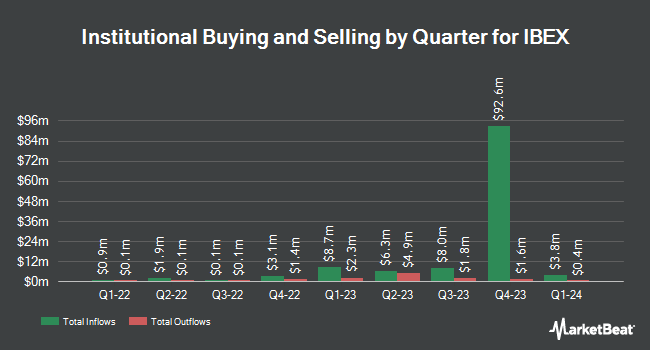

Royce & Associates LP lessened its holdings in IBEX Limited (NASDAQ:IBEX - Free Report) by 14.6% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 529,000 shares of the company's stock after selling 90,413 shares during the period. Royce & Associates LP owned about 3.16% of IBEX worth $10,569,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also made changes to their positions in the business. Quadrature Capital Ltd purchased a new position in IBEX in the first quarter valued at about $349,000. Kennedy Capital Management LLC grew its stake in shares of IBEX by 341.7% in the first quarter. Kennedy Capital Management LLC now owns 282,675 shares of the company's stock valued at $4,362,000 after buying an additional 218,679 shares in the last quarter. Jacobs Levy Equity Management Inc. raised its holdings in shares of IBEX by 9.3% during the 1st quarter. Jacobs Levy Equity Management Inc. now owns 37,390 shares of the company's stock valued at $577,000 after buying an additional 3,191 shares during the period. Private Capital Management LLC lifted its position in IBEX by 14.6% during the 1st quarter. Private Capital Management LLC now owns 55,465 shares of the company's stock worth $856,000 after acquiring an additional 7,069 shares in the last quarter. Finally, Bank of New York Mellon Corp boosted its holdings in IBEX by 15.7% in the 2nd quarter. Bank of New York Mellon Corp now owns 27,626 shares of the company's stock worth $447,000 after acquiring an additional 3,759 shares during the period. Institutional investors and hedge funds own 81.24% of the company's stock.

IBEX Stock Down 1.9 %

IBEX stock opened at $19.35 on Friday. The stock's 50 day moving average is $19.00 and its two-hundred day moving average is $17.05. IBEX Limited has a 52-week low of $13.00 and a 52-week high of $20.56. The company has a market capitalization of $324.40 million, a PE ratio of 10.24 and a beta of 0.76.

IBEX (NASDAQ:IBEX - Get Free Report) last issued its quarterly earnings results on Thursday, September 12th. The company reported $0.54 earnings per share (EPS) for the quarter. IBEX had a net margin of 6.57% and a return on equity of 22.54%. The business had revenue of $124.53 million during the quarter.

Insider Activity

In other IBEX news, Director Mohammedulla Khaishgi sold 4,880 shares of the business's stock in a transaction on Thursday, September 19th. The shares were sold at an average price of $20.00, for a total transaction of $97,600.00. Following the completion of the sale, the director now owns 296,711 shares in the company, valued at $5,934,220. The trade was a 1.62 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Shuja Keen sold 15,000 shares of the firm's stock in a transaction dated Friday, September 13th. The stock was sold at an average price of $19.95, for a total transaction of $299,250.00. Following the completion of the transaction, the director now owns 146,110 shares in the company, valued at approximately $2,914,894.50. The trade was a 9.31 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 243,373 shares of company stock worth $4,813,965. 6.72% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

IBEX has been the topic of a number of analyst reports. Royal Bank of Canada lifted their price objective on shares of IBEX from $18.00 to $20.00 and gave the company a "sector perform" rating in a research note on Friday, September 13th. Robert W. Baird raised their price target on shares of IBEX from $23.00 to $26.00 and gave the company an "outperform" rating in a report on Friday, November 8th. Two research analysts have rated the stock with a hold rating and two have issued a buy rating to the company. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $21.25.

View Our Latest Research Report on IBEX

About IBEX

(

Free Report)

IBEX Limited provides end-to-end technology-enabled customer lifecycle experience solutions in the United States and internationally. The company products and services portfolio includes ibex Connect, that offers customer service, technical support, revenue generation, and other revenue generation outsourced back-office services through the CX model, which integrates voice, email, chat, SMS, social media, and other communication applications; ibex Digital, a customer acquisition solution that comprises digital marketing, e-commerce technology, and platform solutions; and ibex CX, a customer experience solution, which provides a suite of proprietary software tools to measure, monitor, and manage its clients' customer experience.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider IBEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IBEX wasn't on the list.

While IBEX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.