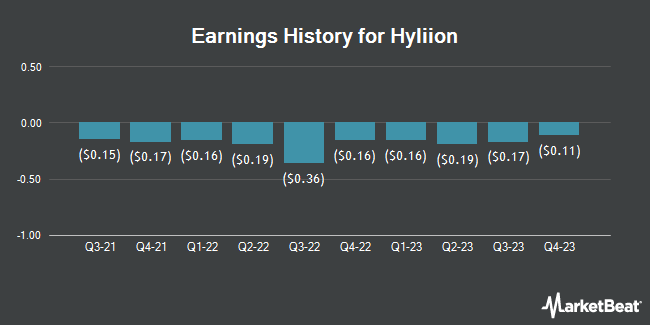

Hyliion (NYSE:HYLN - Get Free Report) is anticipated to release its earnings data before the market opens on Tuesday, February 11th. Analysts expect Hyliion to post earnings of ($0.07) per share for the quarter. Parties interested in participating in the company's conference call can do so using this link.

Hyliion Stock Performance

Shares of NYSE:HYLN traded down $0.03 during midday trading on Wednesday, hitting $1.99. 916,825 shares of the company's stock traded hands, compared to its average volume of 1,075,632. The firm's fifty day moving average price is $2.57 and its two-hundred day moving average price is $2.44. Hyliion has a twelve month low of $1.08 and a twelve month high of $4.09. The company has a market cap of $345.73 million, a PE ratio of -5.38 and a beta of 2.08.

Insider Transactions at Hyliion

In related news, Director Vincent T. Cubbage sold 65,000 shares of the business's stock in a transaction dated Friday, November 22nd. The stock was sold at an average price of $3.90, for a total value of $253,500.00. Following the transaction, the director now owns 972,078 shares in the company, valued at approximately $3,791,104.20. The trade was a 6.27 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Jeffrey A. Craig acquired 50,000 shares of the stock in a transaction on Wednesday, November 20th. The shares were acquired at an average price of $2.95 per share, with a total value of $147,500.00. Following the purchase, the director now owns 282,060 shares in the company, valued at $832,077. This represents a 21.55 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Company insiders own 20.40% of the company's stock.

Hyliion Company Profile

(

Get Free Report)

Featured Articles

Before you consider Hyliion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hyliion wasn't on the list.

While Hyliion currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.