ICU Medical (NASDAQ:ICUI - Get Free Report) is scheduled to be announcing its earnings results after the market closes on Tuesday, November 12th. Analysts expect the company to announce earnings of $1.25 per share for the quarter. ICU Medical has set its FY 2024 guidance at 4.950-5.350 EPS.Individual that are interested in participating in the company's earnings conference call can do so using this link.

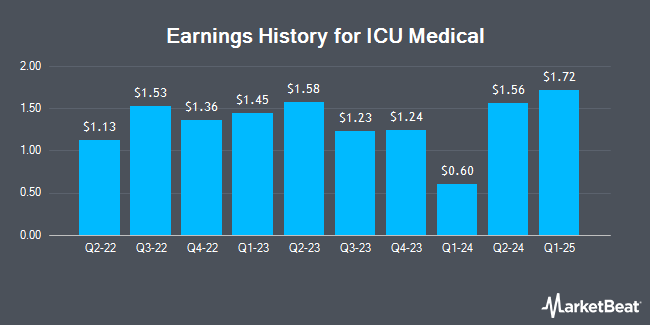

ICU Medical (NASDAQ:ICUI - Get Free Report) last posted its quarterly earnings data on Wednesday, August 7th. The medical instruments supplier reported $1.56 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.00 by $0.56. ICU Medical had a positive return on equity of 5.01% and a negative net margin of 3.07%. The business had revenue of $596.50 million for the quarter, compared to analysts' expectations of $556.64 million. During the same quarter last year, the firm earned $1.58 earnings per share. The business's revenue was up 8.6% on a year-over-year basis. On average, analysts expect ICU Medical to post $4 EPS for the current fiscal year and $5 EPS for the next fiscal year.

ICU Medical Trading Up 0.8 %

Shares of ICU Medical stock traded up $1.39 during trading hours on Tuesday, hitting $173.39. The company's stock had a trading volume of 157,992 shares, compared to its average volume of 273,819. ICU Medical has a 1-year low of $78.28 and a 1-year high of $188.53. The company has a market capitalization of $4.23 billion, a PE ratio of -58.90 and a beta of 0.66. The company has a quick ratio of 1.08, a current ratio of 2.41 and a debt-to-equity ratio of 0.76. The business has a fifty day moving average of $174.27 and a 200 day moving average of $138.31.

Wall Street Analysts Forecast Growth

Several research analysts have recently commented on ICUI shares. Needham & Company LLC reiterated a "hold" rating on shares of ICU Medical in a research report on Thursday, October 10th. KeyCorp increased their price target on ICU Medical from $147.00 to $198.00 and gave the company an "overweight" rating in a research note on Tuesday, October 15th. Raymond James raised their target price on shares of ICU Medical from $158.00 to $190.00 and gave the stock an "outperform" rating in a report on Thursday, September 12th. Jefferies Financial Group initiated coverage on ICU Medical in a report on Monday, October 14th. They set a "hold" rating and a $183.00 price objective on the stock. Finally, StockNews.com upgraded ICU Medical from a "hold" rating to a "buy" rating in a report on Thursday, September 12th. Two analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $170.25.

View Our Latest Analysis on ICU Medical

Insider Buying and Selling

In other ICU Medical news, CEO Vivek Jain sold 12,000 shares of the company's stock in a transaction on Friday, August 16th. The stock was sold at an average price of $156.04, for a total transaction of $1,872,480.00. Following the transaction, the chief executive officer now owns 104,593 shares of the company's stock, valued at approximately $16,320,691.72. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In related news, CEO Vivek Jain sold 12,000 shares of the firm's stock in a transaction on Friday, August 16th. The stock was sold at an average price of $156.04, for a total transaction of $1,872,480.00. Following the sale, the chief executive officer now owns 104,593 shares of the company's stock, valued at approximately $16,320,691.72. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, VP Daniel Woolson sold 2,502 shares of the business's stock in a transaction dated Friday, August 30th. The shares were sold at an average price of $163.22, for a total value of $408,376.44. Following the completion of the sale, the vice president now owns 13,107 shares in the company, valued at approximately $2,139,324.54. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 52,552 shares of company stock worth $8,741,402 in the last three months. Insiders own 6.70% of the company's stock.

ICU Medical Company Profile

(

Get Free Report)

ICU Medical, Inc, together with its subsidiaries, develops, manufactures, and sells medical devices used in infusion therapy, vascular access, and vital care applications worldwide. Its infusion therapy products include needlefree products under the MicroClave, MicroClave Clear, and NanoClave brands; Neutron catheter patency devices; ChemoClave and ChemoLock closed system transfer devices, which are used to limit the escape of hazardous drugs or vapor concentrations, block the transfer of environmental contaminants into the system, and eliminates the risk of needlestick injury; Tego needle free connectors; Deltec GRIPPER non-coring needles for portal access; and ClearGuard, SwabCap, and SwabTip disinfection caps.

Featured Articles

Before you consider ICU Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ICU Medical wasn't on the list.

While ICU Medical currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.