ICON Public (NASDAQ:ICLR - Get Free Report)'s stock had its "outperform" rating reissued by Leerink Partners in a report released on Tuesday,Benzinga reports. They currently have a $255.00 price objective on the medical research company's stock, down from their previous price objective of $270.00. Leerink Partners' price objective would suggest a potential upside of 30.37% from the stock's current price.

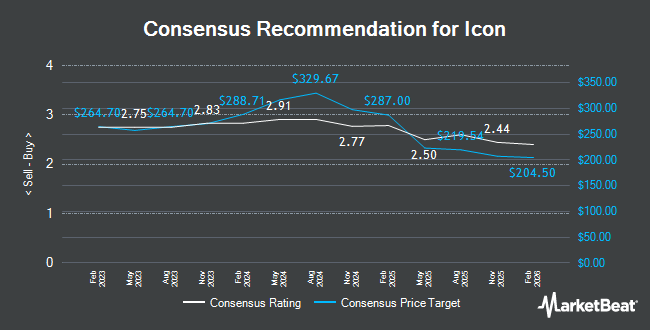

A number of other equities analysts have also issued reports on ICLR. Leerink Partnrs upgraded shares of ICON Public to a "strong-buy" rating in a research report on Wednesday, September 18th. Robert W. Baird lowered shares of ICON Public from an "outperform" rating to a "neutral" rating and set a $340.00 target price on the stock. in a research report on Thursday, October 24th. JPMorgan Chase & Co. reduced their price objective on ICON Public from $375.00 to $280.00 and set an "overweight" rating for the company in a research note on Friday, October 25th. Redburn Atlantic initiated coverage on ICON Public in a research note on Monday, October 14th. They issued a "neutral" rating and a $311.00 target price on the stock. Finally, Evercore ISI cut their price target on ICON Public from $360.00 to $350.00 and set an "outperform" rating for the company in a research note on Tuesday, October 8th. Four equities research analysts have rated the stock with a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $302.91.

Get Our Latest Report on ICON Public

ICON Public Stock Up 4.5 %

ICON Public stock traded up $8.38 during trading on Tuesday, reaching $195.60. The stock had a trading volume of 1,508,185 shares, compared to its average volume of 714,189. ICON Public has a 52-week low of $183.38 and a 52-week high of $347.72. The business has a 50 day moving average price of $263.10 and a 200 day moving average price of $299.72. The company has a quick ratio of 1.34, a current ratio of 1.34 and a debt-to-equity ratio of 0.35. The stock has a market cap of $16.14 billion, a PE ratio of 21.81, a P/E/G ratio of 1.40 and a beta of 1.25.

ICON Public (NASDAQ:ICLR - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The medical research company reported $3.35 EPS for the quarter, missing analysts' consensus estimates of $3.72 by ($0.37). ICON Public had a net margin of 9.00% and a return on equity of 11.91%. The business had revenue of $2.03 billion during the quarter, compared to analysts' expectations of $2.13 billion. During the same quarter in the previous year, the company posted $3.10 EPS. The company's revenue was down 1.2% compared to the same quarter last year. On average, analysts predict that ICON Public will post 13.43 EPS for the current year.

Institutional Investors Weigh In On ICON Public

A number of hedge funds and other institutional investors have recently modified their holdings of the stock. Foyston Gordon & Payne Inc acquired a new stake in shares of ICON Public during the 3rd quarter valued at approximately $11,672,000. Icon Wealth Advisors LLC lifted its position in shares of ICON Public by 861.1% during the 3rd quarter. Icon Wealth Advisors LLC now owns 13,215 shares of the medical research company's stock valued at $3,797,000 after acquiring an additional 11,840 shares during the period. First Horizon Advisors Inc. grew its stake in ICON Public by 33.9% in the 3rd quarter. First Horizon Advisors Inc. now owns 597 shares of the medical research company's stock valued at $172,000 after acquiring an additional 151 shares during the last quarter. Arkadios Wealth Advisors grew its stake in ICON Public by 5.0% in the 3rd quarter. Arkadios Wealth Advisors now owns 1,293 shares of the medical research company's stock valued at $371,000 after acquiring an additional 62 shares during the last quarter. Finally, Whittier Trust Co. of Nevada Inc. grew its stake in ICON Public by 23.1% in the 3rd quarter. Whittier Trust Co. of Nevada Inc. now owns 511 shares of the medical research company's stock valued at $147,000 after acquiring an additional 96 shares during the last quarter. 95.61% of the stock is currently owned by institutional investors and hedge funds.

ICON Public Company Profile

(

Get Free Report)

ICON Public Limited Company, a clinical research organization, provides outsourced development and commercialization services in Ireland, rest of Europe, the United States, and internationally. The company specializes in the strategic development, management, and analysis of programs that support various stages of the clinical development process from compound selection to Phase I-IV clinical studies.

Recommended Stories

Before you consider ICON Public, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ICON Public wasn't on the list.

While ICON Public currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.