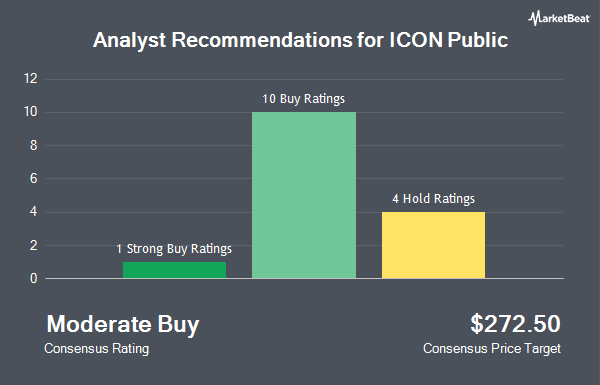

ICON Public Limited (NASDAQ:ICLR - Get Free Report) has earned an average recommendation of "Moderate Buy" from the fourteen ratings firms that are covering the firm, Marketbeat Ratings reports. Three equities research analysts have rated the stock with a hold rating, ten have given a buy rating and one has issued a strong buy rating on the company. The average twelve-month price target among analysts that have issued ratings on the stock in the last year is $304.27.

A number of analysts recently weighed in on the stock. TD Cowen cut their price target on shares of ICON Public from $369.00 to $285.00 and set a "buy" rating on the stock in a research report on Friday, October 25th. Redburn Atlantic assumed coverage on shares of ICON Public in a research report on Monday, October 14th. They issued a "neutral" rating and a $311.00 price target on the stock. Barclays cut their price target on shares of ICON Public from $330.00 to $275.00 and set an "overweight" rating on the stock in a research report on Friday, October 25th. The Goldman Sachs Group cut their price target on shares of ICON Public from $370.00 to $280.00 and set a "buy" rating on the stock in a research report on Friday, October 25th. Finally, Leerink Partnrs upgraded shares of ICON Public to a "strong-buy" rating in a research report on Wednesday, September 18th.

Check Out Our Latest Research Report on ICLR

Institutional Investors Weigh In On ICON Public

Several hedge funds have recently added to or reduced their stakes in the business. Icon Wealth Advisors LLC lifted its holdings in ICON Public by 861.1% during the 3rd quarter. Icon Wealth Advisors LLC now owns 13,215 shares of the medical research company's stock valued at $3,797,000 after purchasing an additional 11,840 shares during the last quarter. First Horizon Advisors Inc. lifted its holdings in ICON Public by 33.9% during the 3rd quarter. First Horizon Advisors Inc. now owns 597 shares of the medical research company's stock valued at $172,000 after purchasing an additional 151 shares during the last quarter. Arkadios Wealth Advisors lifted its holdings in ICON Public by 5.0% during the 3rd quarter. Arkadios Wealth Advisors now owns 1,293 shares of the medical research company's stock valued at $371,000 after purchasing an additional 62 shares during the last quarter. Whittier Trust Co. of Nevada Inc. lifted its holdings in ICON Public by 23.1% during the 3rd quarter. Whittier Trust Co. of Nevada Inc. now owns 511 shares of the medical research company's stock valued at $147,000 after purchasing an additional 96 shares during the last quarter. Finally, Whittier Trust Co. lifted its holdings in shares of ICON Public by 12.3% during the third quarter. Whittier Trust Co. now owns 4,020 shares of the medical research company's stock worth $1,155,000 after buying an additional 441 shares in the last quarter. Institutional investors and hedge funds own 95.61% of the company's stock.

ICON Public Trading Down 3.9 %

ICON Public stock traded down $8.37 during trading hours on Wednesday, reaching $203.90. 1,789,176 shares of the company's stock traded hands, compared to its average volume of 693,597. The company has a debt-to-equity ratio of 0.35, a quick ratio of 1.34 and a current ratio of 1.34. ICON Public has a fifty-two week low of $203.83 and a fifty-two week high of $347.72. The firm has a market capitalization of $16.82 billion, a price-to-earnings ratio of 23.04, a PEG ratio of 1.57 and a beta of 1.25. The firm's 50 day moving average is $273.62 and its 200-day moving average is $303.50.

ICON Public (NASDAQ:ICLR - Get Free Report) last released its earnings results on Wednesday, October 23rd. The medical research company reported $3.35 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $3.72 by ($0.37). The business had revenue of $2.03 billion for the quarter, compared to analyst estimates of $2.13 billion. ICON Public had a net margin of 9.00% and a return on equity of 11.91%. The business's revenue for the quarter was down 1.2% on a year-over-year basis. During the same quarter in the previous year, the company posted $3.10 earnings per share. On average, analysts predict that ICON Public will post 13.43 earnings per share for the current year.

About ICON Public

(

Get Free ReportICON Public Limited Company, a clinical research organization, provides outsourced development and commercialization services in Ireland, rest of Europe, the United States, and internationally. The company specializes in the strategic development, management, and analysis of programs that support various stages of the clinical development process from compound selection to Phase I-IV clinical studies.

Featured Stories

Before you consider ICON Public, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ICON Public wasn't on the list.

While ICON Public currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.