Cibc World Mkts upgraded shares of IAMGOLD (NYSE:IAG - Free Report) TSE: IMG from a hold rating to a strong-buy rating in a research report report published on Monday morning,Zacks.com reports.

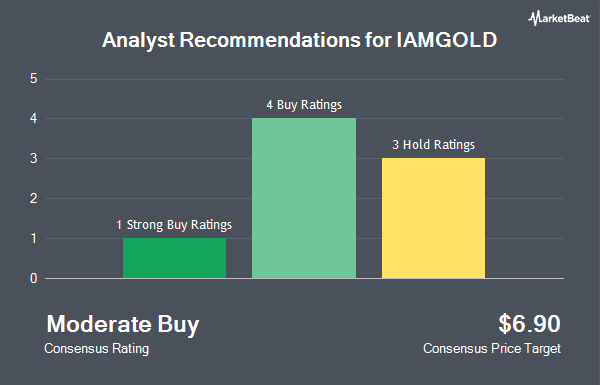

Other equities research analysts also recently issued research reports about the company. Canaccord Genuity Group raised IAMGOLD from a "hold" rating to a "buy" rating in a report on Tuesday, October 22nd. Canaccord Genuity Group raised IAMGOLD from a "hold" rating to a "buy" rating and raised their target price for the company from $7.75 to $10.50 in a report on Tuesday, October 22nd. StockNews.com raised IAMGOLD from a "hold" rating to a "buy" rating in a report on Monday, November 11th. National Bank Financial raised IAMGOLD from a "sector perform" rating to an "outperform" rating in a report on Thursday, October 10th. Finally, Royal Bank of Canada reissued a "sector perform" rating and set a $6.00 price objective on shares of IAMGOLD in a report on Tuesday, October 22nd. Two investment analysts have rated the stock with a hold rating, six have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, IAMGOLD has a consensus rating of "Moderate Buy" and a consensus price target of $6.68.

Get Our Latest Analysis on IAMGOLD

IAMGOLD Price Performance

Shares of IAG stock traded down $0.05 during trading hours on Monday, reaching $5.67. The company's stock had a trading volume of 5,880,589 shares, compared to its average volume of 8,931,454. The firm's 50 day simple moving average is $5.35 and its 200-day simple moving average is $4.68. The company has a market capitalization of $3.24 billion, a price-to-earnings ratio of 4.47 and a beta of 1.56. IAMGOLD has a fifty-two week low of $2.11 and a fifty-two week high of $6.37. The company has a quick ratio of 0.61, a current ratio of 0.89 and a debt-to-equity ratio of 0.24.

Institutional Inflows and Outflows

Several large investors have recently bought and sold shares of IAG. Millennium Management LLC raised its position in IAMGOLD by 194.2% during the 2nd quarter. Millennium Management LLC now owns 7,884,544 shares of the mining company's stock worth $29,573,000 after purchasing an additional 5,204,715 shares during the last quarter. FMR LLC raised its position in IAMGOLD by 107.9% during the 3rd quarter. FMR LLC now owns 8,819,600 shares of the mining company's stock worth $46,174,000 after purchasing an additional 4,577,599 shares during the last quarter. Van ECK Associates Corp raised its position in shares of IAMGOLD by 8.8% in the 3rd quarter. Van ECK Associates Corp now owns 52,894,690 shares of the mining company's stock worth $276,639,000 after acquiring an additional 4,267,084 shares in the last quarter. Two Sigma Advisers LP raised its position in shares of IAMGOLD by 58.8% in the 3rd quarter. Two Sigma Advisers LP now owns 10,083,115 shares of the mining company's stock worth $52,735,000 after acquiring an additional 3,732,315 shares in the last quarter. Finally, Bank of Montreal Can raised its position in shares of IAMGOLD by 130.6% in the 3rd quarter. Bank of Montreal Can now owns 5,384,778 shares of the mining company's stock worth $28,385,000 after acquiring an additional 3,049,252 shares in the last quarter. 47.08% of the stock is owned by institutional investors.

IAMGOLD Company Profile

(

Get Free Report)

IAMGOLD Corporation, through its subsidiaries, operates as an intermediate gold producer and developer in Canada and Burkina Faso. It owns 100% interest in the Westwood project that covers an area of 1,925 hectare and located in Quebec; a 60% interest in the Côté gold project, which covers an area of 596 square kilometer located in Ontario, Canada; and a 90% interests in the Essakane project that covers an area of 274,000 square kilometer situated in Burkina Faso.

Read More

Before you consider IAMGOLD, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IAMGOLD wasn't on the list.

While IAMGOLD currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.