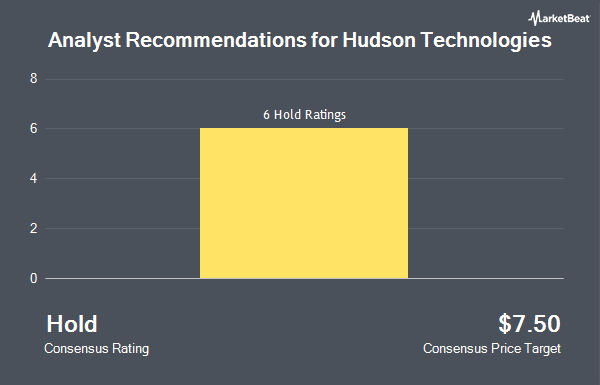

Hudson Technologies, Inc. (NASDAQ:HDSN - Get Free Report) has been given an average rating of "Hold" by the six research firms that are currently covering the company, Marketbeat reports. Six research analysts have rated the stock with a hold rating. The average 12 month price objective among brokerages that have issued ratings on the stock in the last year is $7.85.

A number of research firms have weighed in on HDSN. Roth Capital downgraded Hudson Technologies from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, November 5th. B. Riley reissued a "neutral" rating and set a $7.25 price objective (down from $8.50) on shares of Hudson Technologies in a report on Tuesday, November 5th. Roth Mkm lowered Hudson Technologies from a "buy" rating to a "neutral" rating and cut their target price for the stock from $12.00 to $7.00 in a research note on Tuesday, November 5th. Canaccord Genuity Group decreased their price target on shares of Hudson Technologies from $8.75 to $8.00 and set a "hold" rating on the stock in a research note on Tuesday, November 5th. Finally, Craig Hallum cut shares of Hudson Technologies from a "buy" rating to a "hold" rating and cut their price objective for the company from $10.00 to $7.00 in a research note on Tuesday, November 5th.

View Our Latest Research Report on Hudson Technologies

Hudson Technologies Price Performance

Hudson Technologies stock traded up $0.06 during midday trading on Friday, hitting $5.94. The company's stock had a trading volume of 255,544 shares, compared to its average volume of 1,061,061. Hudson Technologies has a 1-year low of $5.35 and a 1-year high of $15.24. The company has a 50-day moving average price of $7.17 and a two-hundred day moving average price of $8.10. The company has a market cap of $268.49 million, a price-to-earnings ratio of 9.14, a PEG ratio of 0.34 and a beta of 1.22.

Hudson Technologies (NASDAQ:HDSN - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The industrial products company reported $0.17 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.16 by $0.01. The business had revenue of $61.94 million for the quarter, compared to analysts' expectations of $64.92 million. Hudson Technologies had a return on equity of 12.74% and a net margin of 12.49%. During the same quarter in the prior year, the firm posted $0.34 EPS. Sell-side analysts forecast that Hudson Technologies will post 0.57 EPS for the current year.

Institutional Trading of Hudson Technologies

Several large investors have recently modified their holdings of HDSN. Koss Olinger Consulting LLC lifted its position in shares of Hudson Technologies by 3.6% in the 3rd quarter. Koss Olinger Consulting LLC now owns 44,003 shares of the industrial products company's stock worth $367,000 after purchasing an additional 1,513 shares during the period. Rhumbline Advisers raised its position in shares of Hudson Technologies by 2.6% in the 2nd quarter. Rhumbline Advisers now owns 70,982 shares of the industrial products company's stock worth $624,000 after acquiring an additional 1,770 shares in the last quarter. Sequoia Financial Advisors LLC raised its position in shares of Hudson Technologies by 20.2% in the 2nd quarter. Sequoia Financial Advisors LLC now owns 13,700 shares of the industrial products company's stock worth $120,000 after acquiring an additional 2,300 shares in the last quarter. ClariVest Asset Management LLC lifted its stake in shares of Hudson Technologies by 2.8% in the 2nd quarter. ClariVest Asset Management LLC now owns 93,584 shares of the industrial products company's stock valued at $823,000 after purchasing an additional 2,555 shares during the period. Finally, Principal Financial Group Inc. boosted its position in shares of Hudson Technologies by 10.3% during the second quarter. Principal Financial Group Inc. now owns 28,736 shares of the industrial products company's stock valued at $253,000 after purchasing an additional 2,673 shares in the last quarter. 71.34% of the stock is owned by institutional investors.

About Hudson Technologies

(

Get Free ReportHudson Technologies, Inc, through its subsidiary, Hudson Technologies Company, engages in the provision of solutions to recurring problems within the refrigeration industry in the United States. The company engages in the sale of refrigerant and industrial gas; provision of refrigerant management services consisting primarily of reclamation of refrigerants, re-usable cylinder refurbishment, and hydrostatic testing services; and RefrigerantSide services comprising system decontamination and recovery to remove moisture, oils, and other contaminants.

Read More

Before you consider Hudson Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudson Technologies wasn't on the list.

While Hudson Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.