Hudson Portfolio Management LLC cut its holdings in shares of Oracle Co. (NYSE:ORCL - Free Report) by 22.5% during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 10,628 shares of the enterprise software provider's stock after selling 3,085 shares during the period. Oracle accounts for approximately 1.7% of Hudson Portfolio Management LLC's investment portfolio, making the stock its 14th biggest holding. Hudson Portfolio Management LLC's holdings in Oracle were worth $1,771,000 at the end of the most recent quarter.

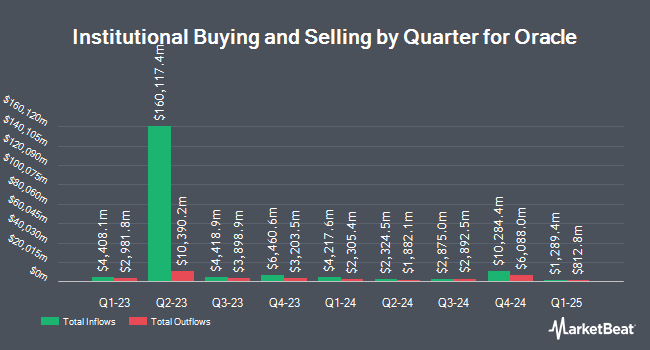

Several other hedge funds and other institutional investors have also recently made changes to their positions in the business. Requisite Capital Management LLC boosted its holdings in Oracle by 2.8% in the fourth quarter. Requisite Capital Management LLC now owns 2,240 shares of the enterprise software provider's stock valued at $373,000 after acquiring an additional 60 shares during the last quarter. Cookson Peirce & Co. Inc. raised its holdings in shares of Oracle by 4.4% in the 4th quarter. Cookson Peirce & Co. Inc. now owns 1,423 shares of the enterprise software provider's stock worth $237,000 after purchasing an additional 60 shares during the period. McLean Asset Management Corp raised its holdings in shares of Oracle by 1.1% in the 4th quarter. McLean Asset Management Corp now owns 5,447 shares of the enterprise software provider's stock worth $908,000 after purchasing an additional 61 shares during the period. Warther Private Wealth LLC lifted its stake in shares of Oracle by 1.8% in the 4th quarter. Warther Private Wealth LLC now owns 3,621 shares of the enterprise software provider's stock valued at $603,000 after purchasing an additional 63 shares in the last quarter. Finally, Howard Bailey Securities LLC grew its holdings in shares of Oracle by 2.9% during the 4th quarter. Howard Bailey Securities LLC now owns 2,274 shares of the enterprise software provider's stock worth $379,000 after purchasing an additional 64 shares during the period. Hedge funds and other institutional investors own 42.44% of the company's stock.

Insider Buying and Selling at Oracle

In related news, Director Naomi O. Seligman sold 2,000 shares of the firm's stock in a transaction that occurred on Wednesday, April 2nd. The shares were sold at an average price of $145.81, for a total transaction of $291,620.00. Following the transaction, the director now owns 34,630 shares in the company, valued at $5,049,400.30. This trade represents a 5.46 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Safra Catz sold 345,174 shares of the company's stock in a transaction that occurred on Friday, January 24th. The stock was sold at an average price of $185.56, for a total value of $64,050,487.44. Following the completion of the sale, the chief executive officer now owns 1,118,592 shares of the company's stock, valued at $207,565,931.52. This trade represents a 23.58 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 2,448,328 shares of company stock valued at $453,791,001 in the last quarter. Corporate insiders own 42.20% of the company's stock.

Oracle Stock Performance

Shares of ORCL traded up $1.39 during midday trading on Tuesday, hitting $136.03. 342,448 shares of the stock traded hands, compared to its average volume of 9,241,575. The business's 50 day moving average price is $154.50 and its two-hundred day moving average price is $167.39. The firm has a market capitalization of $380.47 billion, a PE ratio of 33.27, a price-to-earnings-growth ratio of 3.46 and a beta of 1.22. The company has a debt-to-equity ratio of 5.65, a quick ratio of 0.81 and a current ratio of 0.81. Oracle Co. has a 1-year low of $112.78 and a 1-year high of $198.31.

Oracle (NYSE:ORCL - Get Free Report) last posted its earnings results on Monday, March 10th. The enterprise software provider reported $1.47 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.49 by ($0.02). Oracle had a net margin of 21.16% and a return on equity of 133.25%. The firm had revenue of $14.13 billion for the quarter, compared to analyst estimates of $14.40 billion. During the same period in the previous year, the firm earned $1.41 earnings per share. The company's revenue for the quarter was up 6.4% on a year-over-year basis. Equities research analysts predict that Oracle Co. will post 5 EPS for the current fiscal year.

Oracle Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, April 23rd. Investors of record on Thursday, April 10th will be given a $0.50 dividend. This is a boost from Oracle's previous quarterly dividend of $0.40. This represents a $2.00 annualized dividend and a yield of 1.47%. The ex-dividend date of this dividend is Thursday, April 10th. Oracle's dividend payout ratio (DPR) is currently 46.95%.

Wall Street Analysts Forecast Growth

Several research firms recently commented on ORCL. Cantor Fitzgerald cut their price target on shares of Oracle from $214.00 to $175.00 and set an "overweight" rating on the stock in a report on Tuesday, March 11th. DA Davidson lowered their price target on Oracle from $150.00 to $140.00 and set a "neutral" rating for the company in a report on Monday. KeyCorp restated an "overweight" rating and set a $200.00 price objective on shares of Oracle in a research note on Tuesday, March 11th. Guggenheim reissued a "buy" rating and set a $220.00 price target on shares of Oracle in a research report on Thursday, April 3rd. Finally, Morgan Stanley lowered their price objective on shares of Oracle from $175.00 to $170.00 and set an "equal weight" rating for the company in a research report on Tuesday, March 11th. Thirteen analysts have rated the stock with a hold rating, sixteen have given a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $177.12.

View Our Latest Stock Analysis on Oracle

About Oracle

(

Free Report)

Oracle Corporation offers products and services that address enterprise information technology environments worldwide. Its Oracle cloud software as a service offering include various cloud software applications, including Oracle Fusion cloud enterprise resource planning (ERP), Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain and manufacturing management, Oracle Fusion cloud human capital management, Oracle Cerner healthcare, Oracle Advertising, and NetSuite applications suite, as well as Oracle Fusion Sales, Service, and Marketing.

Further Reading

Before you consider Oracle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oracle wasn't on the list.

While Oracle currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report