Algert Global LLC lowered its position in shares of Hudson Pacific Properties, Inc. (NYSE:HPP - Free Report) by 44.3% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 530,961 shares of the real estate investment trust's stock after selling 423,081 shares during the quarter. Algert Global LLC owned about 0.38% of Hudson Pacific Properties worth $2,538,000 as of its most recent SEC filing.

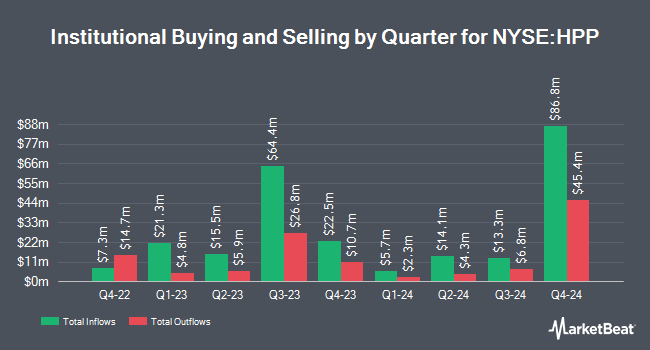

Other institutional investors have also bought and sold shares of the company. Charles Schwab Investment Management Inc. boosted its position in shares of Hudson Pacific Properties by 13.8% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 5,209,577 shares of the real estate investment trust's stock worth $24,902,000 after purchasing an additional 630,932 shares in the last quarter. Intech Investment Management LLC boosted its position in shares of Hudson Pacific Properties by 88.1% during the 3rd quarter. Intech Investment Management LLC now owns 90,267 shares of the real estate investment trust's stock worth $431,000 after purchasing an additional 42,276 shares in the last quarter. Anthracite Investment Company Inc. bought a new position in shares of Hudson Pacific Properties during the 3rd quarter worth about $1,320,000. Thrivent Financial for Lutherans boosted its position in shares of Hudson Pacific Properties by 5.2% during the 3rd quarter. Thrivent Financial for Lutherans now owns 110,760 shares of the real estate investment trust's stock worth $529,000 after purchasing an additional 5,448 shares in the last quarter. Finally, Metis Global Partners LLC bought a new position in shares of Hudson Pacific Properties during the 3rd quarter worth about $66,000. Institutional investors own 97.58% of the company's stock.

Insider Buying and Selling

In other news, Director Jonathan M. Glaser sold 9,287 shares of the firm's stock in a transaction on Friday, August 30th. The shares were sold at an average price of $5.20, for a total transaction of $48,292.40. Following the sale, the director now owns 3,713 shares in the company, valued at approximately $19,307.60. This trade represents a 71.44 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, CEO Victor J. Coleman acquired 50,000 shares of the stock in a transaction dated Monday, November 25th. The shares were bought at an average price of $3.53 per share, for a total transaction of $176,500.00. Following the transaction, the chief executive officer now owns 437,451 shares in the company, valued at approximately $1,544,202.03. This represents a 12.90 % increase in their position. The disclosure for this purchase can be found here. 3.92% of the stock is owned by insiders.

Wall Street Analyst Weigh In

HPP has been the topic of a number of analyst reports. Jefferies Financial Group lowered shares of Hudson Pacific Properties from a "buy" rating to a "hold" rating and lowered their target price for the stock from $5.50 to $5.00 in a report on Tuesday, November 12th. Wells Fargo & Company lowered their target price on shares of Hudson Pacific Properties from $5.00 to $4.50 and set an "equal weight" rating on the stock in a report on Wednesday, September 11th. Scotiabank lowered their target price on shares of Hudson Pacific Properties from $7.00 to $6.00 and set a "sector perform" rating on the stock in a report on Monday, August 26th. BMO Capital Markets lowered shares of Hudson Pacific Properties from an "outperform" rating to a "market perform" rating and lowered their target price for the stock from $8.00 to $6.00 in a report on Thursday, August 8th. Finally, Wolfe Research lowered shares of Hudson Pacific Properties from an "outperform" rating to a "peer perform" rating in a report on Wednesday, August 14th. Two equities research analysts have rated the stock with a sell rating, eight have issued a hold rating and one has given a buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $6.17.

Get Our Latest Report on Hudson Pacific Properties

Hudson Pacific Properties Stock Up 0.8 %

HPP opened at $3.62 on Wednesday. The company has a 50 day moving average of $4.41 and a 200 day moving average of $4.85. Hudson Pacific Properties, Inc. has a 12 month low of $3.01 and a 12 month high of $9.85. The company has a quick ratio of 1.26, a current ratio of 1.26 and a debt-to-equity ratio of 1.47.

Hudson Pacific Properties Company Profile

(

Free Report)

Hudson Pacific Properties NYSE: HPP is a real estate investment trust serving dynamic tech and media tenants in global epicenters for these synergistic, converging and secular growth industries. Hudson Pacific's unique and high-barrier tech and media focus leverages a full-service, end-to-end value creation platform forged through deep strategic relationships and niche expertise across identifying, acquiring, transforming and developing properties into world-class amenitized, collaborative and sustainable office and studio space.

Further Reading

Before you consider Hudson Pacific Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudson Pacific Properties wasn't on the list.

While Hudson Pacific Properties currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.