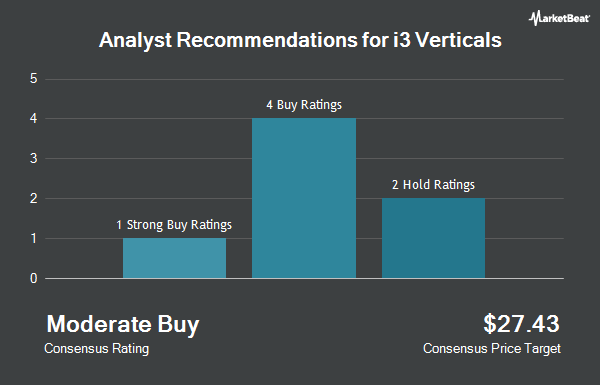

i3 Verticals, Inc. (NASDAQ:IIIV - Get Free Report) has received a consensus recommendation of "Moderate Buy" from the seven ratings firms that are currently covering the firm, MarketBeat.com reports. Two research analysts have rated the stock with a hold recommendation, four have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average 1-year price target among analysts that have issued a report on the stock in the last year is $27.14.

IIIV has been the topic of a number of recent research reports. Stephens restated an "overweight" rating and issued a $29.00 target price on shares of i3 Verticals in a report on Tuesday. Benchmark restated a "buy" rating and issued a $33.00 target price on shares of i3 Verticals in a report on Tuesday. Raymond James reduced their target price on shares of i3 Verticals from $31.00 to $28.00 and set a "strong-buy" rating on the stock in a report on Monday, August 12th. KeyCorp reduced their target price on shares of i3 Verticals from $28.00 to $27.00 and set an "overweight" rating on the stock in a report on Monday, August 12th. Finally, DA Davidson restated a "buy" rating and issued a $32.00 target price on shares of i3 Verticals in a report on Monday, September 30th.

Get Our Latest Report on IIIV

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently modified their holdings of IIIV. Comerica Bank increased its position in i3 Verticals by 46.0% during the 1st quarter. Comerica Bank now owns 2,133 shares of the company's stock worth $49,000 after purchasing an additional 672 shares in the last quarter. Quantbot Technologies LP purchased a new position in i3 Verticals in the 3rd quarter worth approximately $109,000. SG Americas Securities LLC purchased a new position in i3 Verticals in the 2nd quarter worth approximately $116,000. EntryPoint Capital LLC purchased a new position in i3 Verticals in the 1st quarter worth approximately $210,000. Finally, Atom Investors LP bought a new position in i3 Verticals during the third quarter worth $218,000. Institutional investors and hedge funds own 84.22% of the company's stock.

i3 Verticals Stock Performance

NASDAQ:IIIV traded down $1.21 during mid-day trading on Tuesday, reaching $23.19. The stock had a trading volume of 300,930 shares, compared to its average volume of 222,002. The company has a debt-to-equity ratio of 1.01, a quick ratio of 2.98 and a current ratio of 2.98. The firm has a market capitalization of $783.59 million, a price-to-earnings ratio of -271.44 and a beta of 1.53. i3 Verticals has a twelve month low of $17.54 and a twelve month high of $26.00. The business has a 50 day simple moving average of $22.85 and a 200 day simple moving average of $21.95.

i3 Verticals Company Profile

(

Get Free Reporti3 Verticals, Inc provides integrated payment and software solutions primarily to the public sector and healthcare markets in the United States. It operates in two segments, Software and Services, and Merchant Services. The company offers payment processing services that enables upper and lower court case management, collections, finance and accounting, motor vehicle and carrier registration, e-filing and taxation, license plate inventory, property tax management, utility billing, professional licensing, document workflow, and law enforcement software; assists public schools in completing payment processing functions, including accepting payments for online or at school lunches, and school activities.

Further Reading

Before you consider i3 Verticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and i3 Verticals wasn't on the list.

While i3 Verticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.