iA Global Asset Management Inc. lessened its stake in IQVIA Holdings Inc. (NYSE:IQV - Free Report) by 92.4% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 21,612 shares of the medical research company's stock after selling 262,295 shares during the quarter. iA Global Asset Management Inc.'s holdings in IQVIA were worth $5,121,000 at the end of the most recent quarter.

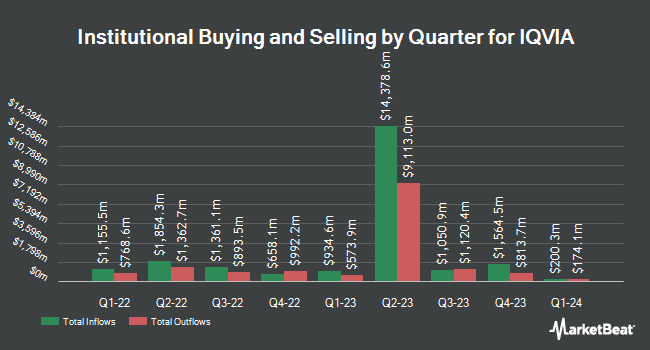

A number of other hedge funds also recently made changes to their positions in IQV. Opal Wealth Advisors LLC acquired a new position in shares of IQVIA in the 2nd quarter valued at $27,000. Capital Performance Advisors LLP acquired a new position in shares of IQVIA in the 3rd quarter valued at $27,000. Park Place Capital Corp acquired a new position in shares of IQVIA in the 3rd quarter valued at $28,000. Itau Unibanco Holding S.A. acquired a new position in shares of IQVIA in the 2nd quarter valued at $29,000. Finally, International Assets Investment Management LLC purchased a new position in shares of IQVIA in the 2nd quarter valued at $32,000. Institutional investors and hedge funds own 89.62% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities analysts have recently commented on the stock. Royal Bank of Canada reissued an "outperform" rating and issued a $270.00 target price on shares of IQVIA in a research note on Wednesday. TD Cowen cut their target price on shares of IQVIA from $270.00 to $255.00 and set a "buy" rating on the stock in a research note on Friday, November 1st. The Goldman Sachs Group cut their target price on shares of IQVIA from $280.00 to $250.00 and set a "buy" rating on the stock in a research note on Friday, November 1st. BTIG Research cut their target price on shares of IQVIA from $290.00 to $260.00 and set a "buy" rating on the stock in a research note on Friday, November 1st. Finally, Morgan Stanley dropped their price target on shares of IQVIA from $280.00 to $265.00 and set an "overweight" rating on the stock in a research note on Monday, November 4th. Five analysts have rated the stock with a hold rating, fourteen have given a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, IQVIA has a consensus rating of "Moderate Buy" and an average target price of $256.50.

View Our Latest Stock Analysis on IQV

IQVIA Trading Up 1.4 %

Shares of NYSE:IQV traded up $2.70 during mid-day trading on Friday, hitting $202.63. The stock had a trading volume of 1,388,125 shares, compared to its average volume of 2,002,141. The company has a debt-to-equity ratio of 1.76, a quick ratio of 0.81 and a current ratio of 0.81. The company has a market cap of $36.78 billion, a PE ratio of 26.59, a P/E/G ratio of 2.09 and a beta of 1.49. IQVIA Holdings Inc. has a 12-month low of $187.62 and a 12-month high of $261.73. The company's 50 day moving average is $215.18 and its 200-day moving average is $225.10.

IQVIA Company Profile

(

Free Report)

IQVIA Holdings Inc engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions.

Featured Articles

Before you consider IQVIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IQVIA wasn't on the list.

While IQVIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.