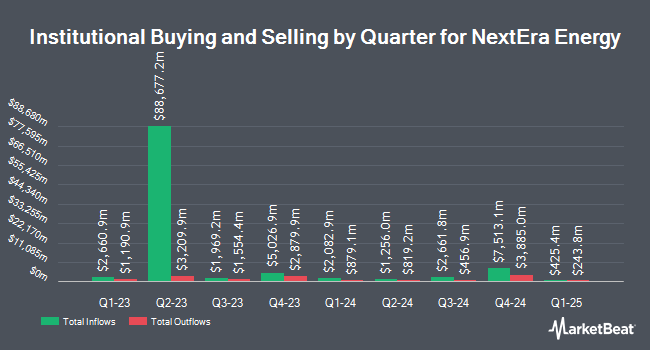

Huntington National Bank lowered its holdings in NextEra Energy, Inc. (NYSE:NEE - Free Report) by 3.1% in the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 1,133,855 shares of the utilities provider's stock after selling 35,735 shares during the period. Huntington National Bank owned approximately 0.06% of NextEra Energy worth $95,845,000 at the end of the most recent reporting period.

A number of other hedge funds also recently added to or reduced their stakes in the business. Bell Bank increased its holdings in NextEra Energy by 2.0% during the 3rd quarter. Bell Bank now owns 9,605 shares of the utilities provider's stock worth $812,000 after purchasing an additional 189 shares during the period. Mizuho Securities Co. Ltd. purchased a new stake in shares of NextEra Energy in the 3rd quarter valued at approximately $51,000. D Orazio & Associates Inc. purchased a new stake in shares of NextEra Energy during the 3rd quarter worth $200,000. Schrum Private Wealth Management LLC grew its stake in shares of NextEra Energy by 47.4% during the third quarter. Schrum Private Wealth Management LLC now owns 11,860 shares of the utilities provider's stock worth $1,002,000 after purchasing an additional 3,813 shares in the last quarter. Finally, Saturna Capital Corp increased its holdings in NextEra Energy by 13.6% in the third quarter. Saturna Capital Corp now owns 9,175 shares of the utilities provider's stock valued at $776,000 after buying an additional 1,100 shares during the last quarter. 78.72% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several research analysts have recently issued reports on NEE shares. Bank of America upped their price objective on NextEra Energy from $77.00 to $81.00 and gave the stock a "neutral" rating in a research report on Thursday, August 29th. Dbs Bank cut shares of NextEra Energy from a "strong-buy" rating to a "hold" rating in a report on Friday, September 27th. Guggenheim increased their target price on shares of NextEra Energy from $90.00 to $92.00 and gave the company a "buy" rating in a research report on Thursday, October 24th. Scotiabank boosted their price target on shares of NextEra Energy from $73.00 to $92.00 and gave the company a "sector outperform" rating in a research report on Tuesday, August 20th. Finally, Wells Fargo & Company lifted their target price on NextEra Energy from $95.00 to $102.00 and gave the stock an "overweight" rating in a research report on Tuesday, September 3rd. Eight analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $86.54.

View Our Latest Stock Analysis on NextEra Energy

NextEra Energy Stock Performance

NYSE:NEE traded up $1.25 during mid-day trading on Thursday, reaching $75.49. The stock had a trading volume of 3,403,759 shares, compared to its average volume of 10,895,388. The company has a debt-to-equity ratio of 1.11, a quick ratio of 0.33 and a current ratio of 0.41. NextEra Energy, Inc. has a twelve month low of $53.95 and a twelve month high of $86.10. The firm has a market capitalization of $155.24 billion, a price-to-earnings ratio of 21.96, a PEG ratio of 2.68 and a beta of 0.57. The business has a 50 day simple moving average of $81.70 and a 200 day simple moving average of $77.36.

NextEra Energy (NYSE:NEE - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The utilities provider reported $1.03 earnings per share for the quarter, beating the consensus estimate of $0.98 by $0.05. The firm had revenue of $7.57 billion during the quarter, compared to the consensus estimate of $8.11 billion. NextEra Energy had a return on equity of 11.94% and a net margin of 26.49%. NextEra Energy's quarterly revenue was up 5.5% on a year-over-year basis. During the same period last year, the business posted $0.94 EPS. On average, analysts expect that NextEra Energy, Inc. will post 3.41 earnings per share for the current fiscal year.

NextEra Energy Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Friday, November 22nd will be given a dividend of $0.515 per share. This represents a $2.06 annualized dividend and a yield of 2.73%. The ex-dividend date is Friday, November 22nd. NextEra Energy's payout ratio is 60.95%.

Insider Transactions at NextEra Energy

In related news, EVP Nicole J. Daggs sold 4,007 shares of NextEra Energy stock in a transaction dated Tuesday, November 12th. The stock was sold at an average price of $75.57, for a total transaction of $302,808.99. Following the completion of the sale, the executive vice president now owns 15,792 shares in the company, valued at approximately $1,193,401.44. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Insiders own 0.18% of the company's stock.

About NextEra Energy

(

Free Report)

NextEra Energy, Inc, through its subsidiaries, generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear,natural gas, and other clean energy. It also develops, constructs, and operates long-term contracted assets that consists of clean energy solutions, such as renewable generation facilities, battery storage projects, and electric transmission facilities; sells energy commodities; and owns, develops, constructs, manages and operates electric generation facilities in wholesale energy markets.

See Also

Before you consider NextEra Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NextEra Energy wasn't on the list.

While NextEra Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.