Versor Investments LP trimmed its stake in shares of Huntington Ingalls Industries, Inc. (NYSE:HII - Free Report) by 64.3% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,928 shares of the aerospace company's stock after selling 3,470 shares during the period. Versor Investments LP's holdings in Huntington Ingalls Industries were worth $510,000 at the end of the most recent quarter.

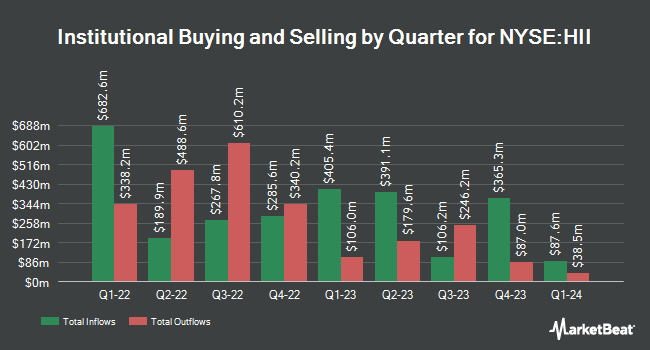

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. CWM LLC lifted its holdings in Huntington Ingalls Industries by 142.8% during the third quarter. CWM LLC now owns 5,251 shares of the aerospace company's stock valued at $1,388,000 after purchasing an additional 3,088 shares in the last quarter. SteelPeak Wealth LLC purchased a new position in Huntington Ingalls Industries during the second quarter valued at $1,769,000. Old North State Wealth Management LLC raised its position in shares of Huntington Ingalls Industries by 60.6% in the third quarter. Old North State Wealth Management LLC now owns 11,790 shares of the aerospace company's stock valued at $3,122,000 after buying an additional 4,450 shares during the last quarter. Diamond Hill Capital Management Inc. acquired a new stake in shares of Huntington Ingalls Industries in the third quarter valued at about $47,698,000. Finally, Mitsubishi UFJ Asset Management Co. Ltd. raised its position in shares of Huntington Ingalls Industries by 30.5% in the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 49,805 shares of the aerospace company's stock valued at $14,517,000 after buying an additional 11,647 shares during the last quarter. 90.46% of the stock is owned by hedge funds and other institutional investors.

Huntington Ingalls Industries Stock Down 4.2 %

Shares of NYSE HII traded down $8.61 during midday trading on Thursday, hitting $195.39. The company's stock had a trading volume of 541,085 shares, compared to its average volume of 334,559. The business's fifty day simple moving average is $246.54 and its two-hundred day simple moving average is $254.35. The company has a debt-to-equity ratio of 0.41, a current ratio of 0.79 and a quick ratio of 0.73. Huntington Ingalls Industries, Inc. has a 1 year low of $184.29 and a 1 year high of $299.50. The firm has a market capitalization of $7.65 billion, a price-to-earnings ratio of 11.03, a price-to-earnings-growth ratio of 1.74 and a beta of 0.55.

Huntington Ingalls Industries (NYSE:HII - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The aerospace company reported $2.56 EPS for the quarter, missing the consensus estimate of $3.84 by ($1.28). Huntington Ingalls Industries had a net margin of 5.99% and a return on equity of 16.89%. The business had revenue of $2.75 billion during the quarter, compared to analysts' expectations of $2.87 billion. During the same period in the previous year, the business posted $3.70 EPS. The company's revenue for the quarter was down 2.4% compared to the same quarter last year. On average, equities analysts predict that Huntington Ingalls Industries, Inc. will post 15.41 EPS for the current year.

Huntington Ingalls Industries Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Friday, November 29th will be paid a $1.35 dividend. The ex-dividend date of this dividend is Friday, November 29th. This represents a $5.40 dividend on an annualized basis and a yield of 2.76%. This is an increase from Huntington Ingalls Industries's previous quarterly dividend of $1.30. Huntington Ingalls Industries's payout ratio is currently 29.36%.

Insider Buying and Selling

In related news, VP D R. Wyatt sold 400 shares of Huntington Ingalls Industries stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $205.24, for a total value of $82,096.00. Following the completion of the transaction, the vice president now owns 19,627 shares in the company, valued at $4,028,245.48. The trade was a 2.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.72% of the stock is owned by insiders.

Analyst Ratings Changes

HII has been the subject of a number of recent research reports. Barclays reduced their target price on shares of Huntington Ingalls Industries from $290.00 to $220.00 and set an "equal weight" rating for the company in a research report on Monday, November 4th. Vertical Research cut shares of Huntington Ingalls Industries from a "buy" rating to a "hold" rating and set a $275.00 price objective for the company. in a research report on Thursday, October 10th. The Goldman Sachs Group cut their price objective on shares of Huntington Ingalls Industries from $226.00 to $194.00 and set a "sell" rating for the company in a research report on Friday, November 1st. Wolfe Research cut shares of Huntington Ingalls Industries from an "outperform" rating to a "peer perform" rating in a research report on Thursday, October 10th. Finally, Bank of America cut their price objective on shares of Huntington Ingalls Industries from $250.00 to $195.00 and set an "underperform" rating for the company in a research report on Wednesday. Two investment analysts have rated the stock with a sell rating, eight have given a hold rating and one has given a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of $228.89.

Get Our Latest Research Report on HII

Huntington Ingalls Industries Company Profile

(

Free Report)

Huntington Ingalls Industries, Inc designs, builds, overhauls, and repairs military ships in the United States. It operates through three segments: Ingalls, Newport News, and Mission Technologies. The company is involved in the design and construction of non-nuclear ships comprising amphibious assault ships; expeditionary warfare ships; surface combatants; and national security cutters for the U.S.

Read More

Before you consider Huntington Ingalls Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntington Ingalls Industries wasn't on the list.

While Huntington Ingalls Industries currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.