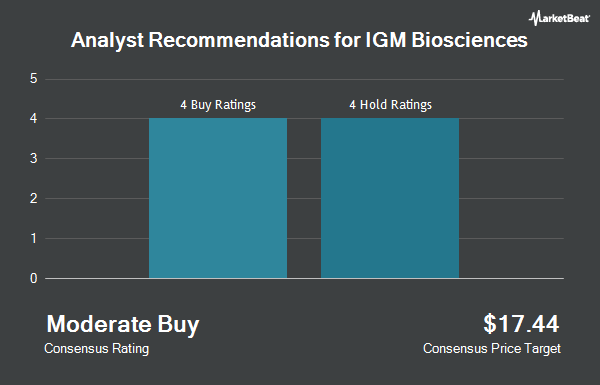

IGM Biosciences, Inc. (NASDAQ:IGMS - Get Free Report) has been given an average recommendation of "Hold" by the eight analysts that are covering the stock, Marketbeat reports. One research analyst has rated the stock with a sell recommendation, three have assigned a hold recommendation and four have issued a buy recommendation on the company. The average 12 month target price among brokerages that have covered the stock in the last year is $16.13.

Several research analysts have recently issued reports on IGMS shares. Stifel Nicolaus increased their target price on IGM Biosciences from $25.00 to $27.00 and gave the stock a "buy" rating in a research report on Monday, November 11th. JPMorgan Chase & Co. downgraded IGM Biosciences from a "neutral" rating to an "underweight" rating and decreased their target price for the company from $12.00 to $9.00 in a research note on Tuesday, October 1st. Wedbush decreased their price objective on shares of IGM Biosciences from $25.00 to $22.00 and set an "outperform" rating for the company in a research note on Tuesday, October 1st. Guggenheim lowered their price target on IGM Biosciences from $25.00 to $20.00 and set a "buy" rating for the company in a report on Tuesday, October 1st. Finally, Royal Bank of Canada upped their target price on IGM Biosciences from $17.00 to $20.00 and gave the stock an "outperform" rating in a research note on Friday, October 18th.

Check Out Our Latest Stock Analysis on IGMS

IGM Biosciences Stock Up 2.4 %

Shares of IGMS traded up $0.23 during mid-day trading on Wednesday, hitting $9.77. 204,686 shares of the company's stock were exchanged, compared to its average volume of 308,434. The stock's 50-day simple moving average is $14.84 and its 200-day simple moving average is $11.13. The firm has a market cap of $580.63 million, a price-to-earnings ratio of -2.62 and a beta of 0.20. IGM Biosciences has a 52 week low of $4.72 and a 52 week high of $22.50.

IGM Biosciences (NASDAQ:IGMS - Get Free Report) last issued its quarterly earnings data on Friday, November 8th. The company reported ($1.01) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.82) by ($0.19). IGM Biosciences had a negative return on equity of 155.42% and a negative net margin of 7,534.03%. The firm had revenue of $0.52 million during the quarter, compared to the consensus estimate of $0.23 million. Analysts forecast that IGM Biosciences will post -3.17 earnings per share for the current fiscal year.

Insider Activity

In other IGM Biosciences news, CEO Fred Schwarzer sold 3,946 shares of the business's stock in a transaction dated Friday, September 13th. The stock was sold at an average price of $11.54, for a total transaction of $45,536.84. Following the completion of the sale, the chief executive officer now owns 250,124 shares of the company's stock, valued at approximately $2,886,430.96. The trade was a 1.55 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. In the last quarter, insiders have sold 5,902 shares of company stock worth $68,109. 57.00% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On IGM Biosciences

A number of hedge funds and other institutional investors have recently made changes to their positions in the company. Baker BROS. Advisors LP increased its holdings in shares of IGM Biosciences by 10.8% in the first quarter. Baker BROS. Advisors LP now owns 4,088,322 shares of the company's stock valued at $39,452,000 after purchasing an additional 397,311 shares during the last quarter. Price T Rowe Associates Inc. MD grew its position in IGM Biosciences by 19.3% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 3,888,023 shares of the company's stock worth $37,520,000 after purchasing an additional 628,001 shares during the last quarter. Redmile Group LLC raised its holdings in IGM Biosciences by 3.4% during the first quarter. Redmile Group LLC now owns 3,072,478 shares of the company's stock worth $29,649,000 after purchasing an additional 100,936 shares in the last quarter. State Street Corp boosted its holdings in IGM Biosciences by 2.7% during the third quarter. State Street Corp now owns 469,790 shares of the company's stock worth $7,770,000 after buying an additional 12,174 shares in the last quarter. Finally, Geode Capital Management LLC increased its holdings in IGM Biosciences by 7.6% during the 3rd quarter. Geode Capital Management LLC now owns 395,799 shares of the company's stock valued at $6,548,000 after acquiring an additional 28,118 shares in the last quarter. Institutional investors own 42.79% of the company's stock.

IGM Biosciences Company Profile

(

Get Free ReportIGM Biosciences, Inc, a clinical-stage biotechnology company, develops Immunoglobulin M (IgM) antibodies for the treatment of cancer and autoimmune and inflammatory diseases. It develops Aplitabart, a Death Receptor 5 Agonist IgM antibody for the treatment of colorectal cancer; imvotamab, a CD20 x CD3 bispecific IgM antibody to treat myositis, as well as for the treatment of systemic lupus erythematosus and rheumatoid arthritis that is Phase Ib clinical trial; and IGM-2644, a bispecific T cell engaging IgM antibody targeting CD38 and CD3 proteins for the treatment of autoimmune diseases.

Further Reading

Before you consider IGM Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IGM Biosciences wasn't on the list.

While IGM Biosciences currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.