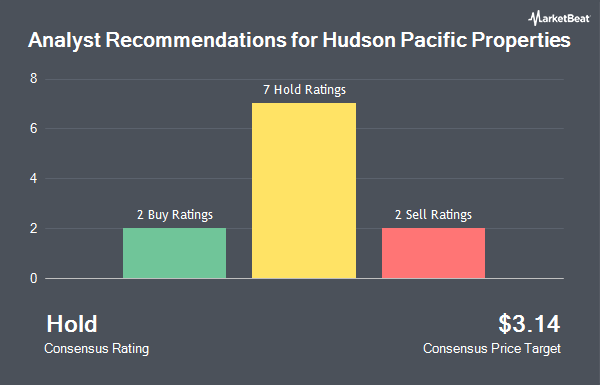

Shares of Hudson Pacific Properties, Inc. (NYSE:HPP - Get Free Report) have been given an average recommendation of "Reduce" by the eleven brokerages that are covering the firm, MarketBeat.com reports. Two investment analysts have rated the stock with a sell rating, eight have assigned a hold rating and one has given a buy rating to the company. The average twelve-month price target among analysts that have covered the stock in the last year is $6.30.

HPP has been the subject of a number of recent research reports. Scotiabank cut their price objective on Hudson Pacific Properties from $7.00 to $6.00 and set a "sector perform" rating for the company in a research report on Monday, August 26th. Jefferies Financial Group downgraded Hudson Pacific Properties from a "buy" rating to a "hold" rating and cut their price objective for the company from $5.50 to $5.00 in a research report on Tuesday. Piper Sandler downgraded Hudson Pacific Properties from an "overweight" rating to a "neutral" rating and cut their price objective for the company from $7.00 to $6.00 in a research report on Thursday, August 8th. BMO Capital Markets downgraded Hudson Pacific Properties from an "outperform" rating to a "market perform" rating and cut their price objective for the company from $8.00 to $6.00 in a research report on Thursday, August 8th. Finally, Wells Fargo & Company cut their price objective on Hudson Pacific Properties from $5.00 to $4.50 and set an "equal weight" rating for the company in a research report on Wednesday, September 11th.

Read Our Latest Research Report on HPP

Hudson Pacific Properties Price Performance

NYSE HPP traded down $0.33 on Tuesday, reaching $4.11. 1,648,518 shares of the stock traded hands, compared to its average volume of 2,366,307. Hudson Pacific Properties has a 12 month low of $4.09 and a 12 month high of $9.85. The firm's fifty day simple moving average is $4.68 and its 200 day simple moving average is $4.99. The company has a market cap of $580.46 million, a price-to-earnings ratio of -2.66 and a beta of 1.31. The company has a quick ratio of 1.47, a current ratio of 1.47 and a debt-to-equity ratio of 1.41.

Insider Buying and Selling

In related news, Director Jonathan M. Glaser sold 9,287 shares of the stock in a transaction on Friday, August 30th. The stock was sold at an average price of $5.20, for a total transaction of $48,292.40. Following the completion of the sale, the director now directly owns 3,713 shares in the company, valued at approximately $19,307.60. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other Hudson Pacific Properties news, COO Andy Wattula sold 9,356 shares of the stock in a transaction on Friday, September 20th. The shares were sold at an average price of $5.28, for a total transaction of $49,399.68. Following the transaction, the chief operating officer now directly owns 61,068 shares of the company's stock, valued at $322,439.04. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, Director Jonathan M. Glaser sold 9,287 shares of the stock in a transaction on Friday, August 30th. The stock was sold at an average price of $5.20, for a total transaction of $48,292.40. Following the transaction, the director now directly owns 3,713 shares in the company, valued at $19,307.60. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 2.95% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On Hudson Pacific Properties

Several hedge funds and other institutional investors have recently made changes to their positions in HPP. State Board of Administration of Florida Retirement System grew its position in Hudson Pacific Properties by 225.5% during the first quarter. State Board of Administration of Florida Retirement System now owns 168,807 shares of the real estate investment trust's stock worth $1,123,000 after buying an additional 116,945 shares in the last quarter. Millennium Management LLC lifted its stake in Hudson Pacific Properties by 282.7% during the second quarter. Millennium Management LLC now owns 1,786,692 shares of the real estate investment trust's stock worth $8,594,000 after purchasing an additional 1,319,869 shares during the period. Scion Asset Management LLC bought a new position in Hudson Pacific Properties during the second quarter worth about $5,505,000. Price T Rowe Associates Inc. MD lifted its stake in Hudson Pacific Properties by 405.7% during the first quarter. Price T Rowe Associates Inc. MD now owns 309,272 shares of the real estate investment trust's stock worth $1,995,000 after purchasing an additional 248,117 shares during the period. Finally, Wolverine Asset Management LLC lifted its stake in Hudson Pacific Properties by 42.3% during the third quarter. Wolverine Asset Management LLC now owns 576,373 shares of the real estate investment trust's stock worth $2,755,000 after purchasing an additional 171,424 shares during the period. 97.58% of the stock is owned by institutional investors and hedge funds.

Hudson Pacific Properties Company Profile

(

Get Free ReportHudson Pacific Properties NYSE: HPP is a real estate investment trust serving dynamic tech and media tenants in global epicenters for these synergistic, converging and secular growth industries. Hudson Pacific's unique and high-barrier tech and media focus leverages a full-service, end-to-end value creation platform forged through deep strategic relationships and niche expertise across identifying, acquiring, transforming and developing properties into world-class amenitized, collaborative and sustainable office and studio space.

Recommended Stories

Before you consider Hudson Pacific Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudson Pacific Properties wasn't on the list.

While Hudson Pacific Properties currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.