IDEXX Laboratories (NASDAQ:IDXX - Get Free Report) updated its FY24 earnings guidance on Thursday. The company provided EPS guidance of $10.37-10.53 for the period, compared to the consensus EPS estimate of $10.45. The company issued revenue guidance of $3.87-3.89 billion, compared to the consensus revenue estimate of $3.88 billion.

IDEXX Laboratories Stock Performance

IDXX stock opened at $418.61 on Thursday. IDEXX Laboratories has a twelve month low of $404.74 and a twelve month high of $583.39. The business's fifty day moving average is $464.08 and its 200-day moving average is $481.54. The company has a quick ratio of 1.03, a current ratio of 1.42 and a debt-to-equity ratio of 0.32. The company has a market cap of $34.28 billion, a P/E ratio of 40.37, a price-to-earnings-growth ratio of 3.63 and a beta of 1.36.

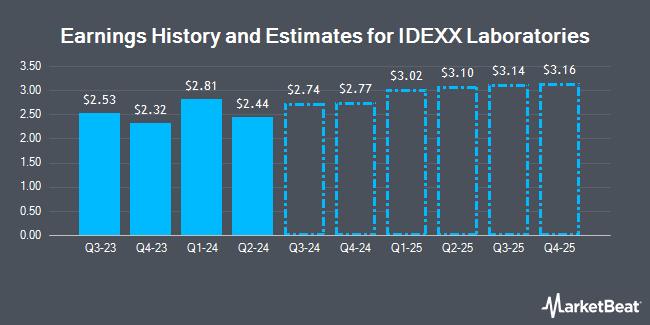

IDEXX Laboratories (NASDAQ:IDXX - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The company reported $2.80 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.69 by $0.11. The business had revenue of $975.50 million during the quarter, compared to the consensus estimate of $980.32 million. IDEXX Laboratories had a return on equity of 55.42% and a net margin of 22.53%. IDEXX Laboratories's quarterly revenue was up 6.6% on a year-over-year basis. During the same period last year, the company earned $2.53 earnings per share. Equities research analysts forecast that IDEXX Laboratories will post 10.43 EPS for the current year.

Analysts Set New Price Targets

IDXX has been the topic of a number of analyst reports. Barclays reduced their price objective on shares of IDEXX Laboratories from $570.00 to $481.00 and set an "overweight" rating on the stock in a research note on Monday, November 4th. Piper Sandler restated a "neutral" rating and set a $435.00 price target (down from $520.00) on shares of IDEXX Laboratories in a report on Monday, November 4th. Stifel Nicolaus cut their price target on IDEXX Laboratories from $510.00 to $500.00 and set a "hold" rating on the stock in a report on Thursday, October 10th. BTIG Research began coverage on IDEXX Laboratories in a research note on Thursday, July 25th. They issued a "buy" rating and a $580.00 price objective for the company. Finally, JPMorgan Chase & Co. decreased their price target on IDEXX Laboratories from $630.00 to $575.00 and set an "overweight" rating for the company in a research report on Friday, October 11th. Three equities research analysts have rated the stock with a hold rating and seven have issued a buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $552.38.

Get Our Latest Stock Report on IDXX

IDEXX Laboratories Company Profile

(

Get Free Report)

IDEXX Laboratories, Inc develops, manufactures, and distributes products primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets in Africa, the Asia Pacific, Canada, Europe, Latin America, and internationally. The company operates through three segments: Companion Animal Group; Water Quality Products; and Livestock, Poultry and Dairy.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider IDEXX Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEXX Laboratories wasn't on the list.

While IDEXX Laboratories currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.