Icon Wealth Advisors LLC lessened its stake in Broadcom Inc. (NASDAQ:AVGO - Free Report) by 60.8% in the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 19,620 shares of the semiconductor manufacturer's stock after selling 30,479 shares during the quarter. Icon Wealth Advisors LLC's holdings in Broadcom were worth $3,384,000 at the end of the most recent reporting period.

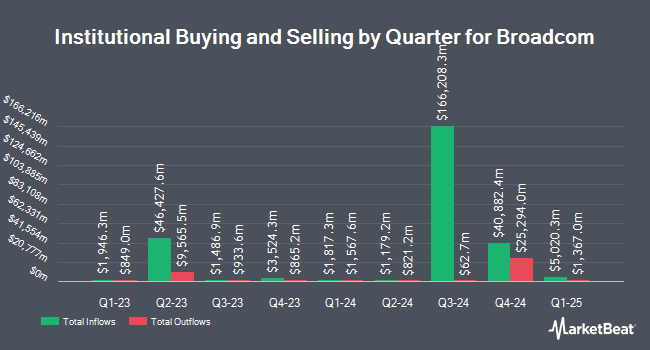

A number of other large investors also recently added to or reduced their stakes in the stock. AXA S.A. lifted its stake in Broadcom by 2.7% in the 2nd quarter. AXA S.A. now owns 291,078 shares of the semiconductor manufacturer's stock worth $467,334,000 after purchasing an additional 7,608 shares in the last quarter. Catalyst Financial Partners LLC increased its holdings in shares of Broadcom by 943.3% in the third quarter. Catalyst Financial Partners LLC now owns 20,136 shares of the semiconductor manufacturer's stock valued at $3,473,000 after purchasing an additional 18,206 shares during the last quarter. Whittier Trust Co. boosted its stake in Broadcom by 947.2% during the third quarter. Whittier Trust Co. now owns 689,858 shares of the semiconductor manufacturer's stock worth $119,000,000 after buying an additional 623,983 shares during the last quarter. Summit Place Financial Advisors LLC boosted its stake in Broadcom by 912.6% during the third quarter. Summit Place Financial Advisors LLC now owns 9,802 shares of the semiconductor manufacturer's stock worth $1,691,000 after buying an additional 8,834 shares during the last quarter. Finally, Signaturefd LLC grew its holdings in Broadcom by 913.0% in the 3rd quarter. Signaturefd LLC now owns 78,977 shares of the semiconductor manufacturer's stock valued at $13,624,000 after buying an additional 71,181 shares in the last quarter. 76.43% of the stock is currently owned by institutional investors and hedge funds.

Ad Stansberry Research

"This Could Be Worse Than the Great Depression, the Dot-Com Crash, and the 2008 Crisis Combined"

What Are These Billionaire Investors Afraid Of?

Billionaires Warren Buffett, Stanley Druckenmiller, George Soros, and David Tepper have all sold off massive U.S. stock positions, including shares of Nvidia, Apple, and Bank of America. Billionaire Ray Dalio, who runs one of the world’s most successful hedge funds, says, “Things are going to get worse for our economy.” What are these billionaires so worried about?

Click here to see why experts and insiders may be preparing for the biggest financial crisis of the

Broadcom Stock Up 0.4 %

Shares of AVGO traded up $0.59 during mid-day trading on Monday, reaching $164.82. The company's stock had a trading volume of 26,820,170 shares, compared to its average volume of 29,283,262. The company's 50 day moving average is $173.70 and its 200 day moving average is $160.62. The stock has a market cap of $769.80 billion, a PE ratio of 142.10, a price-to-earnings-growth ratio of 1.93 and a beta of 1.17. Broadcom Inc. has a 12-month low of $90.31 and a 12-month high of $186.42. The company has a debt-to-equity ratio of 1.02, a current ratio of 1.04 and a quick ratio of 0.94.

Broadcom (NASDAQ:AVGO - Get Free Report) last released its quarterly earnings data on Thursday, September 5th. The semiconductor manufacturer reported $1.24 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.20 by $0.04. Broadcom had a net margin of 10.88% and a return on equity of 30.12%. The company had revenue of $13.07 billion during the quarter, compared to the consensus estimate of $12.98 billion. During the same quarter in the prior year, the firm posted $0.95 earnings per share. Broadcom's revenue for the quarter was up 47.3% on a year-over-year basis. Equities analysts anticipate that Broadcom Inc. will post 3.78 EPS for the current fiscal year.

Broadcom Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Shareholders of record on Thursday, September 19th were paid a $0.53 dividend. The ex-dividend date of this dividend was Thursday, September 19th. This represents a $2.12 dividend on an annualized basis and a yield of 1.29%. This is a boost from Broadcom's previous quarterly dividend of $0.53. Broadcom's payout ratio is currently 184.19%.

Analyst Upgrades and Downgrades

AVGO has been the topic of several recent research reports. UBS Group boosted their price target on shares of Broadcom from $170.00 to $200.00 and gave the company a "buy" rating in a research report on Monday, November 4th. Morgan Stanley boosted their target price on shares of Broadcom from $176.00 to $180.00 and gave the company an "overweight" rating in a report on Friday, September 6th. JPMorgan Chase & Co. raised their price target on shares of Broadcom from $200.00 to $210.00 and gave the stock an "overweight" rating in a report on Friday, September 6th. Benchmark reiterated a "buy" rating and issued a $210.00 price objective on shares of Broadcom in a report on Friday, September 6th. Finally, Truist Financial raised their target price on Broadcom from $204.00 to $205.00 and gave the stock a "buy" rating in a research note on Tuesday, October 8th. Two investment analysts have rated the stock with a hold rating, twenty-three have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $195.96.

Get Our Latest Stock Analysis on AVGO

Insider Buying and Selling at Broadcom

In related news, insider Charlie B. Kawwas sold 25,200 shares of Broadcom stock in a transaction on Thursday, September 19th. The shares were sold at an average price of $168.27, for a total value of $4,240,404.00. Following the transaction, the insider now directly owns 753,280 shares in the company, valued at $126,754,425.60. This trade represents a 3.24 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Gayla J. Delly sold 750 shares of the firm's stock in a transaction on Wednesday, September 25th. The stock was sold at an average price of $174.53, for a total transaction of $130,897.50. Following the completion of the sale, the director now owns 34,750 shares of the company's stock, valued at $6,064,917.50. This trade represents a 2.11 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 311,080 shares of company stock worth $53,540,590. 2.00% of the stock is owned by insiders.

About Broadcom

(

Free Report)

Broadcom Inc designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide. The company operates in two segments, Semiconductor Solutions and Infrastructure Software.

Featured Articles

Before you consider Broadcom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadcom wasn't on the list.

While Broadcom currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.