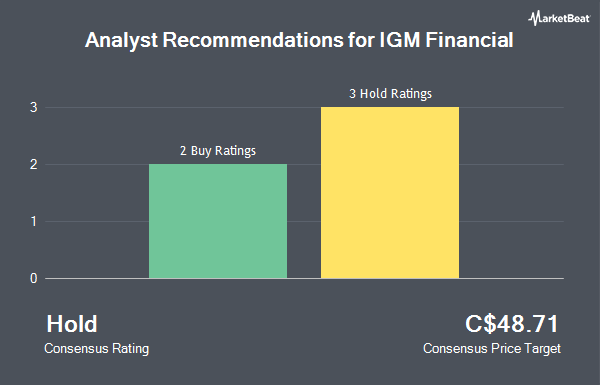

IGM Financial Inc. (TSE:IGM - Get Free Report) has received an average recommendation of "Moderate Buy" from the six ratings firms that are currently covering the stock, MarketBeat.com reports. Three analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. The average 12-month price target among brokers that have issued a report on the stock in the last year is C$49.29.

Several research analysts recently commented on IGM shares. TD Securities lifted their price target on IGM Financial from C$46.00 to C$50.00 in a research report on Monday, November 11th. Scotiabank boosted their price objective on shares of IGM Financial from C$53.00 to C$56.00 in a research note on Friday, November 8th. BMO Capital Markets lifted their price target on shares of IGM Financial from C$43.00 to C$47.00 in a report on Monday, November 11th. Royal Bank of Canada boosted their price objective on shares of IGM Financial from C$46.00 to C$47.00 in a report on Thursday, August 8th. Finally, CIBC boosted their target price on shares of IGM Financial from C$47.00 to C$50.00 in a research report on Friday, November 8th.

Get Our Latest Stock Analysis on IGM

IGM Financial Price Performance

IGM stock traded up C$0.28 during trading on Friday, reaching C$47.31. The company's stock had a trading volume of 330,777 shares, compared to its average volume of 250,775. IGM Financial has a 1 year low of C$32.95 and a 1 year high of C$47.83. The company has a quick ratio of 0.31, a current ratio of 2.12 and a debt-to-equity ratio of 35.99. The company has a market capitalization of C$11.20 billion, a P/E ratio of 13.25, a price-to-earnings-growth ratio of 4.09 and a beta of 1.53. The company's fifty day moving average is C$42.97 and its 200-day moving average is C$39.65.

IGM Financial Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, January 31st. Investors of record on Tuesday, December 31st will be paid a dividend of $0.563 per share. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $2.25 annualized dividend and a yield of 4.76%. IGM Financial's dividend payout ratio is presently 63.38%.

About IGM Financial

(

Get Free ReportIGM Financial Inc operates as a wealth and asset management company in Canada. It operates through Wealth Management and Asset Management segments. The Wealth Management segment offers investments that are focused on providing financial planning and related services; and provides mutual fund management and discretionary portfolio management services.

Featured Articles

Before you consider IGM Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IGM Financial wasn't on the list.

While IGM Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.