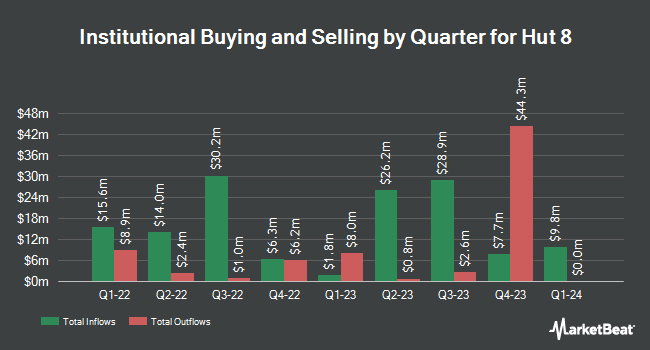

Charles Schwab Investment Management Inc. raised its position in Hut 8 Corp. (NASDAQ:HUT - Free Report) by 21.4% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,011,692 shares of the company's stock after buying an additional 178,527 shares during the period. Charles Schwab Investment Management Inc. owned 1.08% of Hut 8 worth $20,730,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. State Street Corp boosted its position in Hut 8 by 12.6% in the third quarter. State Street Corp now owns 2,740,769 shares of the company's stock valued at $33,602,000 after buying an additional 307,292 shares in the last quarter. JAT Capital Mgmt LP acquired a new position in shares of Hut 8 during the third quarter worth approximately $32,260,000. Geode Capital Management LLC lifted its position in shares of Hut 8 by 21.1% during the third quarter. Geode Capital Management LLC now owns 2,193,900 shares of the company's stock worth $26,902,000 after purchasing an additional 381,720 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. acquired a new position in shares of Hut 8 during the third quarter worth approximately $9,997,000. Finally, Walleye Capital LLC lifted its position in shares of Hut 8 by 179.7% during the third quarter. Walleye Capital LLC now owns 405,780 shares of the company's stock worth $4,975,000 after purchasing an additional 260,695 shares in the last quarter. 31.75% of the stock is currently owned by institutional investors and hedge funds.

Hut 8 Price Performance

NASDAQ HUT traded down $0.02 during trading hours on Friday, hitting $12.90. The company's stock had a trading volume of 3,334,456 shares, compared to its average volume of 5,149,434. The stock has a fifty day moving average of $18.69 and a 200 day moving average of $18.84. The company has a current ratio of 1.00, a quick ratio of 1.00 and a debt-to-equity ratio of 0.35. Hut 8 Corp. has a twelve month low of $6.95 and a twelve month high of $31.95.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on HUT. HC Wainwright reduced their target price on shares of Hut 8 from $35.00 to $30.00 and set a "buy" rating on the stock in a research report on Tuesday, March 4th. Keefe, Bruyette & Woods began coverage on shares of Hut 8 in a research report on Wednesday, January 8th. They set an "outperform" rating on the stock. Piper Sandler began coverage on shares of Hut 8 in a research report on Tuesday, December 17th. They set an "overweight" rating and a $33.00 target price on the stock. Canaccord Genuity Group reiterated a "buy" rating and set a $32.00 target price on shares of Hut 8 in a research report on Tuesday, March 4th. Finally, Cantor Fitzgerald restated an "overweight" rating and issued a $30.00 price objective on shares of Hut 8 in a report on Friday, March 7th. Ten analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the company presently has an average rating of "Buy" and an average target price of $29.89.

Check Out Our Latest Analysis on Hut 8

Hut 8 Profile

(

Free Report)

Hut 8 Corp., together with its subsidiaries, acquires, builds, manages, and operates data centers for digital assets mining, computing, and artificial intelligence in the United States. It operates in four segments: Digital Assets Mining, Managed Services, High Performance Computing Colocation and Cloud, and Other.

See Also

Before you consider Hut 8, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hut 8 wasn't on the list.

While Hut 8 currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.