson & Co. now owns 68 shares of the software maker's stock valued at $36,000 after purchasing an additional 18 shares in the last quarter. Crewe Advisors LLC boosted its position in shares of HubSpot by 525.0% in the second quarter. Crewe Advisors LLC now owns 75 shares of the software maker's stock worth $44,000 after purchasing an additional 63 shares during the period. J.Safra Asset Management Corp increased its stake in shares of HubSpot by 690.9% in the second quarter. J.Safra Asset Management Corp now owns 87 shares of the software maker's stock worth $51,000 after purchasing an additional 76 shares in the last quarter. Finally, Whittier Trust Co. of Nevada Inc. raised its position in shares of HubSpot by 41.6% during the 2nd quarter. Whittier Trust Co. of Nevada Inc. now owns 109 shares of the software maker's stock valued at $64,000 after purchasing an additional 32 shares during the period. 90.39% of the stock is currently owned by institutional investors.

Insider Activity at HubSpot

In other news, insider Dawson Alyssa Harvey sold 573 shares of the company's stock in a transaction on Tuesday, November 12th. The stock was sold at an average price of $700.00, for a total transaction of $401,100.00. Following the transaction, the insider now directly owns 7,603 shares of the company's stock, valued at approximately $5,322,100. This represents a 7.01 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CEO Yamini Rangan sold 116 shares of the stock in a transaction on Wednesday, September 4th. The shares were sold at an average price of $491.19, for a total value of $56,978.04. Following the sale, the chief executive officer now owns 67,203 shares of the company's stock, valued at approximately $33,009,441.57. This represents a 0.17 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 44,391 shares of company stock valued at $29,101,488 over the last quarter. 4.50% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

HUBS has been the subject of several recent analyst reports. KeyCorp upgraded HubSpot from an "underweight" rating to a "sector weight" rating and set a $460.00 price target for the company in a research note on Thursday, August 8th. Stifel Nicolaus upped their price target on HubSpot from $600.00 to $625.00 and gave the stock a "buy" rating in a research note on Tuesday, October 8th. Barclays lifted their target price on HubSpot from $500.00 to $650.00 and gave the stock an "equal weight" rating in a report on Friday, November 8th. Raymond James cut their price target on HubSpot from $725.00 to $675.00 and set an "outperform" rating for the company in a report on Thursday, August 8th. Finally, BMO Capital Markets upped their price objective on HubSpot from $570.00 to $690.00 and gave the stock an "outperform" rating in a report on Thursday, November 7th. Five analysts have rated the stock with a hold rating and eighteen have given a buy rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $672.68.

View Our Latest Stock Analysis on HUBS

HubSpot Trading Down 0.2 %

Shares of HUBS traded down $1.34 during mid-day trading on Friday, hitting $721.42. The company's stock had a trading volume of 174,747 shares, compared to its average volume of 591,014. The firm has a market capitalization of $37.24 billion, a price-to-earnings ratio of -2,671.83, a PEG ratio of 87.86 and a beta of 1.63. The company's 50-day moving average is $597.13 and its 200-day moving average is $556.38. HubSpot, Inc. has a 52-week low of $434.84 and a 52-week high of $754.56.

HubSpot (NYSE:HUBS - Get Free Report) last posted its earnings results on Wednesday, November 6th. The software maker reported $2.18 earnings per share for the quarter, topping analysts' consensus estimates of $1.91 by $0.27. HubSpot had a negative return on equity of 1.16% and a negative net margin of 0.56%. The company had revenue of $669.72 million during the quarter, compared to analyst estimates of $646.97 million. During the same quarter in the prior year, the business earned ($0.04) earnings per share. HubSpot's revenue was up 20.1% on a year-over-year basis. As a group, sell-side analysts predict that HubSpot, Inc. will post 0.4 earnings per share for the current fiscal year.

HubSpot Company Profile

(

Free Report)

HubSpot, Inc, together with its subsidiaries, provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific. The company's CRM platform includes Marketing Hub, a toolset for marketing automation and email, social media, SEO, and reporting and analytics; Sales Hub offers email templates and tracking, conversations and live chat, meeting and call scheduling, lead and website visit alerts, lead scoring, sales automation, pipeline management, quoting, forecasting, and reporting; Service Hub, a service software designed to help businesses manage, respond, and connect with customers; and Content Management Systems Hub enables businesses to create new and edit existing web content.

Recommended Stories

Before you consider HubSpot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HubSpot wasn't on the list.

While HubSpot currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.