Sterling Capital Management LLC lessened its position in shares of IAC Inc. (NASDAQ:IAC - Free Report) by 96.3% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 4,471 shares of the company's stock after selling 115,608 shares during the period. Sterling Capital Management LLC's holdings in IAC were worth $193,000 as of its most recent SEC filing.

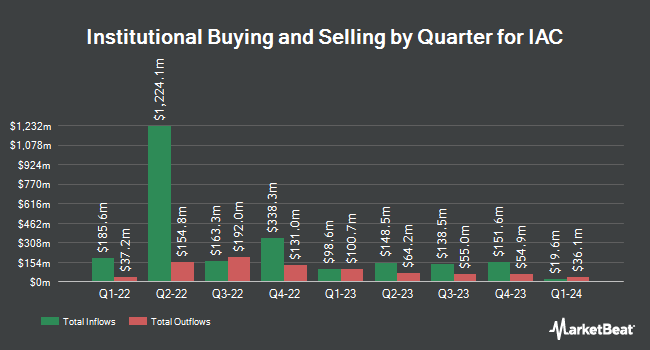

Other institutional investors have also made changes to their positions in the company. Aster Capital Management DIFC Ltd lifted its holdings in shares of IAC by 287.4% in the 4th quarter. Aster Capital Management DIFC Ltd now owns 616 shares of the company's stock worth $27,000 after purchasing an additional 457 shares during the last quarter. Bank Julius Baer & Co. Ltd Zurich acquired a new position in IAC in the 4th quarter worth approximately $41,000. MassMutual Private Wealth & Trust FSB grew its position in IAC by 1,398.5% during the 4th quarter. MassMutual Private Wealth & Trust FSB now owns 2,053 shares of the company's stock worth $89,000 after purchasing an additional 1,916 shares in the last quarter. Allworth Financial LP raised its stake in IAC by 1,193.4% during the 4th quarter. Allworth Financial LP now owns 3,337 shares of the company's stock valued at $139,000 after purchasing an additional 3,079 shares during the period. Finally, KBC Group NV lifted its holdings in shares of IAC by 22.8% in the fourth quarter. KBC Group NV now owns 3,278 shares of the company's stock valued at $141,000 after purchasing an additional 608 shares in the last quarter. 88.90% of the stock is currently owned by institutional investors.

IAC Stock Down 0.4 %

IAC opened at $32.90 on Tuesday. The company has a debt-to-equity ratio of 0.31, a current ratio of 2.80 and a quick ratio of 2.75. The firm's fifty day moving average price is $42.41 and its two-hundred day moving average price is $45.04. The company has a market capitalization of $2.55 billion, a P/E ratio of -5.05 and a beta of 1.24. IAC Inc. has a fifty-two week low of $32.05 and a fifty-two week high of $58.29.

Wall Street Analyst Weigh In

Several research analysts recently weighed in on IAC shares. UBS Group dropped their price target on IAC from $55.00 to $54.00 and set a "neutral" rating on the stock in a research report on Thursday, February 13th. Barclays reduced their target price on IAC from $66.00 to $61.00 and set an "overweight" rating for the company in a report on Thursday, February 13th. JPMorgan Chase & Co. restated an "overweight" rating and issued a $60.00 price objective on shares of IAC in a research note on Friday, March 21st. JMP Securities lowered their target price on shares of IAC from $70.00 to $64.00 and set a "market outperform" rating on the stock in a research note on Thursday, February 13th. Finally, Benchmark cut their target price on shares of IAC from $105.00 to $100.00 and set a "buy" rating for the company in a research report on Thursday, February 13th. Three investment analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the stock. According to data from MarketBeat.com, IAC currently has a consensus rating of "Moderate Buy" and an average target price of $64.31.

View Our Latest Stock Report on IAC

IAC Company Profile

(

Free Report)

IAC Inc, together with its subsidiaries, operates as a media and internet company worldwide. The company publishes original and engaging digital content in the form of articles, illustrations, and videos and images across entertainment, food, home, beauty, travel, health, family, luxury, and fashion areas; and magazines related to women and lifestyle.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider IAC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IAC wasn't on the list.

While IAC currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.