Humacyte (NASDAQ:HUMA - Get Free Report)'s stock had its "buy" rating reiterated by analysts at D. Boral Capital in a research note issued on Friday,Benzinga reports. They currently have a $25.00 price target on the stock. D. Boral Capital's target price would indicate a potential upside of 438.79% from the stock's current price.

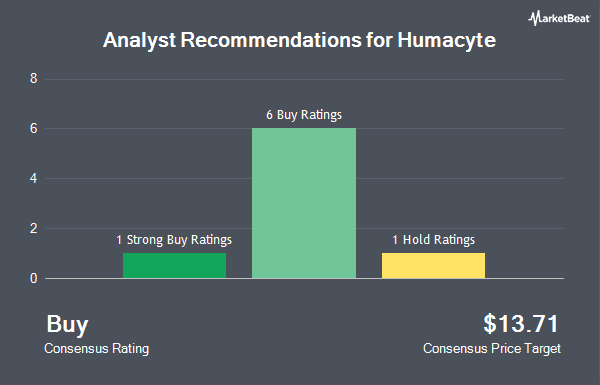

A number of other equities analysts have also weighed in on the company. Cantor Fitzgerald reiterated an "overweight" rating and set a $13.00 target price on shares of Humacyte in a research note on Friday, September 20th. HC Wainwright reiterated a "buy" rating and set a $15.00 price objective (up previously from $12.00) on shares of Humacyte in a research report on Friday. TD Cowen reissued a "buy" rating and issued a $10.00 target price on shares of Humacyte in a research report on Friday, October 18th. Piper Sandler set a $6.00 price target on shares of Humacyte and gave the company a "neutral" rating in a research note on Friday, October 18th. Finally, Benchmark reiterated a "buy" rating and issued a $15.00 price objective on shares of Humacyte in a research note on Thursday, October 10th. One research analyst has rated the stock with a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, Humacyte currently has an average rating of "Buy" and a consensus target price of $13.43.

Get Our Latest Analysis on HUMA

Humacyte Stock Performance

HUMA traded up $1.18 on Friday, reaching $4.64. The company had a trading volume of 75,231,266 shares, compared to its average volume of 2,735,148. The stock has a market cap of $583.99 million, a P/E ratio of -3.46 and a beta of 1.38. The company has a debt-to-equity ratio of 0.61, a quick ratio of 1.10 and a current ratio of 1.10. Humacyte has a fifty-two week low of $2.48 and a fifty-two week high of $9.97. The company's fifty day moving average is $4.83 and its 200 day moving average is $5.85.

Insider Buying and Selling

In other news, Director Brady W. Dougan sold 427,459 shares of Humacyte stock in a transaction on Tuesday, November 19th. The shares were sold at an average price of $4.34, for a total transaction of $1,855,172.06. Following the transaction, the director now owns 1,992,253 shares in the company, valued at approximately $8,646,378.02. The trade was a 17.67 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Laura E. Niklason sold 261,369 shares of the stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $4.40, for a total value of $1,150,023.60. Following the completion of the sale, the chief executive officer now owns 1,730,884 shares of the company's stock, valued at $7,615,889.60. The trade was a 13.12 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 1,500,000 shares of company stock worth $6,606,799 in the last 90 days. Insiders own 11.20% of the company's stock.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. Barclays PLC lifted its position in shares of Humacyte by 177.6% in the 3rd quarter. Barclays PLC now owns 236,742 shares of the company's stock worth $1,288,000 after purchasing an additional 151,458 shares during the period. Geode Capital Management LLC raised its stake in Humacyte by 9.6% during the third quarter. Geode Capital Management LLC now owns 2,040,218 shares of the company's stock worth $11,101,000 after buying an additional 179,120 shares during the last quarter. XTX Topco Ltd lifted its holdings in Humacyte by 48.8% in the third quarter. XTX Topco Ltd now owns 34,049 shares of the company's stock valued at $185,000 after buying an additional 11,172 shares during the period. Insigneo Advisory Services LLC bought a new stake in Humacyte during the third quarter valued at $109,000. Finally, Wellington Management Group LLP grew its holdings in Humacyte by 30.9% during the 3rd quarter. Wellington Management Group LLP now owns 254,411 shares of the company's stock worth $1,384,000 after acquiring an additional 60,087 shares during the period. 44.71% of the stock is owned by institutional investors and hedge funds.

About Humacyte

(

Get Free Report)

Humacyte, Inc engages in the development and manufacture of off-the-shelf, implantable, and bioengineered human tissues for the treatment of diseases and conditions across a range of anatomic locations in multiple therapeutic areas. The company using its proprietary and scientific technology platform to engineer and manufacture human acellular vessels (HAVs) to be implanted into patient without inducing a foreign body response or leading to immune rejection.

See Also

Before you consider Humacyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Humacyte wasn't on the list.

While Humacyte currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.