ICON Public (NASDAQ:ICLR - Get Free Report) issued an update on its FY 2025 earnings guidance on Tuesday morning. The company provided earnings per share guidance of 13.000-15.000 for the period, compared to the consensus earnings per share estimate of 14.930. The company issued revenue guidance of $8.1 billion-$8.7 billion, compared to the consensus revenue estimate of $8.5 billion. ICON Public also updated its FY 2024 guidance to 13.900-14.100 EPS.

ICON Public Stock Performance

Shares of ICON Public stock traded down $17.75 on Tuesday, reaching $200.24. 1,830,683 shares of the company were exchanged, compared to its average volume of 899,485. ICON Public has a 1-year low of $183.38 and a 1-year high of $347.72. The firm has a market cap of $16.52 billion, a price-to-earnings ratio of 22.32, a P/E/G ratio of 1.54 and a beta of 1.20. The company has a debt-to-equity ratio of 0.35, a quick ratio of 1.34 and a current ratio of 1.34. The company's 50-day moving average is $211.31 and its two-hundred day moving average is $270.81.

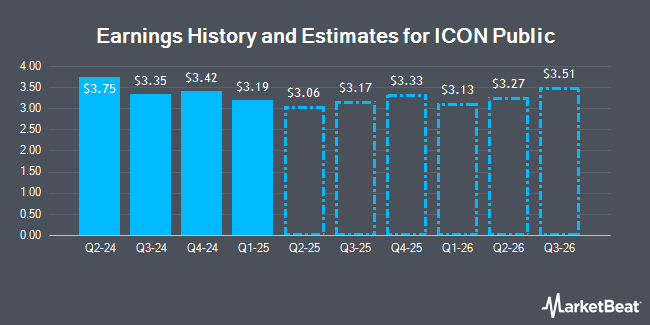

ICON Public (NASDAQ:ICLR - Get Free Report) last posted its earnings results on Wednesday, October 23rd. The medical research company reported $3.35 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $3.72 by ($0.37). ICON Public had a net margin of 9.00% and a return on equity of 11.91%. The company had revenue of $2.03 billion during the quarter, compared to the consensus estimate of $2.13 billion. During the same quarter in the previous year, the business posted $3.10 earnings per share. The business's quarterly revenue was down 1.2% compared to the same quarter last year. As a group, research analysts expect that ICON Public will post 13.42 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

ICLR has been the subject of several analyst reports. Robert W. Baird reduced their price objective on ICON Public from $249.00 to $225.00 and set a "neutral" rating for the company in a research report on Wednesday, November 20th. William Blair reiterated an "outperform" rating on shares of ICON Public in a research report on Tuesday. Leerink Partners reissued an "outperform" rating and set a $255.00 price target (down from $270.00) on shares of ICON Public in a report on Tuesday, November 19th. Leerink Partnrs raised shares of ICON Public to a "strong-buy" rating in a report on Wednesday, September 18th. Finally, Barclays lowered their target price on shares of ICON Public from $330.00 to $275.00 and set an "overweight" rating on the stock in a research note on Friday, October 25th. Four investment analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $287.00.

View Our Latest Analysis on ICLR

ICON Public Company Profile

(

Get Free Report)

ICON Public Limited Company, a clinical research organization, provides outsourced development and commercialization services in Ireland, rest of Europe, the United States, and internationally. The company specializes in the strategic development, management, and analysis of programs that support various stages of the clinical development process from compound selection to Phase I-IV clinical studies.

See Also

Before you consider ICON Public, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ICON Public wasn't on the list.

While ICON Public currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.