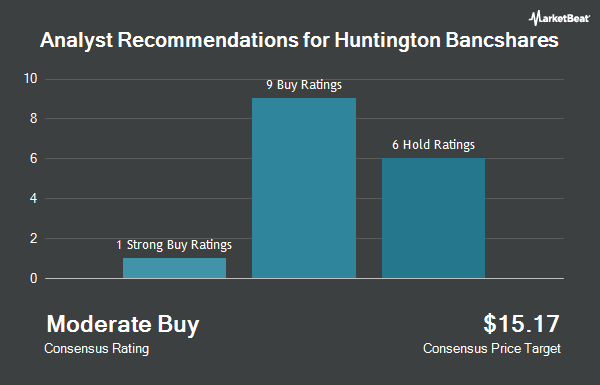

Shares of Huntington Bancshares Incorporated (NASDAQ:HBAN - Get Free Report) have earned an average recommendation of "Moderate Buy" from the nineteen brokerages that are currently covering the firm, Marketbeat.com reports. One equities research analyst has rated the stock with a sell recommendation, five have given a hold recommendation, twelve have issued a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month target price among brokers that have issued ratings on the stock in the last year is $16.62.

A number of equities research analysts have issued reports on HBAN shares. Royal Bank of Canada reiterated an "outperform" rating and issued a $17.00 target price on shares of Huntington Bancshares in a research note on Friday, October 18th. Piper Sandler upped their price objective on shares of Huntington Bancshares from $14.00 to $15.00 and gave the stock an "underweight" rating in a report on Friday, October 18th. Barclays raised their target price on shares of Huntington Bancshares from $15.00 to $17.00 and gave the company an "equal weight" rating in a research note on Friday, October 18th. The Goldman Sachs Group upped their price target on shares of Huntington Bancshares from $16.25 to $20.00 and gave the stock a "buy" rating in a research note on Tuesday, November 26th. Finally, Evercore ISI raised their price objective on shares of Huntington Bancshares from $17.00 to $18.00 and gave the company an "outperform" rating in a research note on Wednesday, October 30th.

Read Our Latest Stock Analysis on Huntington Bancshares

Insider Activity

In other news, CFO Zachary Jacob Wasserman sold 8,644 shares of Huntington Bancshares stock in a transaction on Wednesday, November 13th. The stock was sold at an average price of $17.63, for a total transaction of $152,393.72. Following the transaction, the chief financial officer now owns 259,943 shares in the company, valued at approximately $4,582,795.09. The trade was a 3.22 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, VP Scott D. Kleinman sold 28,600 shares of the stock in a transaction dated Wednesday, November 13th. The stock was sold at an average price of $17.67, for a total value of $505,362.00. Following the completion of the sale, the vice president now directly owns 496,076 shares of the company's stock, valued at approximately $8,765,662.92. This represents a 5.45 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 43,699 shares of company stock worth $757,356 over the last 90 days. 0.89% of the stock is owned by company insiders.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the stock. State Street Corp boosted its stake in shares of Huntington Bancshares by 10.3% during the 3rd quarter. State Street Corp now owns 79,474,115 shares of the bank's stock valued at $1,179,319,000 after buying an additional 7,439,909 shares during the period. Charles Schwab Investment Management Inc. raised its holdings in shares of Huntington Bancshares by 2.5% during the third quarter. Charles Schwab Investment Management Inc. now owns 62,708,399 shares of the bank's stock worth $921,778,000 after acquiring an additional 1,522,767 shares in the last quarter. Geode Capital Management LLC boosted its position in Huntington Bancshares by 1.3% during the third quarter. Geode Capital Management LLC now owns 36,880,662 shares of the bank's stock valued at $540,422,000 after purchasing an additional 473,893 shares during the last quarter. FMR LLC grew its stake in Huntington Bancshares by 16.8% in the third quarter. FMR LLC now owns 23,719,168 shares of the bank's stock valued at $348,672,000 after purchasing an additional 3,410,597 shares in the last quarter. Finally, Victory Capital Management Inc. increased its position in Huntington Bancshares by 13.2% in the 3rd quarter. Victory Capital Management Inc. now owns 20,318,486 shares of the bank's stock worth $298,682,000 after purchasing an additional 2,363,988 shares during the last quarter. 80.72% of the stock is owned by hedge funds and other institutional investors.

Huntington Bancshares Stock Performance

Shares of HBAN traded up $0.01 during mid-day trading on Friday, hitting $18.01. The stock had a trading volume of 6,349,220 shares, compared to its average volume of 14,999,810. The company has a quick ratio of 0.87, a current ratio of 0.88 and a debt-to-equity ratio of 0.86. The company has a market cap of $26.17 billion, a PE ratio of 17.32, a PEG ratio of 3.59 and a beta of 1.03. Huntington Bancshares has a fifty-two week low of $11.10 and a fifty-two week high of $18.44. The company's fifty day simple moving average is $16.05 and its two-hundred day simple moving average is $14.61.

Huntington Bancshares (NASDAQ:HBAN - Get Free Report) last released its quarterly earnings data on Thursday, October 17th. The bank reported $0.33 EPS for the quarter, topping analysts' consensus estimates of $0.30 by $0.03. Huntington Bancshares had a net margin of 14.19% and a return on equity of 10.72%. The firm had revenue of $1.89 billion during the quarter, compared to the consensus estimate of $1.86 billion. During the same quarter in the previous year, the company posted $0.36 earnings per share. On average, equities analysts expect that Huntington Bancshares will post 1.21 earnings per share for the current year.

Huntington Bancshares Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, January 2nd. Stockholders of record on Wednesday, December 18th will be given a $0.155 dividend. This represents a $0.62 annualized dividend and a dividend yield of 3.44%. The ex-dividend date is Wednesday, December 18th. Huntington Bancshares's dividend payout ratio (DPR) is currently 59.62%.

Huntington Bancshares Company Profile

(

Get Free ReportHuntington Bancshares Incorporated operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States. The company offers financial products and services to consumer and business customers, including deposits, lending, payments, mortgage banking, dealer financing, investment management, trust, brokerage, insurance, and other financial products and services.

Featured Articles

Before you consider Huntington Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntington Bancshares wasn't on the list.

While Huntington Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report