Boston Partners cut its stake in Hudson Technologies, Inc. (NASDAQ:HDSN - Free Report) by 60.1% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 27,207 shares of the industrial products company's stock after selling 40,977 shares during the period. Boston Partners owned 0.06% of Hudson Technologies worth $152,000 at the end of the most recent quarter.

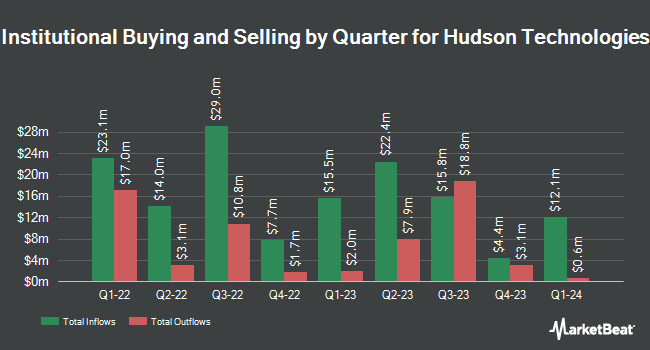

Other hedge funds have also bought and sold shares of the company. JPMorgan Chase & Co. lifted its stake in Hudson Technologies by 69.7% in the third quarter. JPMorgan Chase & Co. now owns 338,607 shares of the industrial products company's stock valued at $2,824,000 after buying an additional 139,042 shares during the period. Sanctuary Advisors LLC acquired a new position in shares of Hudson Technologies during the third quarter valued at about $373,000. Barclays PLC boosted its position in shares of Hudson Technologies by 314.0% during the 3rd quarter. Barclays PLC now owns 68,191 shares of the industrial products company's stock worth $569,000 after purchasing an additional 51,719 shares in the last quarter. Jane Street Group LLC grew its stake in shares of Hudson Technologies by 23.3% in the 3rd quarter. Jane Street Group LLC now owns 79,868 shares of the industrial products company's stock valued at $666,000 after buying an additional 15,099 shares during the period. Finally, Wedge Capital Management L L P NC acquired a new position in Hudson Technologies during the 4th quarter worth approximately $1,612,000. Institutional investors own 71.34% of the company's stock.

Hudson Technologies Price Performance

Hudson Technologies stock traded up $0.05 during mid-day trading on Thursday, hitting $6.34. The company's stock had a trading volume of 243,814 shares, compared to its average volume of 499,419. The business has a 50 day moving average price of $5.86 and a 200-day moving average price of $6.43. The stock has a market cap of $279.12 million, a price-to-earnings ratio of 9.75, a price-to-earnings-growth ratio of 0.49 and a beta of 1.12. Hudson Technologies, Inc. has a 12 month low of $5.17 and a 12 month high of $11.49.

Analysts Set New Price Targets

Separately, Canaccord Genuity Group lowered their price objective on Hudson Technologies from $8.00 to $6.25 and set a "hold" rating for the company in a research note on Monday, March 10th. Six investment analysts have rated the stock with a hold rating, According to data from MarketBeat, Hudson Technologies currently has an average rating of "Hold" and a consensus target price of $7.50.

Read Our Latest Stock Analysis on Hudson Technologies

About Hudson Technologies

(

Free Report)

Hudson Technologies, Inc, through its subsidiary, Hudson Technologies Company, engages in the provision of solutions to recurring problems within the refrigeration industry in the United States. The company engages in the sale of refrigerant and industrial gas; provision of refrigerant management services consisting primarily of reclamation of refrigerants, re-usable cylinder refurbishment, and hydrostatic testing services; and RefrigerantSide services comprising system decontamination and recovery to remove moisture, oils, and other contaminants.

See Also

Before you consider Hudson Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hudson Technologies wasn't on the list.

While Hudson Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.