StockNews.com downgraded shares of Ichor (NASDAQ:ICHR - Free Report) from a hold rating to a sell rating in a report released on Tuesday morning.

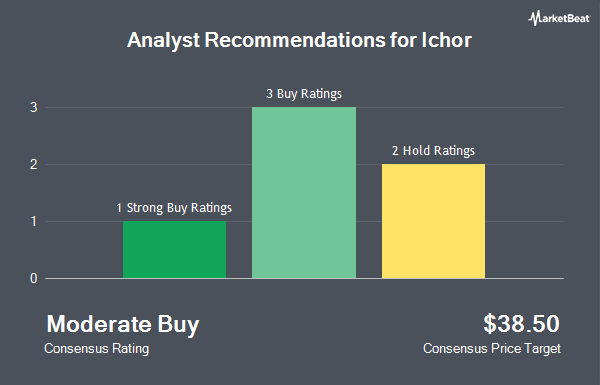

Several other equities research analysts have also recently weighed in on the company. TD Cowen decreased their price target on Ichor from $40.00 to $38.00 and set a "buy" rating on the stock in a research report on Friday, January 17th. Needham & Company LLC restated a "hold" rating on shares of Ichor in a research report on Wednesday, February 5th. Finally, B. Riley restated a "buy" rating and issued a $38.00 price objective (up from $36.00) on shares of Ichor in a research report on Tuesday, November 5th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $42.29.

Get Our Latest Report on Ichor

Ichor Stock Performance

NASDAQ ICHR traded down $0.15 during trading on Tuesday, hitting $29.29. 409,788 shares of the company's stock traded hands, compared to its average volume of 315,518. The stock has a market capitalization of $995.95 million, a price-to-earnings ratio of -45.06 and a beta of 1.91. Ichor has a 12-month low of $25.95 and a 12-month high of $45.21. The company has a debt-to-equity ratio of 0.17, a quick ratio of 1.49 and a current ratio of 3.34. The business has a 50 day moving average of $31.17 and a 200-day moving average of $30.68.

Ichor (NASDAQ:ICHR - Get Free Report) last announced its quarterly earnings results on Tuesday, February 4th. The technology company reported ($0.05) earnings per share for the quarter, missing the consensus estimate of $0.09 by ($0.14). Ichor had a negative net margin of 2.45% and a negative return on equity of 1.38%. As a group, equities research analysts anticipate that Ichor will post 1.01 earnings per share for the current fiscal year.

Insider Buying and Selling at Ichor

In other Ichor news, Director Jorge Titinger sold 3,000 shares of the stock in a transaction that occurred on Friday, February 7th. The shares were sold at an average price of $32.04, for a total transaction of $96,120.00. Following the transaction, the director now directly owns 9,832 shares in the company, valued at $315,017.28. This trade represents a 23.38 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Company insiders own 2.20% of the company's stock.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently bought and sold shares of the business. Creative Planning purchased a new stake in shares of Ichor during the third quarter valued at approximately $578,000. Signaturefd LLC boosted its stake in shares of Ichor by 214.6% during the third quarter. Signaturefd LLC now owns 1,252 shares of the technology company's stock valued at $40,000 after purchasing an additional 854 shares during the period. Pinnacle Associates Ltd. boosted its stake in shares of Ichor by 2.2% during the third quarter. Pinnacle Associates Ltd. now owns 498,955 shares of the technology company's stock valued at $16,780,000 after purchasing an additional 10,761 shares during the period. Harbor Capital Advisors Inc. boosted its stake in shares of Ichor by 105.5% during the third quarter. Harbor Capital Advisors Inc. now owns 39,642 shares of the technology company's stock valued at $1,261,000 after purchasing an additional 20,351 shares during the period. Finally, Versor Investments LP purchased a new stake in shares of Ichor during the third quarter valued at approximately $394,000. 94.81% of the stock is currently owned by institutional investors.

About Ichor

(

Get Free Report)

Ichor Holdings, Ltd. engages in the design, engineering, and manufacture of fluid delivery subsystems and components for semiconductor capital equipment in the United States and internationally. It primarily offers gas and chemical delivery systems and subsystems that are used in the manufacturing of semiconductor devices.

Further Reading

Before you consider Ichor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ichor wasn't on the list.

While Ichor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.