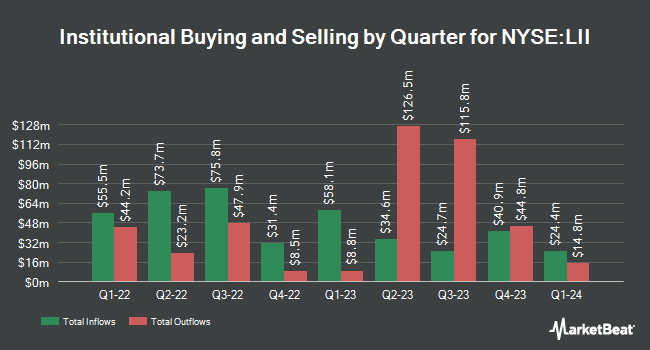

iA Global Asset Management Inc. trimmed its stake in Lennox International Inc. (NYSE:LII - Free Report) by 94.2% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 725 shares of the construction company's stock after selling 11,710 shares during the quarter. iA Global Asset Management Inc.'s holdings in Lennox International were worth $438,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Erste Asset Management GmbH purchased a new position in Lennox International during the third quarter worth about $493,000. Caisse DE Depot ET Placement DU Quebec boosted its holdings in shares of Lennox International by 1,065.7% in the 3rd quarter. Caisse DE Depot ET Placement DU Quebec now owns 7,670 shares of the construction company's stock worth $4,635,000 after buying an additional 7,012 shares during the last quarter. BNP Paribas Financial Markets raised its position in Lennox International by 26.9% in the third quarter. BNP Paribas Financial Markets now owns 23,261 shares of the construction company's stock worth $14,056,000 after acquiring an additional 4,927 shares during the period. Quantbot Technologies LP purchased a new stake in shares of Lennox International during the 3rd quarter worth approximately $77,000. Finally, Eagle Asset Management Inc. lifted its stake in Lennox International by 7.7% in the third quarter. Eagle Asset Management Inc. now owns 14,673 shares of the construction company's stock valued at $9,258,000 after purchasing an additional 1,047 shares during the last quarter. 67.07% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

Several equities research analysts recently weighed in on LII shares. Mizuho lifted their price objective on Lennox International from $650.00 to $675.00 and gave the stock an "outperform" rating in a report on Thursday, October 24th. Royal Bank of Canada upped their target price on Lennox International from $604.00 to $619.00 and gave the stock a "sector perform" rating in a research note on Thursday, October 24th. Robert W. Baird boosted their price objective on Lennox International from $648.00 to $656.00 and gave the stock a "neutral" rating in a report on Thursday, October 24th. Northcoast Research started coverage on shares of Lennox International in a research note on Friday, November 22nd. They issued a "sell" rating and a $475.00 target price on the stock. Finally, Barclays boosted their price target on shares of Lennox International from $624.00 to $674.00 and gave the stock an "equal weight" rating in a research note on Thursday, December 5th. Two analysts have rated the stock with a sell rating, seven have issued a hold rating and five have given a buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $579.38.

View Our Latest Research Report on LII

Lennox International Trading Up 1.2 %

Shares of NYSE LII traded up $7.55 during midday trading on Tuesday, reaching $646.34. The company had a trading volume of 242,204 shares, compared to its average volume of 270,504. The stock has a market cap of $23.02 billion, a PE ratio of 30.35, a price-to-earnings-growth ratio of 2.03 and a beta of 1.08. Lennox International Inc. has a one year low of $406.40 and a one year high of $682.50. The firm's fifty day moving average price is $622.13 and its 200-day moving average price is $579.30. The company has a quick ratio of 0.87, a current ratio of 1.39 and a debt-to-equity ratio of 1.10.

Lennox International (NYSE:LII - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The construction company reported $6.68 earnings per share for the quarter, beating analysts' consensus estimates of $5.95 by $0.73. Lennox International had a return on equity of 148.52% and a net margin of 14.63%. The firm had revenue of $1.50 billion during the quarter, compared to analyst estimates of $1.42 billion. During the same quarter in the prior year, the firm posted $5.37 earnings per share. The business's quarterly revenue was up 9.6% compared to the same quarter last year. On average, equities research analysts anticipate that Lennox International Inc. will post 21.1 earnings per share for the current year.

Lennox International Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be issued a dividend of $1.15 per share. The ex-dividend date is Tuesday, December 31st. This represents a $4.60 dividend on an annualized basis and a yield of 0.71%. Lennox International's dividend payout ratio is presently 21.84%.

Insider Buying and Selling at Lennox International

In other Lennox International news, CAO Chris Kosel sold 200 shares of the business's stock in a transaction on Wednesday, November 13th. The stock was sold at an average price of $625.49, for a total value of $125,098.00. Following the sale, the chief accounting officer now directly owns 1,446 shares of the company's stock, valued at approximately $904,458.54. The trade was a 12.15 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Sherry Buck sold 500 shares of the firm's stock in a transaction on Wednesday, November 27th. The shares were sold at an average price of $660.74, for a total value of $330,370.00. Following the transaction, the director now owns 1,693 shares of the company's stock, valued at $1,118,632.82. The trade was a 22.80 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 2,106 shares of company stock valued at $1,353,233 in the last 90 days. Insiders own 10.40% of the company's stock.

Lennox International Profile

(

Free Report)

Lennox International Inc, together with its subsidiaries, designs, manufactures, and markets a range of products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally. The Home Comfort Solutions segment provides furnaces, air conditioners, heat pumps, packaged heating and cooling systems, indoor air quality equipment, comfort control products, and replacement parts and supplies; residential heating, ventilation, cooling equipment, and air conditioning; and evaporator coils and unit heaters under Lennox, Dave Lennox Signature Collection, Armstrong Air, Ducane, AirEase, Concord, MagicPak, Advanced Distributor Products, Allied, Elite Series, Merit Series, Comfort Sync, Healthy Climate, iComfort, ComfortSense, and Lennox Stores name.

Further Reading

Before you consider Lennox International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lennox International wasn't on the list.

While Lennox International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report