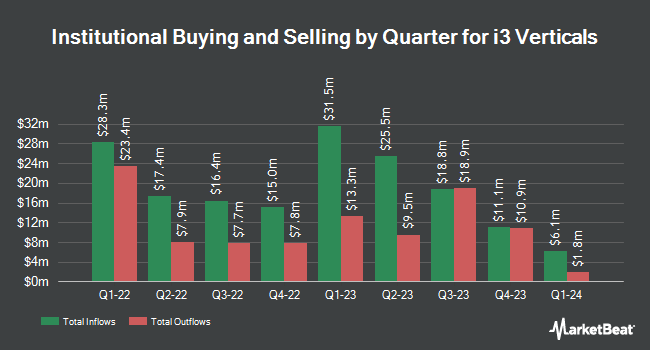

Cramer Rosenthal Mcglynn LLC increased its position in shares of i3 Verticals, Inc. (NASDAQ:IIIV - Free Report) by 32.3% in the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 276,530 shares of the company's stock after acquiring an additional 67,489 shares during the quarter. Cramer Rosenthal Mcglynn LLC owned about 0.82% of i3 Verticals worth $6,371,000 as of its most recent SEC filing.

Other large investors have also recently modified their holdings of the company. KLP Kapitalforvaltning AS purchased a new stake in shares of i3 Verticals during the 4th quarter valued at $99,000. CIBC Private Wealth Group LLC increased its position in i3 Verticals by 52.4% during the 4th quarter. CIBC Private Wealth Group LLC now owns 5,260 shares of the company's stock valued at $126,000 after buying an additional 1,809 shares in the last quarter. AlphaQuest LLC raised its stake in i3 Verticals by 688,600.0% in the fourth quarter. AlphaQuest LLC now owns 6,887 shares of the company's stock valued at $159,000 after buying an additional 6,886 shares during the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. boosted its holdings in i3 Verticals by 26.4% in the fourth quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 7,130 shares of the company's stock worth $168,000 after acquiring an additional 1,488 shares in the last quarter. Finally, SG Americas Securities LLC grew its stake in shares of i3 Verticals by 62.4% during the fourth quarter. SG Americas Securities LLC now owns 8,646 shares of the company's stock worth $199,000 after acquiring an additional 3,323 shares during the last quarter. Institutional investors own 84.22% of the company's stock.

Analyst Upgrades and Downgrades

Several analysts have weighed in on the stock. DA Davidson boosted their target price on shares of i3 Verticals from $32.00 to $34.00 and gave the stock a "buy" rating in a research report on Monday, February 10th. KeyCorp upped their target price on i3 Verticals from $27.00 to $32.00 and gave the company an "overweight" rating in a research report on Monday, February 10th. Morgan Stanley boosted their price target on i3 Verticals from $22.00 to $27.00 and gave the company an "equal weight" rating in a research note on Wednesday, February 12th. Finally, BMO Capital Markets lifted their target price on i3 Verticals from $22.00 to $26.00 and gave the stock a "market perform" rating in a report on Monday, February 10th. Two analysts have rated the stock with a hold rating, four have given a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, i3 Verticals presently has an average rating of "Moderate Buy" and a consensus price target of $29.86.

Get Our Latest Stock Report on i3 Verticals

i3 Verticals Price Performance

IIIV stock traded up $0.25 during trading on Wednesday, hitting $25.62. 65,804 shares of the company traded hands, compared to its average volume of 228,246. i3 Verticals, Inc. has a 1 year low of $18.75 and a 1 year high of $29.80. The company has a market cap of $847.36 million, a PE ratio of 5.71 and a beta of 1.36. The stock's 50-day simple moving average is $25.14 and its 200 day simple moving average is $24.45.

i3 Verticals (NASDAQ:IIIV - Get Free Report) last released its quarterly earnings data on Thursday, February 6th. The company reported $0.23 earnings per share for the quarter, missing analysts' consensus estimates of $0.28 by ($0.05). i3 Verticals had a net margin of 41.85% and a return on equity of 3.36%. Research analysts expect that i3 Verticals, Inc. will post 0.9 earnings per share for the current year.

i3 Verticals Profile

(

Free Report)

i3 Verticals, Inc provides integrated payment and software solutions primarily to the public sector and healthcare markets in the United States. It operates in two segments, Software and Services, and Merchant Services. The company offers payment processing services that enables upper and lower court case management, collections, finance and accounting, motor vehicle and carrier registration, e-filing and taxation, license plate inventory, property tax management, utility billing, professional licensing, document workflow, and law enforcement software; assists public schools in completing payment processing functions, including accepting payments for online or at school lunches, and school activities.

Featured Stories

Before you consider i3 Verticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and i3 Verticals wasn't on the list.

While i3 Verticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.