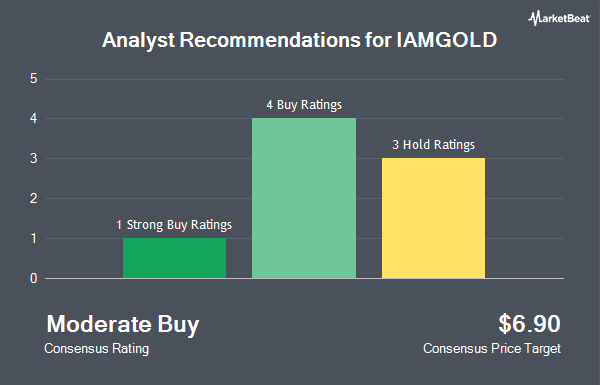

Shares of IAMGOLD Co. (NYSE:IAG - Get Free Report) TSE: IMG have been assigned an average rating of "Moderate Buy" from the nine analysts that are presently covering the stock, MarketBeat.com reports. Three equities research analysts have rated the stock with a hold recommendation, four have assigned a buy recommendation and two have assigned a strong buy recommendation to the company. The average 12-month target price among brokers that have covered the stock in the last year is $7.23.

Several research firms recently commented on IAG. Raymond James reissued a "market perform" rating and set a $8.00 target price on shares of IAMGOLD in a research note on Friday, April 4th. National Bank Financial upgraded IAMGOLD to a "strong-buy" rating in a research report on Friday, March 21st. CIBC restated an "outperform" rating on shares of IAMGOLD in a report on Thursday, March 20th. Finally, StockNews.com lowered IAMGOLD from a "buy" rating to a "hold" rating in a research report on Thursday, February 27th.

Get Our Latest Report on IAG

Institutional Inflows and Outflows

Several large investors have recently bought and sold shares of IAG. Allspring Global Investments Holdings LLC grew its position in shares of IAMGOLD by 27.4% during the 4th quarter. Allspring Global Investments Holdings LLC now owns 1,289,000 shares of the mining company's stock worth $6,654,000 after buying an additional 277,000 shares during the period. Cibc World Market Inc. raised its position in shares of IAMGOLD by 54.0% during the 4th quarter. Cibc World Market Inc. now owns 5,119,599 shares of the mining company's stock valued at $26,452,000 after acquiring an additional 1,795,869 shares during the last quarter. Triasima Portfolio Management inc. lifted its stake in shares of IAMGOLD by 44.5% in the 4th quarter. Triasima Portfolio Management inc. now owns 352,315 shares of the mining company's stock valued at $1,820,000 after purchasing an additional 108,524 shares during the period. JPMorgan Chase & Co. boosted its position in shares of IAMGOLD by 66.6% in the 3rd quarter. JPMorgan Chase & Co. now owns 1,511,328 shares of the mining company's stock worth $7,904,000 after purchasing an additional 604,259 shares during the last quarter. Finally, Public Employees Retirement System of Ohio acquired a new stake in shares of IAMGOLD during the third quarter worth $1,083,000. Institutional investors and hedge funds own 47.08% of the company's stock.

IAMGOLD Stock Performance

Shares of NYSE IAG traded up $0.70 during midday trading on Friday, hitting $6.51. The company's stock had a trading volume of 35,554,533 shares, compared to its average volume of 9,924,190. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.61 and a current ratio of 0.89. IAMGOLD has a 1-year low of $3.44 and a 1-year high of $6.69. The firm's fifty day moving average price is $6.03 and its 200-day moving average price is $5.63. The firm has a market cap of $3.72 billion, a P/E ratio of 4.49 and a beta of 1.52.

IAMGOLD (NYSE:IAG - Get Free Report) TSE: IMG last issued its quarterly earnings data on Thursday, February 20th. The mining company reported $0.10 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.15 by ($0.05). IAMGOLD had a return on equity of 10.64% and a net margin of 50.19%. The business had revenue of $469.90 million for the quarter, compared to analyst estimates of $498.68 million. On average, sell-side analysts forecast that IAMGOLD will post 0.67 EPS for the current fiscal year.

IAMGOLD Company Profile

(

Get Free ReportIAMGOLD Corporation, through its subsidiaries, operates as an intermediate gold producer and developer in Canada and Burkina Faso. It owns 100% interest in the Westwood project that covers an area of 1,925 hectare and located in Quebec; a 60% interest in the Côté gold project, which covers an area of 596 square kilometer located in Ontario, Canada; and a 90% interests in the Essakane project that covers an area of 274,000 square kilometer situated in Burkina Faso.

Featured Articles

Before you consider IAMGOLD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IAMGOLD wasn't on the list.

While IAMGOLD currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.